Top Stocks From The Booming Fintech Industry To Bet On

Fintech (short for financial technology) is revolutionizing how we handle money, making financial services faster, cheaper, more accessible and user-friendly. From digital payments and mobile banking to artificial intelligence (AI)-powered insurance, robo-advisors, blockchain and fraud prevention, fintech is disrupting traditional finance in every way imaginable.

The rapid adoption of fintech, especially among Millennials and Gen Z, has made it a high-growth industry. Whether it’s transferring money, making payments, investing or even getting financial advice — all of this can now be done with just a click on your smartphone or laptop. With convenience and innovation driving demand, the fintech sector is poised for massive expansion.

Did you know that fintech revenues are projected to skyrocket to $1.5 trillion by 2030? This explosive growth creates massive investment opportunities, making fintech stocks some of the hottest picks for investors seeking long-term gains.

The fintech industry is experiencing unprecedented growth, with traditional financial institutions investing heavily in fintech-driven products to stay relevant. For investors, this presents a golden opportunity to invest in companies at the forefront of financial innovation. As digital finance continues to evolve, stocks like Robinhood Markets HOOD, Moody’s Corporation MCO and Upstart Holdings, Inc. UPST are gaining traction.

Our Fintech Screen will help you identify the right stocks now to ride the wave of this trillion-dollar revolution. Leveraging advanced tools, our thematic screens identify companies shaping the future, making it easier to capitalize on emerging trends.

Ready to uncover more transformative thematic investment ideas? Explore 30 cutting-edge investment themes with Zacks Thematic Screens and discover your next big opportunity.

3 Fintech Stocks to Consider Right Away

Robinhood, founded in 2013 by Vlad Tenev and Baiju Bhatt, democratized finance by providing commission-free stock trading. Launched in 2015, its app quickly gained popularity among younger investors, disrupting traditional brokerage firms. The platform became a major force in retail investing, particularly during the pandemic, when a surge in retail trading fueled its rapid growth.

Robinhood has evolved from a brokerage firm mainly trading in digital assets to a more mature and diversified entity, striving to widen its market and reach. The company operates in multiple financial sectors, offering stock and ETF trading, options trading, cryptocurrency transactions, retirement accounts and cash management services. The company has also expanded into prediction markets and launched the Robinhood Wallet for self-custodial crypto storage. These diverse offerings make it a key player in the fintech industry, attracting millions of users with its user-friendly and innovative approach. The company intends to become a one-stop shop for building generational wealth.

Robinhood plans to expand internationally, particularly in Europe and Asia, while introducing services for institutional investors. The company, carrying a Zacks Rank #2 (Buy), is developing AI-powered investment tools and exploring Decentralized Finance (DeFi) integration to enhance its offerings. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

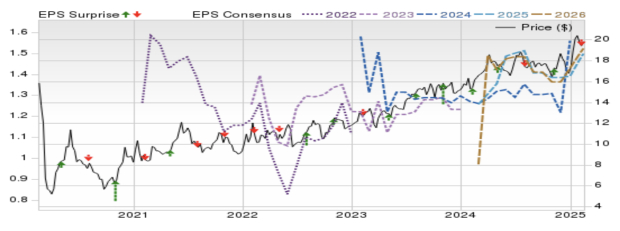

With these initiatives, the company will continue to reshape the financial industry by making investing more accessible and technologically advanced. The Zacks Consensus Estimate for HOOD’s 2025 sales and EPS implies year-over-year growth of 25.3% and 38.5%, respectively.

Moody’s has undergone a significant transformation over the last decade, integrating advanced analytics, machine learning (ML) and AI to enhance its risk assessment capabilities. By leveraging vast datasets, the company now delivers deeper insights into credit markets and financial risks, assessing interconnected threats such as supply-chain disruptions, cyber risks and extreme weather events.

Moody’s data-driven approach has positioned it as a leader in financial analytics, helping clients navigate increasingly complex economic landscapes. Through acquisitions and continuous modernization, the company has strengthened its analytical capabilities, introducing cloud-based intelligent risk platforms that efficiently process massive datasets. These advancements enable faster, more accurate decision-making for financial services professionals.

Today, Moody’s has fully embraced AI, particularly Generative AI, to enhance its analytics and research solutions. AI-powered tools have streamlined risk assessments and financial modeling, significantly improving efficiency. As a result, Moody’s can process trillions of dollars in rated debt while maintaining exceptional analytical accuracy.

As the demand for sophisticated risk assessment solutions grows, Moody’s remains at the forefront of fintech innovation. With a Zacks Rank #2, the company continues to invest in cutting-edge AI and data-driven technologies, reinforcing its leadership in financial intelligence. The Zacks Consensus Estimate for MCO’s 2025 sales and EPS implies year-over-year growth of 6.7% and 11.4%, respectively.

Upstart, an AI-driven fintech disruptor, pioneered the application of AI to lending, enabling a system that is more efficient and accurate for both borrowers and lenders. Unlike traditional lenders that rely on FICO scores, the company uses ML to evaluate non-traditional data points, like education and employment history, allowing it to approve loans for a broader range of borrowers and, at the same time, maintain strong credit performance.

Upstart does not originate loans itself but acts as an intermediary, earning revenues through referral fees from lending partners, loan servicing fees, and income from loan sales and securitization. Beyond personal loans, the company has expanded into auto lending and is exploring opportunities in small business loans and mortgages. This will create diverse revenue streams, strengthening its long-term potential.

The company’s direct-to-consumer lending platform, Upstart.com, enables individuals to apply for loans directly, funded by partner institutions or institutional investors. Its competitive edge lies in its AI-driven approach, which speeds up loan approvals and provides access to credit for underserved borrowers. By leveraging automation and data analytics, the company aims to disrupt traditional lending and make borrowing more inclusive and efficient.

The Zacks Consensus Estimate for UPST’s 2025 sales and EPS implies year-over-year growth of 59.3% and 775%, respectively. The stock carries a Zacks Rank of 2.

Just Released: Zacks Top 10 Stocks for 2025

Hurry – you can still get in early on our 10 top tickers for 2025. Handpicked by Zacks Director of Research Sheraz Mian, this portfolio has been stunningly and consistently successful. From inception in 2012 through November, 2024, the Zacks Top 10 Stocks gained +2,112.6%, more than QUADRUPLING the S&P 500’s +475.6%. Sheraz has combed through 4,400 companies covered by the Zacks Rank and handpicked the best 10 to buy and hold in 2025. You can still be among the first to see these just-released stocks with enormous potential.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Moody's Corporation (MCO): Free Stock Analysis Report

Upstart Holdings, Inc. (UPST): Free Stock Analysis Report

Robinhood Markets, Inc. (HOOD): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).