Ross Stores Inaugurates 19 Stores As Part Of Its Expansion Plan

As part of the expansion strategy, Ross Stores, Inc. ROST unveiled 16 Ross Dress for Less and three DD’s Discounts stores in 14 different states in March. These new locations contribute to the company’s broader goal of adding approximately 90 stores in fiscal 2025, comprising about 80 Ross and 10 dd’s DISCOUNTS.

The new stores include Ross Dress for Less locations in the retailer’s newer markets of Connecticut, Minnesota, New Jersey and New York, while the company is primarily focused on DD’s Discounts’ growth in the existing markets of California, Georgia and Texas. With these additions, Ross Stores now operates 2,205 Ross Dress for Less and DD’s Discounts locations across 44 states, the District of Columbia and Guam.

As part of its long-term plan, Ross Stores aims to expand to 2,900 Ross locations and 700 dd’s DISCOUNTS stores, leveraging consumer demand for value and convenience. This strategic expansion reinforces Ross Stores’ commitment to broadening its reach and catering to the increasing demand for affordable, quality merchandise.

ROST’s Robust Growth Strategies

Ross Stores has been benefiting from key tailwinds, including its store expansion strategy and off-price retailing model. By offering branded and designer goods at discounted prices, the company has maintained strong customer loyalty while adapting to evolving consumer preferences. ROST continues to strengthen its market position by introducing new stores and enhancing its operational capabilities.

Beyond expansion, Ross Stores operates a chain of off-price retail apparel and home accessories stores, catering to value-conscious shoppers. Its proven business model, built on competitive bargains, ensures its stores remain attractive shopping destinations. The off-price model provides a compelling value proposition, leveraging micro-merchandising to optimize product allocation and drive strong margins. Ross Stores continues to benefit from positive customer response across both banners, reinforcing its leadership in the off-price retail sector.

The expansion reflects not only Ross Stores’ aggressive growth strategy but also its confidence in the long-term potential of the discount retail sector. As economic uncertainties and shifting consumer behaviors continue to heighten the demand for value-driven shopping, the off-price model remains highly relevant. The company’s ability to provide competitive prices on a diverse range of merchandise, from apparel to home essentials, reinforces its appeal among budget-conscious shoppers and strengthens its position in the retail landscape.

However, softening sales trends in late January and February have posed challenges. The company notes that unseasonable weather and increased macroeconomic and geopolitical volatility have affected customer traffic. Given the uncertainty surrounding these external factors, Ross Stores has adopted a cautious approach to business forecasting, particularly at the start of fiscal 2025.

Looking ahead, the company expects some of the recent challenges to be temporary. As ROST navigates a difficult external environment, it remains committed to identifying growth opportunities and effectively managing factors within its control. For the first quarter of fiscal 2025, Ross Stores anticipates comps between a decline of 3% and flat, compared with 3% growth in the prior-year quarter. The company foresees its fiscal first-quarter EPS to be $1.33-$1.47 compared with $1.46 in the prior-year quarter.

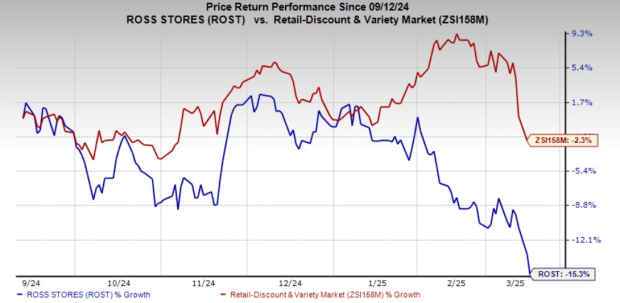

ROST, which currently carries a Zacks Rank #4 (Sell), has lost 15.3% in the past six months compared with the industry’s decline of 2.3%.

ROST Stock's Past Six Months' Performance

Image Source: Zacks Investment Research

Three Picks You Can’t Miss

Some better-ranked stocks are Boot Barn Holdings, Inc. BOOT, Urban Outfitters URBN and Deckers Outdoor Corporation DECK.

Boot Barn is a specialty retailer of premium, high-quality casual apparel. It flaunts a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Boot Barn’s fiscal 2025 earnings and revenues indicates growth of 21.4% and 14.9%, respectively, from the fiscal 2024 reported levels. BOOT delivered a trailing four-quarter average earnings surprise of 7.2%.

Urban Outfitters, a fashion lifestyle specialty retailer, currently sports a Zacks Rank of 1. URBN delivered an average earnings surprise of 28.4% in the trailing four quarters.

The consensus estimate for Urban Outfitters’ current financial-year sales indicates growth of 6% from the year-ago figure.

Deckers is a leading designer, producer, and brand manager of innovative, niche footwear and accessories. It presently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for DECK’s fiscal 2025 earnings and revenues implies growth of 21% and 15.6%, respectively, from the year-ago actuals. DECK delivered a trailing four-quarter average earnings surprise of 36.8%.

Zacks' Research Chief Names "Stock Most Likely to Double"

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t winners but this one could far surpass earlier Zacks’ Stocks Set to Double like Nano-X Imaging which shot up +129.6% in little more than 9 months.

Free: See Our Top Stock And 4 Runners UpWant the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Deckers Outdoor Corporation (DECK): Free Stock Analysis Report

Ross Stores, Inc. (ROST): Free Stock Analysis Report

Urban Outfitters, Inc. (URBN): Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).