18 People Share The Financial Differences Between Them And Their Parents

While some people are thoroughly optimistic about their future, personal growth, and technological progress, others are far more skeptical. One major worry that younger generations have is that they might never achieve the same level of financial security and stability as their older relatives.

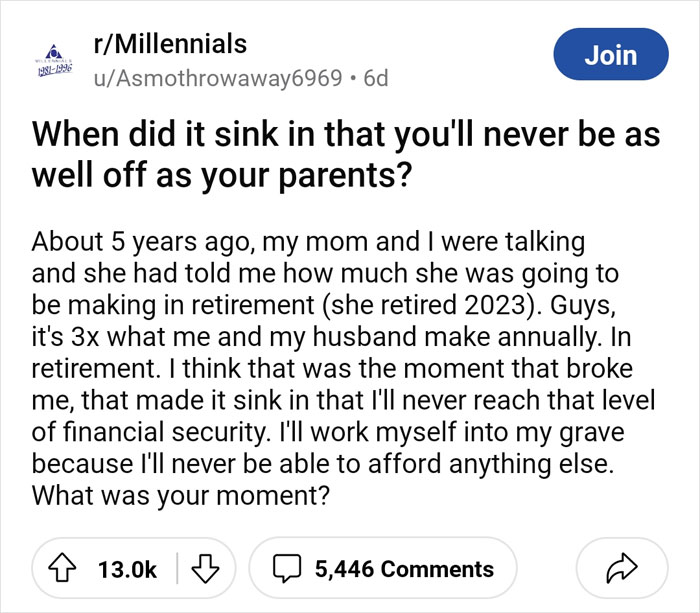

Prompted by redditor u/Asmothrowaway6969, the members of the r/Millennial online community shared their thoughts about not being as well off as their parents, and revealed the differences between their financial situations. Scroll down for their opinions and experiences, and let us know whether or not you're in a similar boat.

#1

My dad just retired at 76, he has a great pension was making 150k and they asked him to retire this year for a 1 years pay.his replacement is making 45k, no retirement package and actually has more duties than my dad did, so overall is doing the job of 2 people that were paid 150k each...

so ya good luck with that.

Image credits: worktillyouburk

#2

I was raised by my aunt and uncle. My uncle casually said he bought their house (valued at 1.5 mil now) when they were 28 at $28,000. THAT was the moment.

Image credits: HellyOHaint

#3

My parents ask me for money. They brooooke.

Image credits: Gazealotry

Millennials (aka Generation Y) are people born between 1981 and 1996. Meanwhile, members of Generation Z (aka Gen Z or Zoomers) were born between 1997 and 2012. Anyone born after that is currently considered a member of Generation Alpha (Gen A).

So, even though many Millennials are still relatively young, many of them are hoping to settle down, own a home, and get promoted to higher positions. But similar to members of Gen Z, some Millennials find that they’re stretched thin financially.

The World Economic Forum found that a whopping 42% of Millennials and 35% of Gen Z rank the cost of living as their top concern. In the meantime, 23% of Millennial respondents see climate change as the second biggest concern, followed by unemployment (20%), healthcare (19%), and personal safety (18%).

#4

This latest birthday, #37. My parents built a huge house on an entire acre of land, on 1 income in their early 30s. I just turned 37, have been renting since I was 19, have an education and a good career myself, and will probably never be able to afford a house. Sad.

Image credits: MPD1987

#5

My parents had the typical middle-class lifestyle and I have had to earn double what they did to obtain it. Now I just need compound interest to do its thing.

Image credits: Ok-Abbreviations9936

#6

For me personally, it depends on what metric I’m using for a comparison. I’m 33 and make far more money than either one of my parents ever have. But because of vastly increased cost of living, I don’t “have” as much as they did at my age. Namely, a house. At my age, my parents had already been home owners for years whereas it’s still really not on my horizon at all. .

Image credits: sts816

For Gen Z, the second biggest concern, according to the WEF, is unemployment (22%). Climate change ranks third (21%), followed by mental health (19%) and personal safety (17%).

As reported by Business Insider, the staggering rent that many young people pay has left them concerned they might never be able to afford property of their own in the future. They’re venting about the unfairness of it all on platforms like TikTok and elsewhere on social media.

#7

My wife makes more than her mom ever did working part time, from home. I passed my dad's income at around 35 yrs old. Our net worth exceeds both sets of parents, put together. Our house is worth more than both of theirs put together as well.That said, they invested in us. They paid for my college and her college, at least what wasn't covered by scholarships. Her mom gave us cash to help with a down payment on a stater home (long since paid back). We plan on doing the same for our kids and invest heavily in 529s, and our retirement.

I watched my parents struggle at times as wife watched her mom work 3 jobs. Luckily for all of us, everyone turned out well (except for my dip s**t sister...). It's not all bad out here.

Image credits: NeoGeo2015

#8

My mom is an addict and my father is stuck doing backbreaking work at a retail chain making half of what I do.My parents aren’t better off. They got cheated just like most of us. Despite my relative success life remains more challenging than you’d anticipate at this income level, not because of some personal failing, but because our society has simply changed so much.

We CAN do better. I think that requires us to be real about who is responsible for our challenges. I’ll give you a hint—it’s more specific than “boomers” or “parents.” .

Image credits: ProsePilgrim

#9

Mom was a dope addict and dad a career criminal. I was literally conceived in a federal penitentiary. I'm now a 38 year old software engineer, living with my wife of almost 10 years who practices anesthesia at a large and highly respected children's hospital. We have a million dollar home in a MCOL area on over 20 acres of land, 6 figure savings, loaded retirement accounts, and everything we could possibly need. F**k my parents. I am and always will be better than them.

Image credits: eddielee394

Statista points out that based on the data from the third quarter of 2023, 51.3% of the total wealth in the US was owned by the Baby Boomer Generation. Millennials owned just 9.3%. While this might sound unfair to many young people, things might not be as financially grim as they might first appear.

CNN recently reported on the findings in The Wealth Report about how American Millennials are getting ready to inherit a whopping $90 trillion in assets by 2044. In short, in a relatively short span of time, they’re going to become the most wealthy generation. However, this doesn’t mean that every Millennial is going to pop the champagne in celebration: whether or not you stand to inherit anything is all down to luck.

#10

I'm 100% more well off than my parents. They are immigrants from Mexico and by going to the US I've been able to take advantage of more opportunities than I'd ever be able to get at their hometown.

Image credits: Fart1992

#11

Clawed my way out of poverty so I never had this moment.

Image credits: cronicillnezz

#12

My mom pulled me aside when I was in college to be a teacher. But I knew it. I'm not dumb and my mom was a director at a Big Pharma Co. Before she retired, she was pulling in ~250k USD a year.I have never planned on having kids or even pets and therefore plan to live generally smaller than my parents did. Smaller house, fewer cars, etc. I make decent money teaching (union state!) and I'm comfortably saving for retirement. That's enough.

Image credits: gunnapackofsammiches

#13

My parents weren't very well off, wasn't hard to achieve more than them.

Image credits: TheDukeofArgyll

#14

I grew up on food stamps and now earn over 100k. I will never have this feeling.

Image credits: little_runner_boy

#15

Yeah no, I am far better off than my parents. Biological mom died when I was young, step mom has a solid career so she'll be fine when dad passes. But dad spent way too many years getting paid under the table (and saved none of it) before getting into an above board job so his Social Security is like $1k a month max. They're doing okay-ish but only because stepmom still works.

Image credits: Fr4nzJosef

#16

My mom has a nice pension, school teacher at the height of public pensions in a city, but I already make more than she ever did, my husband makes more than my dad did at that age not sure where we’ll be at retirement compared to them but I think probably ahead we are both savers by nature and have a lot invested, though my dad ended up doing quite well in his career probably more than either of us will ever make so who knows. If we were willing to work harder / more hours / more high pressure jobs we maybe could but we like our work / life balance and spending time with our kids.

Image credits: drinkingtea1723

#17

I'm pretty sure I'm better off than my mom.

Image credits: bgaesop

#18

>Update: Nice to know it's just me that's a failure. ThanksYou say in your post that your mom makes $200k in retirement per year. You also say it is 3x what you and your husband make combined.

Which means you and your husband make less than $67k combined. Which means the two of you are averaged salaries of $33,500. If you are a millennial it means you are at least in your late 20s or early 30s. Earning $33k.

$33,500 is about $16 an hour full-time. I live in rural PA and the Burger King in my town has a sign hiring for $16 an hour.

So you are making BK wages compared to your mom who held a long and apparently successful career as one of the most senior people at the IRS. She probably had an accounting degree and maybe a graduate degree and put her time into her career.

I mean, what are you expecting here? To just be given a $200k annual lifetime pension for no work? Life has never been that way. I swear some of the poverty posts in this sub give millennials a bad name.

Image credits: ballmermurland