1 No-brainer Vanguard Dividend Etf To Buy Right Now For Less Than $200

Vanguard High Dividend Yield ETF (NYSEMKT: VYM) has a 2.7% dividend yield. That may not sound like a high yield, but it is more than twice the average of stocks in the S&P 500 (SNPINDEX: ^GSPC), which is yielding a little under 1.2%. That comparison is actually interesting in another way, and it highlights the value that Vanguard High Dividend Yield ETF provides -- even if you only have $200 to invest right now.

Vanguard High Dividend Yield ETF uses a simple approach

The first thing that investors need to understand about any exchange-traded fund (ETF) they buy is the investment approach. These are pooled investment products, so you are really hiring someone else to handle the investing process for you. You have to make sure you know what they are doing.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Vanguard High Dividend Yield ETF is an index-based ETF, which means it simply mimics an index. That index is the FTSE High Dividend Yield Index.

Image source: Getty Images.

The FTSE High Dividend Yield Index is pretty simple. The first step in creating the index is to select all dividend-paying companies on the U.S. exchanges. The second step is to line up all of those companies by yield, from highest to lowest. The third step is to include the highest-yielding 50% in the index.

The index is market-cap weighted, so the largest stocks have the greatest impact on performance. That's pretty easy to understand and clearly focuses investors on the highest-yielding stocks. The cost for all of this is a tiny 0.06% expense ratio.

Why isn't Vanguard High Dividend Yield ETF's dividend yield higher?

Some dividend investors might balk at this point, wondering how an ETF that is designed to buy the highest-yielding stocks can have a yield that actually seems fairly modest on an absolute level. The answer boils down to the number of stocks being included in the portfolio.

Just like the S&P 500, Vanguard High Dividend Yield ETF holds around 500 stocks. While all of them pay dividends, the index it tracks actually pushes fairly low down into the yield range of all dividend-paying stocks. It has no choice, given the sheer number of dividend-paying stocks.

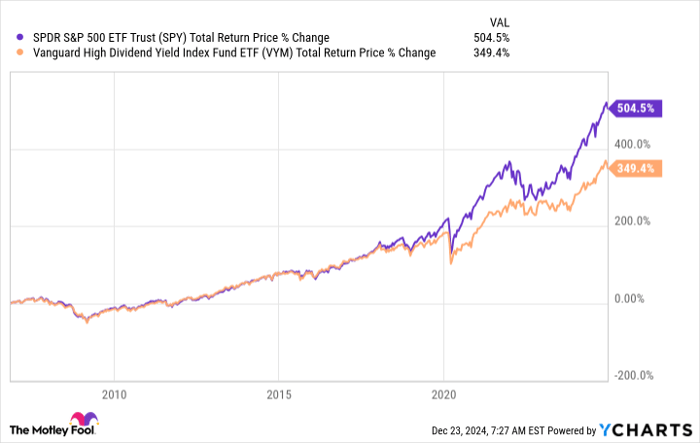

Data by YCharts.

But here's the interesting thing: Until a few very large companies started to dominate the S&P 500's returns, Vanguard High Dividend Yield ETF tracked fairly closely with the market's performance, as highlighted in the chart. Given the highly diversified portfolio it owns, that isn't shocking. This suggests that, for a dividend investor, this ETF could be switched out for the S&P 500 as a core stock holding. Right now might even be a good time to consider a switch, given the dynamics driving the S&P 500 today.

There are some statistics to consider on this front beyond the extra yield you'd collect. For example, the S&P 500's average price-to-earnings ratio is 28.4 times, while Vanguard High Dividend Yield ETF's is a lower 21.2 times. The same holds true for price-to-book value, with the S&P 500 at 5 times and Vanguard's ETF at 2.9 times. Essentially, you get a higher yield and a portfolio that looks like it has a more reasonable valuation.

Vanguard High Dividend Yield ETF has a solid dividend foundation

If you don't want to take on the effort of picking individual dividend stocks, Vanguard High Dividend Yield ETF is a good way to create a foundation on which to build your portfolio. Its diversification, above-market yield, and simple portfolio construction are all attractive features. But the really nice part is that it allows you to easily layer higher-yielding, more aggressive investments on top of it without upending your portfolio, making it a solid foundational investment whether you have $200 or $2 million to invest.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $363,593!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,899!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $502,684!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 23, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard Whitehall Funds-Vanguard High Dividend Yield ETF. The Motley Fool has a disclosure policy.