5 High Earnings Yield Value Stocks To Buy Amid Market Volatility

The U.S. stock market took a hit on Friday as a wave of troubling economic news sent all major indexes tumbling. The S&P 500 suffered its worst drop in two months, sinking 1.7%, while the Dow and Nasdaq fell 1.7% and 2.2%, respectively.

Consumer confidence slid sharply, with the University of Michigan’s sentiment index dropping to 64.7 from 71.7 in January. Rising inflation fears, weaker home sales and a slowdown in services activity signal economic cooling.

Business activity hit a 17-month low, reflecting growing uncertainty around tariffs and government policies. With market volatility rising and economic risks mounting, investors should focus on fundamentals. In these uncertain times, value investing—seeking strong companies at reasonable prices—could be the smartest strategy forward.

One interesting ratio that you can consider for ferreting out attractively valued stocks is earnings yield.You can unlock your portfolio value by investing in high earnings yield stocks like Nu Skin Enterprises NUS, Harmony Biosciences HRMY, Phibro Animal Health PAHC, Dana Incorporated DAN and NRG Energy NRG to fetch handsome long-term rewards.

Earnings Yield Metric Strength

Earnings yield, expressed as a percentage, is calculated by dividing a company's annual earnings per share (EPS) by its market price. This metric shows the expected return from earnings for each dollar invested in a stock. When comparing stocks, those with a higher earnings yield are generally seen as undervalued, while those with a lower yield may be overpriced, assuming other factors are similar.

Earnings yield is the inverse of the price-to-earnings (P/E) ratio but offers additional insight. It helps investors compare stocks to fixed-income securities, such as bonds. Many investors compare a stock’s earnings yield to the 10-year Treasury yield to assess its attractiveness relative to risk-free returns.

If a stock's earnings yield is lower than the Treasury yield, it may be overvalued compared to bonds. However, if it is higher, the stock could be undervalued, making it a more appealing option. In such cases, value investors may see greater opportunities in the stock market.

The Winning Strategy

We have set an Earnings Yield greater than 10% as our primary screening criterion but it alone cannot be used for picking stocks that have the potential to generate solid returns. So, we have added the following parameters to the screen:

Estimated EPS growth for the next 12 months greater than or equal to the S&P 500: This metric compares the 12-month forward EPS estimate with the 12-month actual EPS.

Average Daily Volume (20 Day) greater than or equal to 100,000: High trading volume implies that a stock has adequate liquidity.

Current Price greater than or equal to $5.

Buy-Rated Stocks: Stocks with a Zacks Rank #1 (Strong Buy) or 2 (Buy) have been known to outperform peers in any type of market environment. You can see the complete list of today’s Zacks #1 Rank stocks here.

Our Picks

Here we highlight five of the 54 stocks that qualified the screen:

Nu Skin: It develops and distributes a wide range of premium cosmetics, beauty, personal care and wellness products. The Zacks Consensus Estimate for NUS’ 2025 earnings implies year-over-year growth of 25%. Estimates for this year’s earnings per share have moved up by 26 cents over the past seven days. Nu Skin currently sports a Zacks Rank #1 and has a Value Score of A.

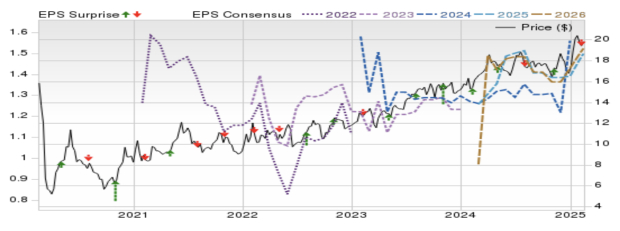

Harmony Biosciences: This pharmaceutical company engages in developing and commercializing therapies for rare neurological disorders. The Zacks Consensus Estimate for HRMY’s 2025 earnings implies year-over-year growth of 32.5%. EPS estimates have moved up by 3 cents over the past seven days. Harmony Biosciences currently sports a Zacks Rank #1 and has a Value Score of A.

Phibro: It is a leading global diversified animal health and mineral nutrition company. The Zacks Consensus Estimate for PAHC’s fiscal 2025 earnings implies year-over-year growth of 62%. EPS estimates have moved up by 9 cents over the past seven days. Phibro currently sports a Zacks Rank #1 and has a Value Score of A.

Dana: It is a provider of technology driveline, sealing and thermal-management products. The Zacks Consensus Estimate for DAN’s 2025 earnings implies year-over-year growth of 60%. EPS estimates have moved up by 20 cents over the past 30 days. Dana currently sports a Zacks Rank #1 and has a Value Score of A.

NRG Energy: It is engaged in the production, sale and delivery of energy and energy products and services to residential, industrial as well as commercial consumers. The Zacks Consensus Estimate for NRG’s 2025 earnings implies year-over-year growth of 54%. EPS estimates have moved up by $2.28 over the past seven days. NRG currently sports a Zacks Rank #1 and has a Value Score of B.

You can get the rest of the stocks on this list by signing up now for a 2-week free trial to the Research Wizard stock picking and backtesting software. You can also create your own strategies and test them first before making investments.

The Research Wizard is a great place to begin. It's easy to use. Everything is in plain language. And it's very intuitive. Start your Research Wizard trial today. And the next time you read an economic report, open up the Research Wizard, plug your finds in, and see what gems come out.

Click here to sign up for a free trial to the Research Wizard today.

Disclosure: Officers, directors and/or employees of Zacks Investment Research may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material. An affiliated investment advisory firm may own or have sold short securities and/or hold long and/or short positions in options that are mentioned in this material.

Disclosure: Performance information for Zacks’ portfolios and strategies are available at: https://www.zacks.com/performance.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NRG Energy, Inc. (NRG): Free Stock Analysis Report

Dana Incorporated (DAN): Free Stock Analysis Report

Nu Skin Enterprises, Inc. (NUS): Free Stock Analysis Report

Phibro Animal Health Corporation (PAHC): Free Stock Analysis Report

Harmony Biosciences Holdings, Inc. (HRMY): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).