Carvana Stock Down 34% In A Month: Is This A Buying Opportunity?

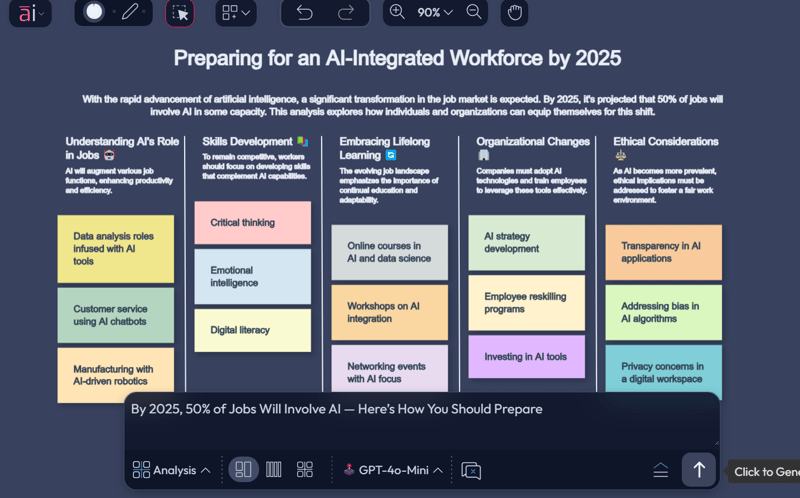

Shares of the auto e-retailer Carvana CVNA have taken a hit, dropping 34% in the past month. That’s worse than the industry, sector and the S&P 500 index. This sharp pullback comes after a stellar 2024 when CVNA stock skyrocketed more than 300%. However, 2025 has been a different story.

In January, short-seller Hindenburg Research (which has since gone bankrupt) accused Carvana of manipulating its accounting to hide losses. While the firm’s closure eased some concerns, doubts about Carvana’s financial health lingered. A deal with Ally Financial ALLY helped restore some confidence, as it assured investors that Carvana could still market its auto loans.

Beyond that, macroeconomic uncertainty is weighing on the stock. Slowing consumer spending and rising delinquency risks have added pressure. Meanwhile, Carvana is making a bold move by stepping into the new car business. The company finalized a deal last month to acquire a franchised dealership in Arizona, marking a potential shift from its used-car-only model. CVNA’s close peer CarMax KMX once tried a similar strategy in the 1990s but later abandoned it.

So, with the stock down over the past month, is this a buying opportunity or a sign to stay cautious? Let’s take a closer look.

1-Month Price Performance Comparison

Image Source: Zacks Investment Research

Key Growth Drivers for Carvana

Despite recent stock struggles, Carvana's business fundamentals remain strong. Retail sales volumes have been on the rise, with the company selling more than 100,000 cars in each of the last three reported quarters. In the final quarter of 2024, retail units sold jumped 50% year over year, and Carvana expects continued sequential growth in the first quarter of 2025 and significant expansion throughout the year.

Image Source: Carvana

Image Source: Carvana

Carvana is currently the second-largest used car retailer in the United States, yet it holds just a 1% share of the highly fragmented automotive retail market. This signals substantial room for growth, particularly as more consumers shift toward online car buying. If Carvana can capitalize on this trend, its market share could increase significantly in the coming years.

A crucial factor in Carvana’s turnaround has been its three-step plan — achieving positive adjusted EBITDA, increasing EBITDA per unit and returning to growth with a leaner operating model.

The company has consistently beaten earnings estimates over the last four quarters, demonstrating the effectiveness of these initiatives. In 2024, Carvana delivered record adjusted EBITDA of approximately $1.4 billion, achieving its highest-ever full-year margins. Management expects further EBITDA growth in 2025, driven by cost efficiencies and operational improvements.

Carvana has also successfully reduced costs associated with retail reconditioning and inbound transport. By in-sourcing third-party services, optimizing staffing, standardizing processes, enhancing proprietary software and improving logistics, the company has lowered expenses while expanding its retail gross profit per unit (GPU). Additional revenue streams from value-added services further support these gains.

Image Source: Carvana

The acquisition of ADESA’s U.S. operations has bolstered Carvana’s logistics, auction capabilities and reconditioning operations. Leveraging ADESA’s infrastructure allows Carvana to scale vehicle refurbishment more effectively, increasing reconditioning capacity to an estimated 3 million units annually at full utilization, up from 1.3 million currently. This expansion should help Carvana improve vehicle quality, inventory turnover and profitability.

What Do Zacks Estimates for CVNA Say?

The Zacks Consensus Estimate for CVNA’s 2025 sales and EPS calls for a year-over-year uptick of 23% and 117%, respectively. The consensus mark for CVNA’s 2025 EPS estimates has moved north over the past 30 days.

Image Source: Zacks Investment Research

Conclusion

Carvana's efforts to streamline operations, scale its platform and leverage its unique business model position it well for future growth. While near-term economic challenges persist, the company’s operational discipline and expanding market potential suggest that the recent stock price decline could present a buying opportunity. Investors with a long-term perspective should invest in the stock now, given its improving fundamentals and growth trajectory.

CVNA currently carries a Zacks Rank #2 (Buy) and a VGM Score of B. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CarMax, Inc. (KMX): Free Stock Analysis Report

Ally Financial Inc. (ALLY): Free Stock Analysis Report

Carvana Co. (CVNA): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).