The New Champions Of The Stock Market: Millennials

iStock; Alyssa Powell/BI

It turns out the Robinhood crowd was onto something when they piled into the stock market during the pandemic.

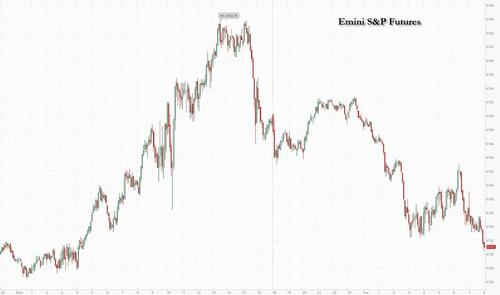

Americans between the ages of 18 and 40 — so, largely millennials — saw their wealth surge by 80% from early 2019 to late 2023, according to a new report from the Federal Reserve Bank of New York. The explanation: an explosion in the value of their financial assets and, more specifically, their stock-market portfolios. Young investors are likelier to invest in equities and riskier assets than older adults, who are closer to retirement and tend to have their money parked in safer places, like bonds. Millennials’ gamble on stocks paid off: The S&P 500 rose roughly 90% from 2019 through 2023, and, according to the New York Fed, the younger generation’s higher allocation to equities even helped to slightly close their wealth gap with older Americans.

“The under-40 group experienced a much greater increase in equity portfolio share than the older groups did; this increased exposure to equities — the fastest-growing financial asset class during the period — enabled younger adults to record higher growth in both financial assets and overall wealth,” the report’s authors wrote.

The researchers weren’t able to parse what drove the jump in portfolio growth —the increase was a combination of both new investments and the growth of existing investments. Government stimulus checks probably played a role in driving more millennials to invest, especially since younger Americans generally have lower incomes than baby boomers and were therefore likelier to receive the checks. That government support gave millennials some money to play with, and they decided to play it on stocks.

While these gains are clearly a good thing for millennials and older Gen Zers, they’re not a total panacea for the yawning wealth gap between younger Americans and their older counterparts. Yes, as the New York Fed reported, the stock-market gains “led to a limited narrowing of age-based wealth disparities over the past four years,” but that gap remains. As of 2019, people under 40 held 4.9% of total US wealth even though they’re 37% of the population. People over 54, who make up a similar share of the population, held 71.6% of total wealth. Nearing the end of 2023, under-40s controlled 6.7% of total wealth, while those over 54 had 72.8%. In other words, it’s still OK to have a grudge against boomers.

Nick Colas, the cofounder of DataTrek Research, told me that the surge in wealth for young people also reflects a simple function of math. “Starting points matter. Older cohorts had more assets in 2020, so their growth is slower. Younger ones had less, so it has been much easier for them,” he said. Put another way, it’s easier for the value of a $1,000 stock portfolio to double than the value of a $300,000 house to grow by a similar percentage.

Colas also noted that it looks like the youngest investors were perhaps not great at staying invested and hopped out of the market when things started to get rocky instead of riding it out. Research from Ernst & Young, reported by Bloomberg, came to a similar conclusion: Millennials were likelier than Gen X and baby boomers to quit the stock market when it fell in 2022.

Wealth inequality is, of course, still a major problem in America. And while being young is fun life-wise, it is not so fun money-wise. It’s also worth noting that wealth inequality got worse by race during the time period in question.

Still, if you want to build wealth, investing is a good idea — and after years of being a little bit of financial screwups, millennials started to take that wealth-building seriously during the pandemic. Now, the challenge is to try to keep at it, get some more luck in the stock market and, God willing, their own homes.

Emily Stewart is a senior correspondent at Business Insider, writing about business and the economy.