What Makes Bitcoin Truly Valuable?

I'm a skeptic but also open-minded when it comes to Bitcoin. I want to learn, and I think there are a few people here who can share insights that would be helpful.

The reason for my skepticism is that I view Bitcoin as a currency in the way humanity has since the beginning of civilization. Traditionally, a currency established trust based on the following criteria:

- Intrinsic value

- Durability

- Stability

- Portability

- Divisibility

- Utility

- Scarcity

This is why, for a long time, people used salt, cacao beans, and even cowry shells as currencies. It's quite fascinating when you think about it. Imagine going to the grocery store now and being able to hand over a bunch of shells in exchange for your milk, cheetos, and frozen pizza.

These weird currencies preceded the widespread adoption of precious metals. Bronze, an alloy of copper and tin, was one of the earliest and most durable metal-based currencies. However, silver and gold eventually became the standard in most regions.

Gold became the ultimate standard and remained so until the 70s, when the US abandoned the gold standard in favor of fiat currency (brainded decision), making the dollar no longer backed by physical gold, a dumbass mistake in my view.

Since then, the world's reserve currency (the dollar) essentially no longer met criteria 1 (intrinsic value) and 7 (scarcity), yet people kept trusting it, which is crazy because for thousands of years before this transition, it would've never worked.

Now we have cryptocurrencies, or rather, Bitcoin and the others. Yes, it's not fiat money (as its value does not come from government law and regulation), but it also doesn't fully meet the established criteria.

It lacks intrinsic value. Unlike silver or gold, which are tangible and have various technological and mechanical applications due to their high conductivity and resistance to corrosion, Bitcoin does not.

Yes, Bitcoin has scarcity, but it's artificial, not natural. The limit on total coins has been programmed that way, but even with this limit, unlike gold or silver, you can replicate Bitcoin in an identical manner using an identical blockchain, endlessly. In fact, people have created versions meant to be "better," though none have found a market fit as strong as Bitcoin's.

Bitcoin also lacks the utility of other currencies. You can't wait 10 minutes at the grocery store for a payment to get processed. It's not practical or acceptable. And even if vendors and customers were willing to accept a 10-15 minute delay for a payment to clear, there just aren't many vendors currently accepting Bitcoin. In many countries and cities, there are no vendors willing to accept it at all.

I know for sure my aunties aka boomers sure as hell aren't going to open up a wallet and try to pay for their haircut at the hair salon with Bitcoin. Those boomers have been hoarding money though. That's a gigantic share of the economy not willing to adopt Bitcoin, and their kids aren't going to spend their inheritances on Bitcoin either as they still fall outside of the current demographic.

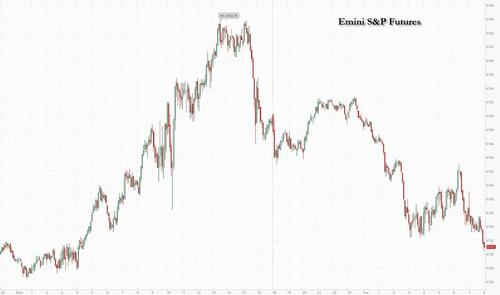

Bitcoin's stability, or lack thereof, is also a concern. It's highly volatile, primarily used as an investment tool rather than as an actual currency.

At the end of the day, a currency that people trust is what matters most. For five decades, people have trusted the dollar (we are sheep, truly), which has also just been numbers on a screen, without any underlying value or natural scarcity.

So, people can trust a currency even if it isn't scarce or lacks intrinsic value. However, the absence of intrinsic value, natural scarcity, and utility is a significant weakness, one that has caused issues with debt and inflation.

Bitcoin's decentralization has caused governments and the traditional banking system to attempt to impose laws and conditions that resist it, but that's not the only reason for its low adoption rate beyond investors and speculators.

If another decentralized currency emerges, one that meets all the criteria, Bitcoin could face an existential crisis.

I'd like Bitcoin experts here to share their perspectives and insights. I'm open to having my arguments challenged based on logic, rationale, and human psychology. I want to see the other side of the coin (pun so intended), as there's a reason why many people fully trust Bitcoin to become a practical currency that will achieve critical mass and become the new gold standard.

Like I said, I'm a skeptic but also open-minded and ready to learn. So, please, prove me wrong if possible.

Edit: Unfortunately, no one so far has been able to address the weaknesses of Bitcoin, as mentioned above, or provided any new insights that could shed light on how it might overcome its limitations. I am fully aware that I’m on Reddit and in the Bitcoin subreddit, which is very likely an echo chamber for Bitcoin evangelists. I do appreciate the few comments here from those who are self-aware about this fact and seem to be honest about it. I’m now more convinced than ever that Bitcoin is an investment tool and not a currency, primarily because not one person was able to address Bitcoin’s practicality as a currency in all its dimensions. I’ll consider Bitcoin as a hedge, but I don’t believe in it as the new future gold standard until it actually becomes one.

[link] [comments]