Bursa Rebounds To Close At Intraday High On Bargain-hunting

KUALA LUMPUR: Bursa Malaysia rebounded to end at an intraday high today as bargain-hunting emerged following a series of sell-offs, amid upbeat regional market performance.

Rakuten Trade Sdn Bhd’s vice-president of equity research Thong Pak Leng said regional indices ended higher led by strong buying interest in technology stocks, after receiving a further boost from Alibaba Group Holding Ltd’s earnings report, which saw its fastest revenue growth in over a year.

“Despite concerns over escalating geopolitical tensions and an expanding tariff war, Chinese technology stocks have remained resilient, driven by enthusiasm for DeepSeek’s artificial intelligence model.

“The local benchmark index’s gains were primarily led by utilities, energy, and consumer stocks, as investors took advantage of oversold positions, signalling a potential market stabilisation,” he told Bernama.

Meanwhile, UOB Kay Hian Wealth Advisors Sdn Bhd head of investment research Sedek Jantan said the FTSE Bursa Malaysia KLCI (FBM KLCI) surpassed the critical 1,590 level, with positive rebounds in the oil and gas, consumer products, telecommunications, and construction sectors.

“Market sentiment has improved from yesterday, supported by both domestic and external factors.

“On the domestic front, the statistics department announced that the inflation rate remained stable at 1.7% year-on-year in January, indicating that the recent civil servant salary hike has not led to broad-based price pressures,” he told Bernama.

According to the department, Malaysia’s inflation rate remained at 1.7% in January 2025, with the index points standing at 133.6 points compared to 131.4 points in the same month last year.

Regionally, Japan’s Nikkei 225 increased 0.26% to 38,776.94, Hong Kong’s Hang Seng Index jumped 3.99% to 23,477.92, Singapore’s Straits Times Index increased 0.06% to 3,929.94, China’s Shanghai Composite Index firmed 0.85% to 3,379.11, and South Korea’s Kospi gained 0.02% to 2,654.58.

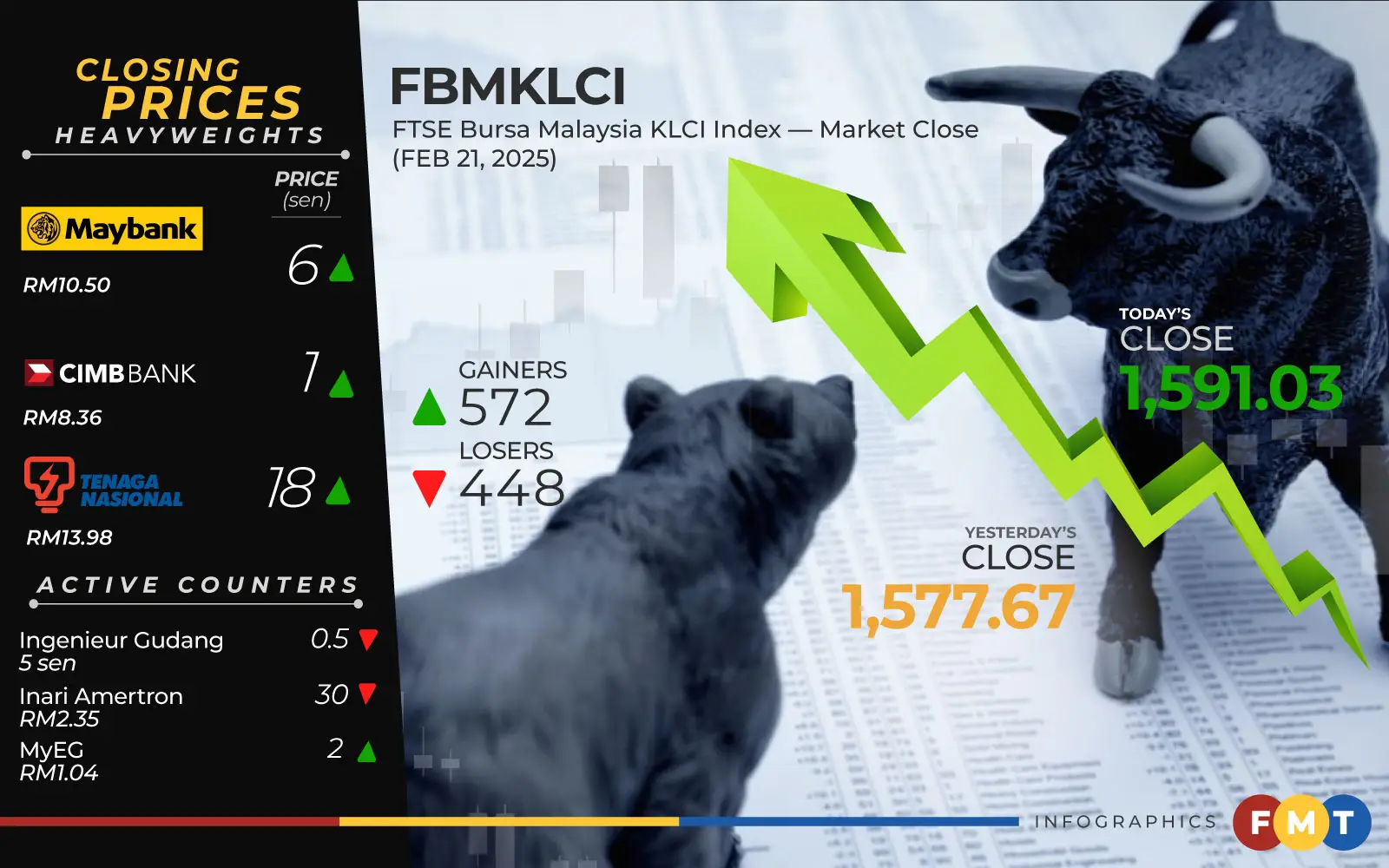

At 5pm, the FBM KLCI rose 13.36 points, or 0.84%, to 1,591.03 from yesterday’s close of 1,577.67.

The market bellwether opened 2.25 points higher at 1,579.92 and subsequently hit a low of 1,578.14 in the early session before trending upwards towards closing.

On the broader market, gainers led decliners 572 to 448, while 506 stocks were unchanged, 826 untraded, and 21 suspended.

Turnover narrowed to 2.99 billion units worth RM2.63 billion from 3.15 billion units worth RM2.43 billion yesterday.

On the home front, heavyweights Maybank increased six sen to RM10.50, CIMB and Public Bank were each one sen higher at RM8.36 and RM4.50, respectively, Tenaga Nasional put on 18 sen to RM13.98, and IHH Healthcare bagged five sen to RM7.26.

As for active stocks, Ingenieur Gudang inched down 0.5 sen to five sen, Inari Amertron plummeted 30 sen to RM2.35, while MyEG climbed two sen to RM1.04.

TWL Holdings and Velesto Energy inched up 0.5 sen each to 2.5 sen and 18.5 sen, respectively.

On the index board, the FBM Emas Index advanced 77.68 points to 11,991.67, the FBMT 100 Index jumped 78.22 points to 11,725.23, the FBM Emas Shariah Index surged 125.79 points to 11,716.91, the FBM 70 Index climbed 35.86 points to 17,404.86, and the FBM ACE Index inched up 0.45 of-a-point to 4,920.98.

By sector, the financial services index rose 47.23 points to 19,318.04, the industrial products and services index edged up 3.85 points to 165.05, the plantation index soared 66.02 points to 7,458.32, and the energy index perked up 5.81 points to 785.76.

The Main Market volume increased to 1.56 billion units worth RM2.37 billion from 1.46 billion units worth RM2.10 billion yesterday.

Warrants turnover improved to 1.01 billion units worth RM99.28 million against 1 billion units worth RM107.98 million previously.

The ACE Market volume dwindled to 412.15 million units valued at RM153.71 million versus 688.42 million units valued at RM221.16 million yesterday.

Consumer products and services counters accounted for 148.67 million shares traded on the Main Market, industrial products and services (393.87 million), construction (112.04 million), technology (215.64 million), SPAC (nil), financial services (71.37 million), property (196.41 million), plantation (16.80 million), REITs (22.21 million), closed/fund (18,800), energy (165.51 million), healthcare (115.36 million), telecommunications and media (33.81 million), transportation and logistics (24.54 million), utilities (50.08 million), and business trusts (12,400).