Powell To Face Pressure On Rates From Democrats, Bank Rules From Republicans

Powell To Face Pressure On Rates From Democrats, Bank Rules From Republicans

Authored by Mike Shedlock via MishTalk.com,

Fed Chair Jerome Powell meets with Congress this week. He will face pressure on two different fronts.

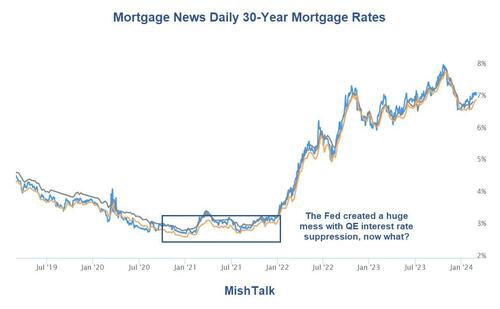

Image courtesy of Mortgage News Daily, annotations by Mish

Pressure on Two Fronts

Bloomberg reports Powell to Face Pressure on Rates From Democrats, Bank Rules From Republicans

The Fed chair heads to Capitol Hill on Wednesday and Thursday for his semiannual testimony before Congress, two years after the central bank began its aggressive battle against surging inflation. With the economy powering along and inflation inching toward the Fed’s sweet spot, Powell will make the case for why officials are in no rush to lower rates.

In a Jan. 30 letter, Senator Sherrod Brown urged Powell to cut rates “early this year,” arguing that high rates are hurting small businesses and putting homeownership out of reach for many Americans. That missive from the Senate Banking Committee chair, an Ohio Democrat who is running for reelection this year, could give cover to other committee Democrats who want to press Powell on rates.

Housing

Maryland Democrat Chris Van Hollen, in an interview last week, said the Fed needs to focus on housing costs “and taking actions necessary to make things more affordable for more Americans.”

“Right now those high interest rates are actually increasing costs for families because one of the big parts of costs for families is housing,” Senator Elizabeth Warren, a persistent Powell critic, said in a Bloomberg Television interview. “It’s time to get those interest rates down.”

Capital Rules

Republicans will use Powell’s appearance to grill him on the Fed’s proposal to ramp up capital requirements for big banks by almost 20%.

Election Year

Powell has repeatedly said the looming election plays no role in policy decisions, but some Fed watchers worry rate cuts this year — investors are betting the first reduction will come in June — could be perceived as the Fed giving a boost to Democrats.

Elizabeth Warren Hoot of the Day

Home prices are at record highs. Just what does she think will happen to home prices and inflation if Powell cuts rates too early?

Small businesses are struggling but why is that?

The answer is Biden’s free money to students, Biden’s regulatory madness, Biden’s union push, and massive minimum wage hikes, especially in places like California are all highly inflationary.

The Fed’s Big Problem

On average, the economy looks OK. But averages are misleading. Several large groups of people are struggling. They all have one thing in common.

Case-Shiller home price index, CPI rent index, and the index of hourly earnings for production and nonsupervisory workers.

The Fed’s Big Problem is There Are Two Economies But Only One Interest Rate

Who’s Unhappy?

Those looking to buy a home but cannot afford the record high prices, are not faring well in this economy.

The last great time to buy a home was in 2012. Over the next eight years, home prices moved further and further away from wages.

When the Covid pandemic hit in 2020, we had record QE, record fiscal stimulus, mortgage rates hit record lows, and inflation hit the highest levels in 40 years.

When the Fed slashed interest rates to zero, mortgage rates fell below 3.0% for an extended period allowing everyone to refinance at 3.0 percent or below. Most did.

Winners and Losers

-

The homeowners are generally doing OK. The home ownership rate is 65.7 percent.

-

The 34.3 percent who rent are generally not doing OK.

The study did not break things down by home owners vs renters, but I suspect most of the use is by renters.

According to the latest CPI report, rent was up at least 0.4 percent for the 29th straight month. Shelter, a broader category, rose 0.6 percent. Food rose 0.4 percent.

CPI data from the BLS, chart by Mish

Credit Card and Auto Delinquencies Soar

Credit card debt surged to a record high in the fourth quarter. Even more troubling is a steep climb in 90 day or longer delinquencies.

Record High Credit Card Debt

Credit card debt rose to a new record high of $1.13 trillion, up $50 billion in the quarter. Even more troubling is the surge in serious delinquencies, defined as 90 days or more past due.

For nearly all age groups, serious delinquencies are the highest since 2011 at best.

Auto Loan Delinquencies

Serious delinquencies on auto loans have jumped from under 3 percent in mid-2021 to to 5 percent at the end of 2023 for age group 18-29.

Age group 30-39 is also troubling. Serious delinquencies for age groups 18-29 and 30-39 are at the highest levels since 2010.

For further discussion please see Credit Card and Auto Delinquencies Soar, Especially Age Group 18 to 39

Generational Homeownership Rates

Home ownership rates courtesy of Apartment List

The above chart is from the Apartment List’s 2023 Millennial Homeownership Report

Those struggling with rent are more likely to Millennials and Zoomers than Generation X, Baby Boomers, or members of the Silent Generation.

The same age groups struggling with credit card and auto delinquencies.

On Average Everything is Great

Average it up as Fed and all the clueless economic and political writers do, and things look great.

This is why we have seen countless stories attempting to explain why people should be happy.

Hello Mr. Powell

There are two economies (the homeowners/asset holders and everyone else). However, there is only one interest rate. Patience please says Powell.

Lowering rates risks risks fueling the housing bubble and the most expensive stock market in history.

It’s Powell’s move. No matter what he does Elizabeth Warren will howl.

She wants lower interest rates, but that will stoke inflation and it will not do a damn thing for renters who don’t have a down payment and cannot a house no matter what the mortgage rate is.

This is a dilemma of the Fed’s making and there is no solution.