Monopoly Round-up: Are We Headed Into Recession?

Today’s round-up has a bunch of news, both good and bad. My favorite item is Trump being super mean to Booz Allen management consultants who grift off taxpayers, and their response being a lobbying campaign titled ‘Defend the Spend.’ But there’s a lot more.

First, though, I have an announcement of some in-person events this week for those in the D.C. area. On Tuesday, I’ll be doing two talks with author and anti-monopolist Cory Doctorow. The first is at 4pm on Enshittification in the Trump Years. Will big tech bosses own Trump, or the other way around? Sign up here. The second is at 6:30 pm at the D.C. Public Library to celebrate the release of Doctorow’s new thriller novel, Picks and Shovels, set in 1986 Silicon Valley. It’s quite good!

Before getting to the full round-up, I want to spend a little time on bad economic numbers that came out this week and ask something basic. Is America headed for or in recession?

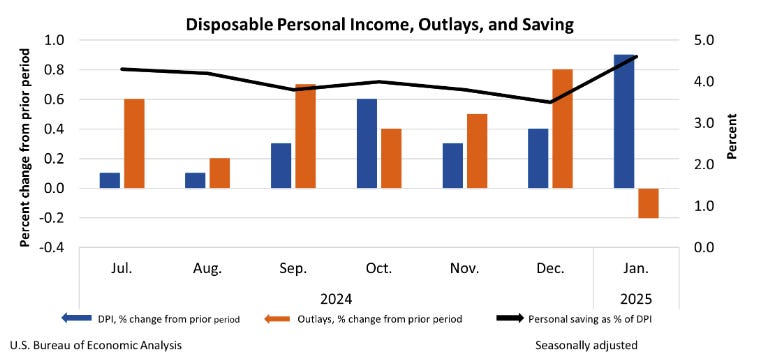

One way to tell is to figure out whether consumers are saving more than usual. Roughly two thirds of economic activity is driven by consumer spending, so if people start saving instead of spending, that can tip the U.S., and the world, into recession. The American consumer has been the powerhouse of world demand since the early 2010s, and every bet that we would slow down purchases has turned out to be wrong. But this time, according to the Personal Consumption Expenditures index, the savings rate is way up. Income is still increasing, but instead of spending, people are socking that money away.

And the story seems pretty clear. This week, data came out showing that consumer confidence has collapsed to a level last seen in 2021, and goods and services growth is at a 17-month low.

Recessions are measured in retrospect, since whether the economy grew or shrank can only be seen after the fact. But the Atlanta Fed has something called GDPNow, which is a measurement trying to get as close to real-time as possible, and after new data came out this week on trade and consumer spending, they are projecting the U.S. is shrinking at a rate of 1.5% in this quarter, versus what they thought was 2.3% growth. That’s mostly because of less activity due to the LA fires as well as a boost in imports, but it’s still a bad sign.

There are a couple of reasons why I think we’re going into a downturn. There’s the structural weirdness of our economy. On first blush, things seem fine. I look at the economic cycle as based on economist Hyman Minsky’s theory. According to Minsky, a recession is usually the result of a bunch of companies or people going bankrupt all at once because they collectively borrowed too much and couldn’t manage their debts. That’s certainly what happened in 2008. But today, the American consumer looks like they are in pretty good shape, with a healthy amount of income to service their debts.

But something about this doesn’t square with the misery that people feel in the economy, as 77% of the public thinks their income isn’t keeping up with inflation. Credit and auto loan delinquencies are higher than they’ve been since the 2008 financial crisis. How does this economy look good when people feel so bad? One reason is that our stats were collected premised on a reasonably equal society that no longer exists. Today, 10% of high earners account for half of consumer spending. That’s insane. There are actually two economies, one with high earners, and then everyone else. But our stats don’t account for that.

Outside of the consumer, there is a bunch of weird stuff in our financial markets, from private credit to high commercial real estate debt to crypto to a multi-trillion dollar private equity bubble. Something like 10% of U.S. firms are “zombie companies,” which is to say, structurally unprofitable and subsisting by borrowing. Similarly, at this point, investment by big tech firms in generative AI is big enough to affect the economy, and while the firms financing investment are very profitable, the sector itself isn’t generating the revenue to justify the investment. And interest rates, which used to be low and allow for cheap financing, are now quite high, and putting pressure on firms that need capital.

That’s not how things were supposed to work. The premise of Trump’s election was that he’d boss around the Fed and get Jay Powell to lower rates, spurring a revival of home sales and factory construction. Consumers and businesses, confident now that Biden was gone and expecting tax cuts, would happily spend and invest. Prices would drop with more drilling, and less government spending due to DOGE.

But none of that is happening. Because of Trump’s unreliable comments on tariffs, and the clear budget busting nature of coming tax cuts, long-term consumer expectations on inflation are the highest they’ve been since 1995. And the Fed isn’t cutting rates. Instead, homebuilders are frozen and so is all the spending that brings. For instance, door and window maker Jed Weld is projecting revenue will fall 4-9% next year.

I am generally supportive of tariffs, since the U.S. needs to rebalance our trading relationships. But execution matters, and Trump has been unwilling to lay out a clear direction. One day he says he’ll put 25% tariffs on Canada and Mexico, the next day he says he won’t. Metals, lumber, semiconductors, pharmaceuticals may or may not see increased import charges, there might be exceptions, there might not be. I generally find the whole “uncertainty” framework silly, an excuse for big business CEOs to attack rules they don’t like. But it is true that it’s impossible to figure out how to invest in an environment where the rules keep changing, and could change at any point.

The administration is like that with most major policies, from government operations to mass deportations. As one banker told the Financial Times, “With hindsight we did not appreciate the nature of what the administration was going to be like.” One result is that Trump, who came into office relatively popular, is now negative 18 with independents. More broadly, people are scared, and don’t feel like Trump is focused on making the economy better.

Finally, I think we’re in for mass layoffs across the economy, as a result of DOGE. But it’s not limited to government, though we’ll start there. The narrative of DOGE is they are finding efficiencies through the use of AI. So far, about 110,000 Federal employees have been laid off, and that’s just the beginning; Trump has asked for large scale Reductions in Force across government that will take place over the next few months. And for every Federal employee there are two government contractors, so these numbers understate the dynamic. (On the bright side, it does seem like DOGE is cutting management consulting contracts, as BIG suggested.)

But CEOs are looking at what Musk did to Twitter, and what he’s doing to the government, and thinking, “why not me?” A host of corporate leaders are now trying to cut their workforce and replace it with AI. In technology, Microsoft is firing people, Meta is getting rid of 5% of its workforce, and HP and Salesforce are following. Layoffs are happening at Google, Autodesk, Blue Origin, Sonos, eBay, Sophos and Intel. In the non-tech economy, UnitedHealth Group’s Optum, Starbucks, and Walgreens, among others, are engaged in mass layoffs. Stanford and Harvard are freezing hiring, as are higher educational institutions across the country.

This dynamic reminds me of how Ronald Reagan fired striking air traffic controllers, which was a green light to corporate America to break unions across the economy. DOGE, for better or worse, is the trend in America. As with anything, there are positives and negatives. Cutting many people across the board, is going to cause significant damage, perhaps irreparable or even catastrophic damage, but it may also uproot institutional cancers like management consulting.

So those are the dynamics I can see, but of course, there’s usually a lot I can’t see.

That said, a confirmation of an impending recession is that the boring nerds who run the world are quietly panicking and trying to blame each other preemptively for it. And there is no more of a boring brilliant nerd than Treasury Secretary Scott Bessent, a bespectacled billionaire and former George Soros trader, who now runs the show for Trump. "The private sector has been in recession," he said last week in a suitably dull speech at the Australian embassy. It’s notable that Bessent is changing his position. As macro-economic analyst Skanda Amarnath said, Bessent “flipped from complaining about Fed cuts to claiming a longstanding private sector recession.”

Another red flag is that the people in charge are trying to change how government statistics work to avoid the recession word. After the Atlanta GDPNow measure came out, Elon Musk called Keynesian analysis evil, and said that we should judge DOGE not by cuts but by changes in bond yields (which will go down in a recession.) He then tweeted, “A more accurate measure of GDP would exclude government spending.” A few days later, Commerce Secretary Howard Lutnick says he’s considering removing government spending from calculations of gross domestic product. The overt corruption of government statistics suggests they know what’s coming.

So what’s the plan if we go into recession? Let’s go back to Bessent. We’re still in the Biden economic order, but in 6-12 months, he argued, we’ll be in Trump’s. What he is saying, in other words, is prepare for a recession. And coming out of it, he wants to “re-privatize the economy.”

That is, he’d probably prefer if there were no recession, but as there likely will be one, his goal will be to shape the recovery. Trump will seek to take the resources freed up by mass job loss and government disinvestment in universities and research, clean energy, industrial policy, Medicaid, and so forth, and direct it to fossil fuel oriented resource extraction and forms of speculative activity. Or at least, that’s what the plan looks like.

I can imagine a world where a lot of people get radicalized and angry as things break, and rebuild an argument for public governance. Or I can imagine a world of where government has turned over tax collection, most government spending, highways, the global positioning system, the post office, the FAA, weather data, much of the military, and all research to a small number of monopolists. And frightened citizens, shellshocked, just don’t know what to believe or who to trust as it happens.

Generally, I’m an optimist. Generally.

And after the paywall, you can read the full round-up. My favorite story is about how Booz Allen consultants are getting kicked in the teeth by Trump. There’s also news of a very creepy service from Instacart helping grocery stores charge individual consumers different prices. Also, Jim Cramer has a sad as he ‘where are all the mergers Trump promised?!?’ Plus possible merger challenges on deck and the Trump antitrust officials move through Senate committees, and a new and insanely gross crypto scam with the taxpayer as the bagholder.