Left Curve

(Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.)

WE INTERRUPT REGULAR BULL MARKET PROGRAMMING FOR THIS IMPORTANT MESSAGE:

You’re fucking up!

How, you ask?

Some of you think you are masters of the universe right now because you bought Solana sub $10 and sold it at $200. Others did the smart thing and sold fiat for crypto during the 2021 to 2023 bear market but lightened up as prices surged in the first quarter of this year. If you sold shitcoins for Bitcoin, you get a pass. Bitcoin is the hardest money ever created. If you sold shitcoins for fiat that you don’t immediately need for living expenses, you are fucking up. Fiat will continue to be printed ad infinitum until the system resets.

Bull markets don’t come often; it is a travesty when you make the right call but do not maximise your profit potential. Too many of us try to exist in the centre of the bell curve and reason with the bull market. The true crypto legends and degens Left Curve it. They just buy, hodl, and buy some more as long as the bull market is pumping.

I sometimes catch myself thinking like a beta cuck loser. And when I do, I must remind myself of the overarching macro theme that the entire retail and institutional investing world is starting to believe. That is, all the major economic blocs (US, China, European Union “EU” and Japan) are debasing their currencies to deleverage their government’s balance sheet. Now that TradFi has a direct way to profit off of this narrative via US and soon-to-be UK and Hong Kong spot Bitcoin ETFs, they are pushing their clients to preserve the energy purchasing power of their wealth using these crypto-derivative products.

I want to quickly step through the fundamental reason why crypto is rallying aggressively against fiat. Of course, there will come a time when this narrative loses its potency, but that time is not now. At this moment, I will resist the urge to take chips off the table. I will encourage myself to add more to the winners. I will exist purely in the Left Curve.

As we exit the window of weakness that I forecasted would occur due to April 15th US tax payments and the Bitcoin halving, I want to remind readers why the bull market will continue and prices will get sillier on the upside. Rarely in markets do the things that got you here (Bitcoin from zero in 2009 to $70,000 in 2024), get you there (Bitcoin to $1,000,000). However, the macro setup that created the fiat liquidity surge that powered Bitcoin’s ascent will only get more pronounced as the sovereign debt bubble begins to burst.

Nominal Gross Domestic Product (GDP)

What is the purpose of a government? The government provides common goods like roads, education, healthcare, social order, etc. Obviously, that’s an aspirational wish list for many governments who instead provide death and despair… but I digress. In return for these services, we, the citizenry, pay taxes. A government with a balanced budget provides as many services as possible for a given amount of tax receipts.

However, sometimes, there are situations where the government borrows money to do something it believes will have a long-term positive value without raising taxes.

For example:

A hydroelectric dam that is expensive to construct. Instead of raising taxes, the government issues bonds to pay for the dam. The hope is that the economic return of the dam meets or exceeds the bond’s yield. The government entices citizens to invest in the future by paying a yield close to the economic growth the dam will create. If, in 10 years, the dam will grow the economy by 10%, then government bond yields should be at least 10% to entice investors. If the government pays less than 10%, it profits at the expense of the public. If the government pays more than 10%, the public profits at the government’s expense.

Let’s zoom out a bit and talk about the economy at a macro level. The economic growth rate for a particular nation-state is its nominal GDP, which consists of inflation and real growth. If the government wants to run budget deficits to supercharge nominal GDP growth, it is natural and logical that investors should receive a yield equal to the nominal GDP growth rate.

While it is natural for investors to expect to receive a yield equal to nominal GDP growth, politicians would rather pay less than that. If politicians can create a situation where government debt yields less than the nominal GDP growth rate, politicians can spend money faster than Sam Bankman-Fried at an Effective Altruism charity event. The best part is that taxes do not need to be raised to pay for this spending.

How does a politician create such a utopia? They financially repress savers with the help of the TradFi banking system. The easiest way to ensure government bond yields are less than nominal GDP growth is to instruct the central bank to print money, buy government bonds, and artificially reduce government bond yields. Then, the banks are instructed that government bonds are the only “suitable” investments for the public. In that way, the public’s savings are surreptitiously funnelled into low-yielding government debt.

The problem with artificially lowering government bond yields is that it promotes malinvestment. The first projects are usually worthy. However, as politicians strive to create growth in order to get re-elected, the quality of projects declines. At this point, the government debt rises faster than the nominal GDP. Politicians now have a tough decision to make. The malinvestment losses must be recognised today via an acute financial crisis or tomorrow via low to no growth. Typically, politicians choose a long, drawn-out period of economic stagnation because the future occurs after they are out of office.

A good example of malinvestment would be green energy projects that are only possible because of government subsidies. After many years of generous subsidies, some projects cannot earn their return on invested capital and/or the real cost to consumers is prohibitive. Predictably, once government support is removed, demand wanes and projects falter. Read this story about changes to California electricity grid prices as an example of what happens when government support is provided then removed.

During the bad times, bond yields become even more distorted as the central bank presses the Brrrr button harder than Lord Ashdrake pounds the sell button. Government bond yields are kept below the nominal GDP growth rate so that the government’s debt load is inflated away.

Identification

The crucial task for investors is to understand when government bonds are a good investment or not. The simplest way to do that is to look at the nominal YoY GDP growth rate compared to a 10-year government bond’s yield. The 10-year bond yield is supposed to be a market signal that informs us about the future expectation for nominal growth.

Real Yield = 10-year Government Bond Yield — Nominal GDP Growth Rate

When the real yield is positive, government bonds are a good investment. The government is usually the most creditworthy borrower because it has a monopoly on violence. When citizens refuse to pay their taxes, a bullet in the head or a prison stint is on the table.

When the real yield is negative, government bonds are terrible investments. The trick is for the investor to find assets outside of the banking system that can grow faster than inflation.

All four major economic blocks enact policies to financially repress savers and engineer negative real yields. China, the EU, and Japan ultimately take their monetary policy cues from the US. Therefore, I will focus on the US’s past and future monetary and fiscal situation. As the US engineers loosen financial conditions, the rest of the world will follow suit.

‘Murica

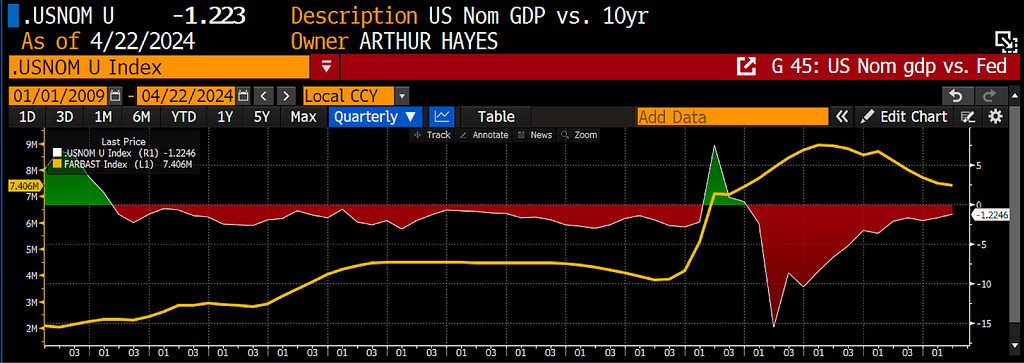

This chart shows the real yield (.USNOM Index) in white vs. the Federal Reserve’s (Fed) balance sheet in yellow. I started in 2009 because that is when Satoshi, our Lord and Savior, launched Bitcoin’s genesis block.

As you can see, after the 2008 Global Financial Crisis deflationary shock, the real yield swung from positive to negative. It went positive again, briefly, due to the deflationary shock of COVID. The boomers decided to lock everyone up so they didn’t die of the flu, and the economy cratered as a result.

A deflationary shock is when real yields spike because economic activity declines sharply.

Apart from 2009 and 2020, government bonds have been terrible investments vs. stocks, real estate, crypto, etc. Bond investors only did well by juicing their trades with insane amounts of leverage. That is the essence of risk parity for readers who are hedge fund muppets.

This unnatural state of the world could only happen because the Fed grew its balance sheet by purchasing government bonds with printed money, a process called quantitative easing (QE).

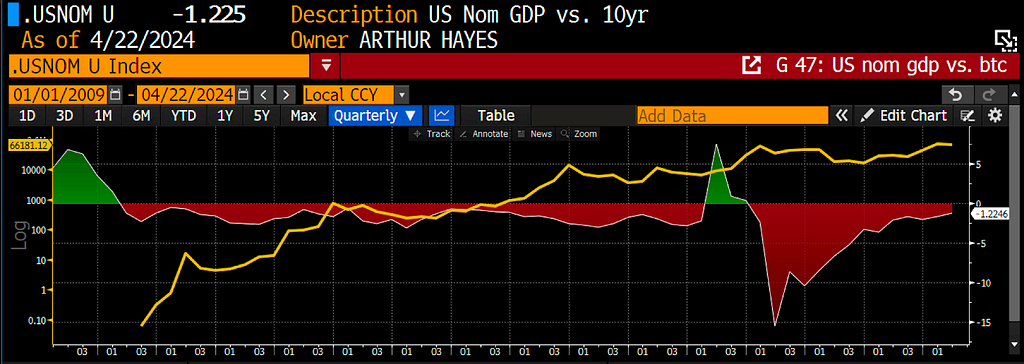

The escape valve for this period of negative real yields was and is Bitcoin (yellow). Bitcoin is rising in a non-linear fashion on a log chart. Bitcoin’s rise is purely a function of an asset with a finite quantity being priced in depreciating fiat dollars.

That explains the past, but markets are forward-looking. Why should you Left Curve your crypto investments and feel confident that this bull market is only getting started?

Free Shit

Everyone wants to get something for nothing. Obviously, the universe never offers such a bargain, but that doesn’t stop politicians from promising goodies without raising the tax rates to pay for them. Support for any politician, be it at the ballot box in a democracy or implied support in a more autocratic system, stems from the ability of a politician to create economic growth. When the easy and obvious growth-supporting policies have been enacted, politicians reach for the printing press to funnel money to their preferred constituency at the expense of the entire populace.

Politicians can offer their supporters free shit as long as the government borrows at a negative real yield. Therefore, the more partisan and polarised the nation-state, the more incentive the ruling party has to enhance their re-election odds by spending money they don’t have.

2024 is a critical year for the world as many large nation-states will hold presidential elections. The US election is crucial globally as the ruling Democratic party will do anything in their power to stay in office (as evidenced by the fact that they have done some dubious things to the Republicans since the Orange Man “lost” the previous election). A large percentage of the American population believes that the Democrats kinda sorta cheated Trump out of a victory. Regardless of whether you believe that is the truth, the fact that a large percentage of the population holds that view ensures that the stakes of this election are incredibly high. As I said before, Pax Americana’s fiscal and monetary policy will be aped by China, the EU, and Japan, which is why it is important to follow the election.

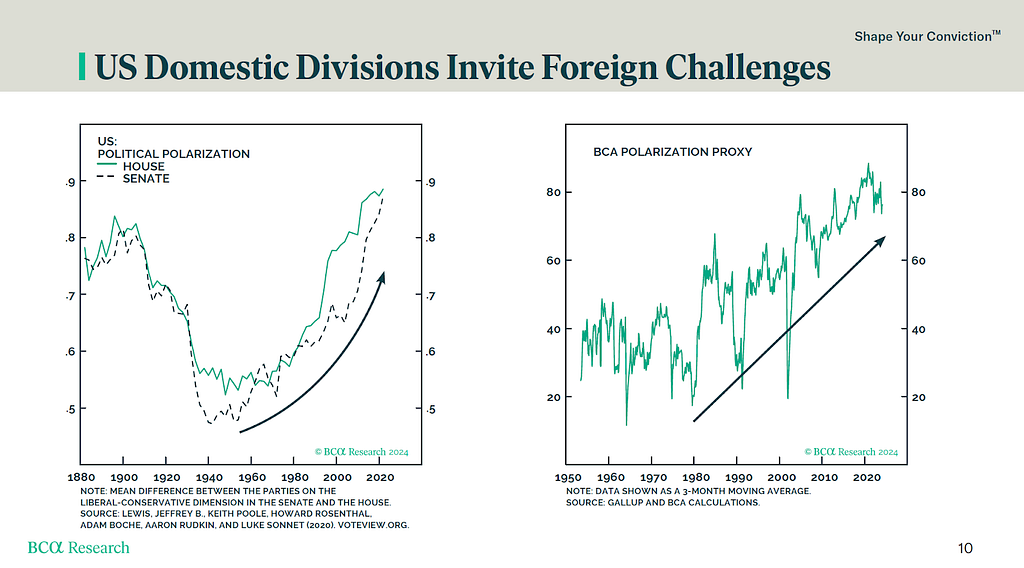

The above is a chart from BCA Research showing US political polarisation over time. As you can see, the electorate hasn’t been this polarised since the late 19th century. This makes it winner-take-all from an election perspective. The Democrats know that if they lose, the Republicans will reverse many of their policies. The next question is, what is the easiest way to ensure re-election?

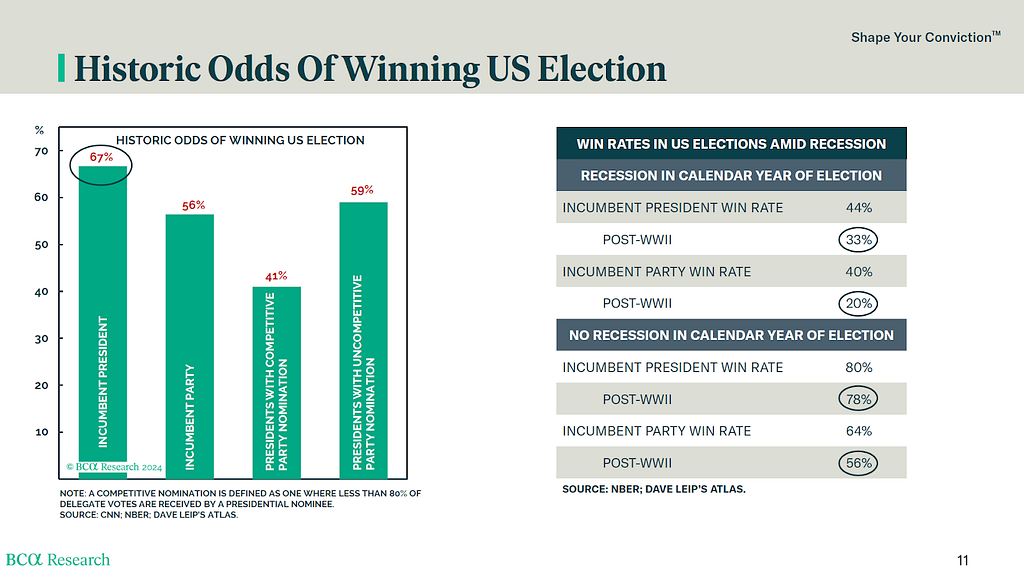

It’s the economy, stupid. The undecided voters who determine the electoral winners do so based on how they feel about the economy. As the above chart depicts, an incumbent President’s re-election odds drop from 67% to 33% if the general population feels the economy is in a recession during an election year. How does a ruling party with control of monetary and fiscal policy ensure that there will be no recession?

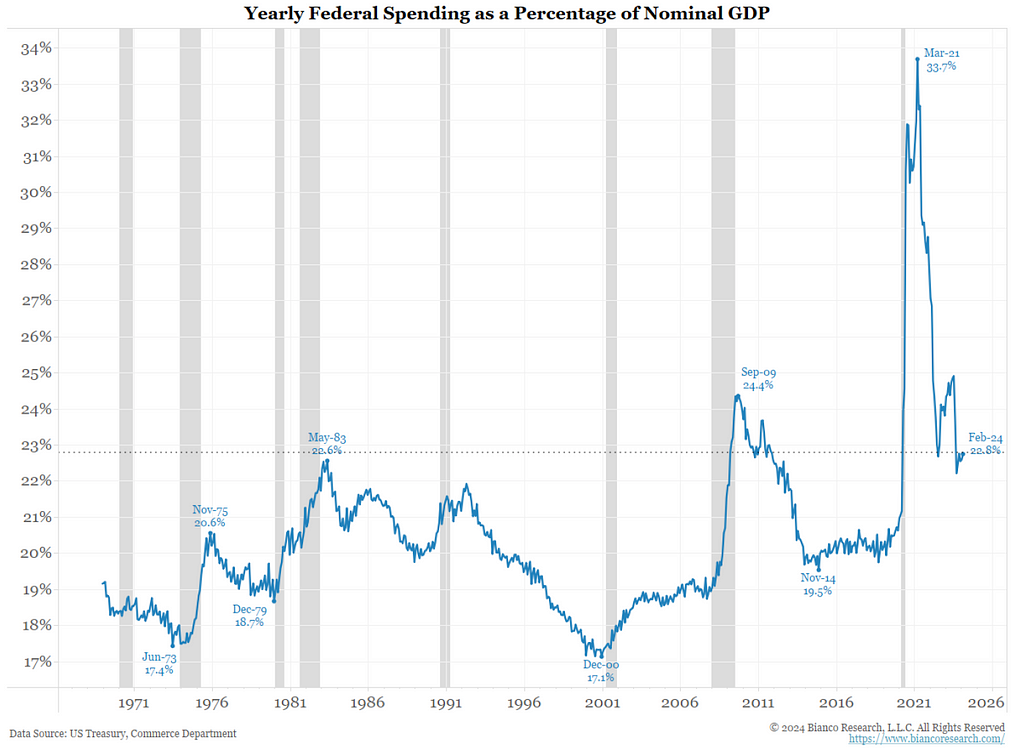

Nominal GDP growth is directly impacted by government spending. As you can see from this Bianco Research chart, the US government’s spending accounts for 23% of nominal GDP. That means the ruling party can print GDP wherever they please, so long as they are willing to borrow enough money to fund the required level of spending. GDP is now a political variable. The US is following in the footsteps of the Chinese Communist Party.

In China, the politburo determines the GDP growth rate every year. The banking system then creates enough credit to power the desired level of economic activity. For many Western-trained economists, the “strength” of the US economy is perplexing because many of the leading economic variables they monitor point to an impending recession. But as long as the ruling political party can borrow at negative rates, it will create the economic growth necessary to remain in power.

The above is why the Democrats, led by US President Biden, will do all they can to increase government spending. It is then up to US Treasury Secretary Bad Gurl Yellen and her beta cuck towel boy Fed President Jerome Powell to ensure that US Treasury bond yields are markedly below nominal GDP growth. I don’t know what money-printing euphemism they will create to ensure negative real yields persist, but I am confident that they will do what is necessary to get their boss and his party re-elected.

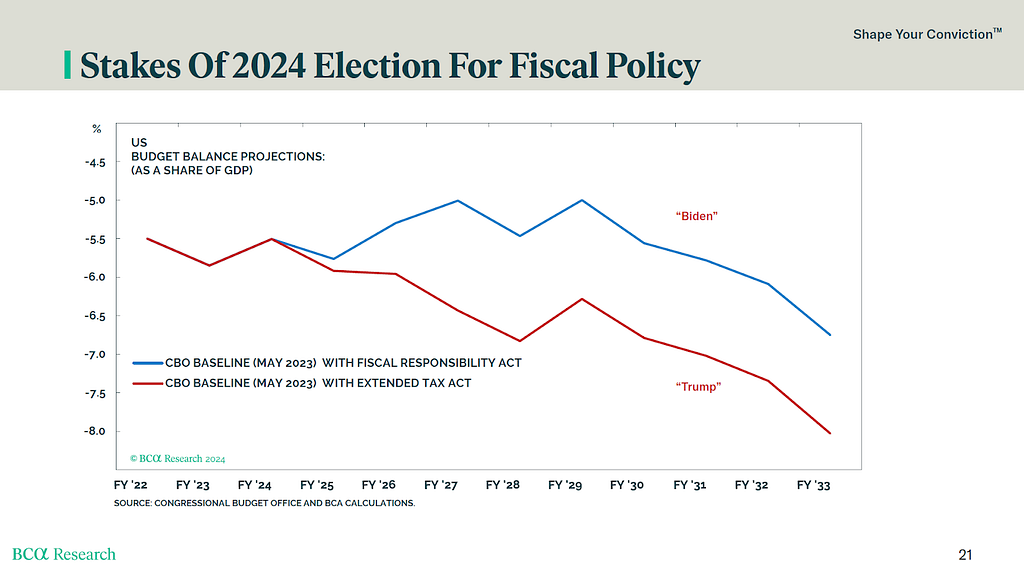

However, the Orange Man might take the prize. In this scenario, what would happen to government spending?

Nothing. The above chart estimates the deficit under a Biden or Trump presidency from 2024 onwards. As you can see, Trump is forecasted to spend even more than Slow Joe. Trump is campaigning on another round of tax cuts, which would further inflate the deficit. Whichever senile geriatric clown is the chosen one, rest assured government spending will not decline.

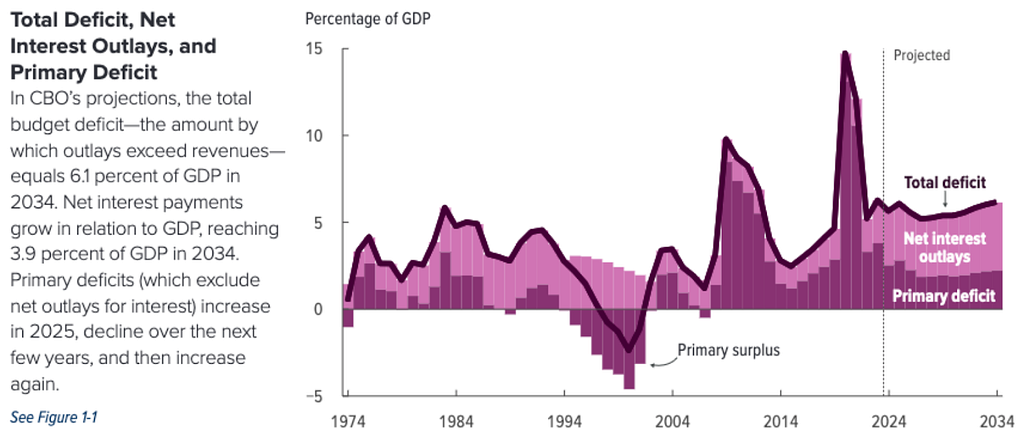

The Congressional Budget Office (CBO) forecasts government deficits based on the current and assumed future political environment. Massive deficits are forecast for as far as the eye can see. At a fundamental level, if politicians can create 6% growth by borrowing at 4%, why would they ever stop spending?

As explained above, the political situation in the US gives me extreme confidence that the money printer will go Brrrr. If you thought it was absurd what the US monetary and political elite did to “solve” the 2008 GFC and COVID, you ain’t seen nothing yet.

The wars on the Pax Americana periphery continue to chug along primarily in the Ukraine / Russia and Israel / Iran theatres. As expected, the warmongers from both political parties are content to continue funding their proxies with borrowed billions of cash money. The cost will only increase as the conflicts escalate and more countries are drawn into the melee.

Chop Chop Chop

As we enter the northern hemispheric summer and decision-makers enjoy a respite from reality, crypto volatility will decline. This is the perfect time to take advantage of the recent crypto dip to slowly add to positions. I have my shopping list of shitcoins that got pummelled over the last week. I will talk about them in upcoming essays. There will also be many token launches that won’t pop as much as they would have had the launch occurred in the first quarter. This gives those who are not pre-sale investors a great entry point. Whatever the flavour of crypto risk excites you, the next few months will present a golden opportunity to add to positions.

Calling all degens to the Left Curve. Your hunch that money printing will accelerate as politicians spend money on handouts and wars is correct. Do not underestimate the desire to remain in office of the incumbent elites. If real rates become positive, then re-assess your crypto conviction. But until that time, let your winners run, you glorious degenerate piece of shit.