3 Best Performing Financial Services Stocks On The S&p 500 Index

Building on its impressive 23.3% gain in 2024, the S&P 500 Index has jumped 4.5% so far in 2025.

Among the sectors that are driving the S&P 500 Index, Financial Services has jumped 8% this year (the second-best performing sector). The momentum is driven by potential favorable changes in the sector under Trump 2.0.

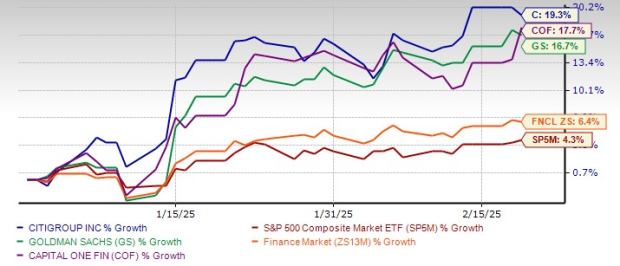

While the Financial Services sector comprises several big names, today let’s focus on the three best-performing stocks – Citigroup C, Capital One COF and Goldman Sachs GS. These stocks have also outperformed the S&P 500 Index and the Zacks Finance sector.

Year-to-Date C, COF & GS Stock Price Performance

Image Source: Zacks Investment Research

Before discussing the above-mentioned stocks in detail, let’s first check out the reasons for investors’ bullish stance on the Financial Services sector.

Since the announcement of the U.S. presidential election results in early November 2024, the Financial Services sector has been in the spotlight. This momentum has carried into 2025, driven by expectations of potential deregulation, relaxed regulatory capital requirements and a pro-business stance under the Trump 2.0 administration.

However, uncertainty surrounding the pace of interest rate cuts remains a key challenge. The introduction of Trump tariffs could reignite inflation, potentially prompting the Federal Reserve to adopt a less dovish stance. As a result, the Financial Services sector may face some financial headwinds.

So, investors must keep an eye on these factors to make wise investment decisions.

3 Top Financial Services Stocks to Invest in Now

Citigroup is undergoing a major overhaul under CEO Jane Fraser to streamline operations and reduce costs. It was restructured into five operating segments, and it plans to eliminate 20,000 jobs by 2026, having already cut 10,000. The bank is also exiting consumer banking in multiple markets to focus on profitable businesses like investment banking (IB) and wealth management. These changes aim to free up capital, boost efficiency and drive a 4-5% revenue CAGR, with $2-2.5 billion in annual savings by 2026.

Additionally, Citigroup is advancing its digital strategy with artificial intelligence (AI) tools for employees in eight countries, reaching 140,000 users, with plans for expansion. In late 2024, it invested in Pylon to automate mortgage origination and partnered with Google Cloud to enhance AI and cloud capabilities. Digital users grew 5% year over year in 2024, supporting revenue growth and efficiency.

Further, Citigroup is expected to benefit from lower interest rates. The Fed has lowered the interest rates by 100 basis points in 2024 and has hinted at two more cuts this year. In 2024, Citigroup’s NII (excluding Markets) declined 1% to $47.1 billion from the year-ago period. For 2025, management expects NII (excluding Markets) to be modestly up, with momentum continuing in 2026.

At present, Citigroup sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Capital One is a diversified consumer loan provider that operates primarily in the banking and credit card sectors. The company is in the process of acquiring Discover Financial Services DFS in an all-stock transaction valued at $35.3 billion. This merger, announced last February, is poised to reshape the credit card industry by creating a vertically integrated payments platform, combining Capital One's extensive banking operations with Discover Financial's established card network.

The transaction, expected to close by next quarter, has received the approval of the Delaware State Bank Commissioner, with the consent from the Fed and the Office of the Comptroller of the Currency still pending. Earlier this week, shareholders of COF and DFS gave their nod to the deal.

The DFS merger is crucial for Capital One's ambition to build a globally competitive payments network, enabling it to better compete with bigger industry players like Visa and Mastercard. The company projects that the merger will generate $2.7 billion in pre-tax synergies and be more than 15% accretive to adjusted non-GAAP earnings per share by 2027.

Over the years, Capital One has been engaged in strategic acquisitions. These reflect its revenue diversifying efforts. Revenue prospects look encouraging given the company’s solid credit card and online banking businesses, Discover Financial buyout and decent loan demand.

Currently, Capital One carries a Zacks Rank of 3 (Hold).

Goldman, one of the world’s leading investment banks, is undergoing a strategic transformation. The company is scaling back its consumer banking operations to refocus on its core strengths – IB and trading.

Per the Wall Street Journal, in November 2024, Apple proposed that Goldman exit their consumer banking partnership within 12-15 months, potentially affecting the Apple Card and Apple Savings account. In October 2024, GS finalized a deal to transfer its GM credit card business to Barclays. The company also sold GreenSky and Personal Financial Management units in late 2023. Also, it plans to discontinue unsecured loans through Marcus, having already sold most of its loan portfolio that year.

The IB industry saw strong growth in 2024, driven by a rebound in corporate debt, equity issuances and deal-making. After two years of sluggish performance, global M&A activity surged. According to S&P Global Market Intelligence, nearly 37,800 transactions were announced or completed last year.

Goldman’s IB revenues had declined 47.9% in 2022 and 15.5% in 2023. However, the trend reversed in 2024, with revenues jumping 24% to $7.73 billion. The company retained its #1 ranking in announced and completed M&A deals and was placed third in equity underwriting. With a strong deal pipeline and a robust IB backlog, the company’s leadership position continues to provide a competitive advantage.

Goldman also sports a Zacks Rank #1, at present.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Goldman Sachs Group, Inc. (GS): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Discover Financial Services (DFS): Free Stock Analysis Report

Capital One Financial Corporation (COF): Free Stock Analysis Report