Can Vz Capitalize On Santander Tie-up To Boost Customer Benefits?

According to industry grapevines, Verizon Communications Inc. VZ is reportedly eyeing a partnership with Spain-based banking giant Banco Santander, S.A. SAN to augment customer satisfaction. Per the deal, Verizon customers will benefit from extended bill credits once they open a high-yielding savings account with Santander's new digital bank platform. This is likely to translate into incremental customer additions and help Verizon expand its subscriber base.

By collaborating with Verizon, Santander is aiming to strengthen its geographical presence in the United States. With 409 branches primarily in nine states in the Northeast, it has one of the biggest auto-lending businesses in America. It now intends to leverage Verizon’s wide customer base to develop its technology platform in the United States for consumer banking, including digital-only banking and consumer finance.

The proposed partnership with Verizon is one of the several options that the bank is currently considering to establish itself as a full-service digital bank in the country after having launched its U.S. digital bank in October 2024. If this deal is completed, it is likely to be a win-win transaction for both the participating companies.

VZ Focusing on Customer-Centric Model

With a customer-centric business model, Verizon delivers faster peak data speeds and capacity for customers, driven by disciplined engineering and steady infrastructure investments. The company’s 5G network hinges on three fundamental drivers to deliver the full potential of next-generation wireless technology. These include massive spectrum holdings, particularly in the millimeter-wave bands for faster data transfer, end-to-end deep fiber resources and the ability to deploy a large number of small cells.

Verizon is witnessing significant 5G adoption and fixed wireless broadband momentum with premium unlimited plans. It is offering various mix-and-match pricing in both wireless and home broadband plans, which has led to solid customer additions. Moreover, in the enterprise and wholesale business, Verizon is changing its revenue mix toward newer growth services like cloud, security and professional services.

Verizon has further expanded Fios Forward to support digital inclusion and provide opportunities for underserved households to thrive in the digital world. With no data caps, Fios customers can experience faster upload and download than comparable plans. The telecom giant plans to accelerate the availability of its 5G Ultra Wideband network across the country. The company’s growth strategy includes 5G mobility, nationwide broadband and mobile edge compute and business solutions.

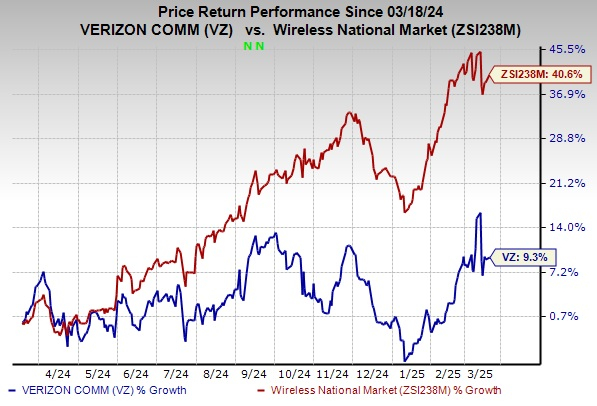

The stock has gained 9.3% over the past year compared with the industry’s growth of 40.6%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Verizon currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2 (Buy), is likely to benefit from strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experiences. Arista delivered an earnings surprise of 12.9%, on average, in the trailing four quarters. It is well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Ubiquiti Inc. UI, sporting a Zacks Rank #1, offers a comprehensive portfolio of networking products and solutions for service providers and enterprises. Its service-provider product platforms offer carrier-class network infrastructure for fixed wireless broadband, wireless backhaul systems and routing, while enterprise product platforms provide wireless local area network infrastructure, video surveillance products and machine-to-machine communication components. In the trailing four quarters, it delivered an earnings surprise of 7.5%.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Banco Santander, S.A. (SAN): Free Stock Analysis Report

Arista Networks, Inc. (ANET): Free Stock Analysis Report

Ubiquiti Inc. (UI): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).