Radian Group Lags Industry, Trades At A Discount: Time To Buy The Dip?

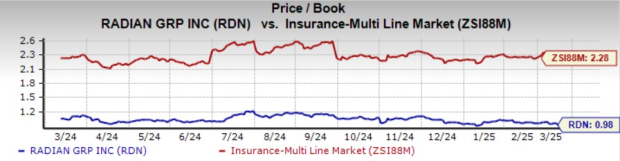

Radian Group RDN shares are trading at a discount to the Zacks Multi line insurance industry. Its price-to-book of 0.98X is lower than the industry average of 2.28X.

With a capitalization of $4.5 billion, Radian continues to benefit from credit performance in the mortgage insurance portfolio. With strong persistency rates and the current positive industry pricing environment, RDN expects in-force portfolio premium yield to remain stable.

Image Source: Zacks Investment Research

Shares of other insurers like MGIC Investment Corporation MTG are trading at a multiple lower than the industry average, while that of Arch Capital Group ACGL are trading at a multiple higher than the industry average.

Radian stock has lost 2.1% year to date, underperforming the industry and the sector but outperforming the Zacks S&P 500 composite’s return in the same time frame.

RDN vs Industry, Sector & S&P 500 YTD

Image Source: Zacks Investment Research

RDN shares are trading below the 50-day moving average, indicating a bearish trend.

Based on short-term price targets offered by seven analysts, the Zacks average price target is $36.43 per share. The average indicates a potential 14% upside from the last closing price.

Growth Projections for RDN

The Zacks Consensus Estimate for 2025 earnings per share is pegged at $3.79, indicating a 7.8% year-over-year decrease on 5.8% higher revenues of $1.3 billion. The consensus estimate for 2026 is pegged at $3.92 per share, indicating a 3.4% year-over-year increase on 3.03% higher revenues of $1.4 billion.

RDN’s Return on Capital

Return on invested capital in the trailing 12 months was 7.8%, better than the industry average of 2%. This reflects RDN’s efficiency in utilizing funds to generate income.

However, return on equity, which reflects the company’s efficiency in utilizing shareholders' funds, was 13.9% in the trailing 12 months, lower than the industry average of 14.4%.

Factors Acting in Favor of Radian

Radian’s heightened focus on the core business and services with higher growth potential ensures a predictable and recurring fee-based revenue stream.

New business, combined with increasing annual persistency, should drive continued growth of the insurance-in-force portfolio. Radian’s mortgage insurance portfolio creates a strong foundation for future earnings. RDN has been witnessing a declining pattern of claim filings. We expect paid claims to decline further, thus strengthening the balance sheet and improving its financial profile.

This mortgage insurer has been strengthening its capital position with capital contribution, reinsurance transaction and cash position. This helps Radian to engage in wealth distribution via dividend hike and share buybacks.

Parting Thoughts

Radian expects the private mortgage insurance market to be approximately 10% bigger in 2025 than in 2024. A lower interest rate environment is a positive for mortgage insurers. After three rate cuts in 2024, two more are expected this year. The company believes that the resulting pent-up demand provides strong support for future purchase volume, which drives the growth in large and valuable insurance in-force portfolio.

The 4.1% increase in quarterly dividend in the first quarter of 2025 marks the sixth consecutive year. RDN has increased the quarterly dividend that has more than doubled over the past five years. Its current dividend yield of 2.7% betters the industry average of 2.5%, making it an attractive pick for yield-seeking investors.

Given its attractive valuation, it is better to take position in this Zacks Rank #2 (Buy) mortgage insurer.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

MGIC Investment Corporation (MTG): Free Stock Analysis Report

Radian Group Inc. (RDN): Free Stock Analysis Report

Arch Capital Group Ltd. (ACGL): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).