Americold Announces Acquisition Of Facility In Houston, Tx, For $127m

To accommodate customer growth, Americold Realty Trust COLD recently announced the signing of an agreement to acquire a facility in Houston, TX, for approximately $127 million, which includes planned expansions and equipment upgrades.

This strategic move aligns with the company’s strategy to expand its market-leading presence in the high-turn retail segment of the cold storage supply chain.

The facility, constructed in 2022, is located in the Cedar Port Industrial Park in Baytown, TX. The acquisition of this 10.7 million cubic feet facility will add around 35,700 pallet positions to the company’s cold storage warehouse portfolio. The acquisition also includes approximately 16 acres of adjacent land that could be used for future expansion projects.

The company expects returns from this acquisition to be consistent with the stated return expectations for similar acquisitions in the past.

Per George Chappelle, CEO of Americold, “The catalyst for this acquisition was the award of a large grocery retail contract with one of the world’s largest retailers. The new business represents a significant win in our $200M sales initiative.”

Conclusion

This acquisition highlights the company’s commitment to acquiring assets in key markets to capture profitable growth opportunities and deliver customer service as per their needs.

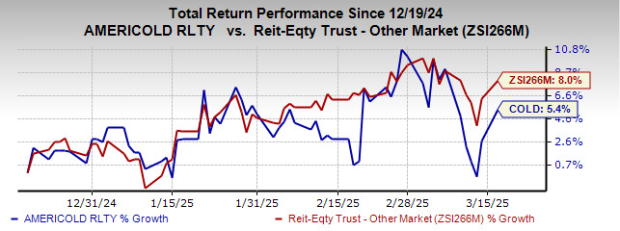

Shares of this Zacks Rank #3 (Hold) company have gained 5.4% over the past three months compared with the industry’s growth of 8%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader REIT sector are Welltower WELL and SL Green Realty SLG, each carrying a Zacks Rank of #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Welltower’s 2025 FFO per share is pegged at $4.89, which indicates year-over-year growth of 13.2%.

The Zacks Consensus Estimate for SL Green’s full-year FFO per share is $5.52 which indicates an increase of 9.7% from the year-ago period.

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO), a widely used metric to gauge the performance of REITs.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

SL Green Realty Corporation (SLG): Free Stock Analysis Report

Americold Realty Trust Inc. (COLD): Free Stock Analysis Report

Welltower Inc. (WELL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).