2 Artificial Intelligence (ai) Stocks I'd Love To Buy On The Next Dip

Artificial intelligence (AI) is a massive and expansive umbrella encompassing many different technologies. You are probably familiar with generative AI, like ChatGPT, Perplexity, and Alphabet's Google Gemini (NASDAQ: GOOGL). This market forecast calls for growth of nearly tenfold by 2030 (which isn't far away now!), as you can see below.

Statista

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But there are many other markets, too -- speech recognition, cybersecurity, weapons detection, driver-assist and autonomous vehicle tech, and robotics, to name a few. And advanced semiconductors are underneath all of this technology.

Investors should be involved in this market. However, it's important to remember that active investing involves two main pillars: terrific companies and enticing valuations. As Warren Buffett said, "Price is what you pay; value is what you get." In other words, make sure what you buy is reasonably priced.

The major indexes hit record highs numerous times in 2024, and stocks of some great companies sport hefty valuations reminiscent of 2021. Market corrections, defined as drops of at least 10%, happen on average once every year or so. So, I like to keep a list of stocks to buy or add to a position when the opportunity arises. Here are two I'm watching closely.

Arm Holdings

Some companies operate behind the scenes of so many products, yet we are unaware of them. Arm Holdings (NASDAQ: ARM) is one of those. If you own a smartphone, there is a greater than 99% chance an Arm-based chip powers it. More than 99% of global smartphones use Arm technology.

Smartphones were a tremendous accomplishment. Now, AI is Arm's next frontier. This includes generative AI, advanced cloud computing, autonomous driving, advanced driver assist, and more. Arm works closely with tech giants to design the chips needed to create advanced products. For instance, Meta (NASDAQ: META) recently partnered with Arm on its next-generation large language models (LLMs). This is just one of many collaborations that give Arm a tremendous growth runway.

While Arm is a semiconductor company, it's important to note that it is not a manufacturer but a designer. It creates the architecture that companies use to build out for their needs. It makes money by licensing the technology and collecting royalties when products are sold. Arm reported $844 million in revenue last quarter (fiscal Q2 2025) on 5% growth. That seems low, but management chalked it up to the timing of major deals and noted strong bookings in the quarter. We can expect higher growth when the company reports Q3.

Because of its critical place in a growing industry, Arm is a stock I want to own and have owned. However, the valuation is tough to justify now. The midpoint of Arm's revenue guidance for fiscal year 2025 is $3.95 billion. This means it trades for nearly 40 times sales based on its current $157 billion market cap. Looking at another metric, Arm stock trades at a price-to-earnings ratio of almost 100, based on its forecast for $1.55 in non-GAAP (adjusted) earnings per share for the fiscal year. Enthusiasm seems to have outpaced the fundamentals. Arm should have a tremendous future. However, investors should consider waiting for a dip in the price or using a risk-mitigation strategy like dollar-cost averaging to buy this stock.

SoundHound AI

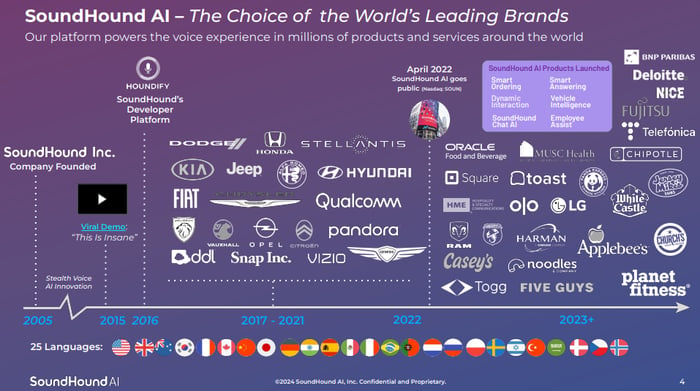

One technology mentioned above is speech recognition or conversational intelligence. The technology enables advanced voice commands in vehicles, automated ordering at drive-thrus and by phone, and AI-powered customer service. Automation is popping up everywhere, and SoundHound AI's (NASDAQ: SOUN) technology powers much of it. The company reports partnerships with many well-known brands, as shown below.

Source: SoundHound.

This impressive list is driving terrific revenue gains. SoundHound reported an 89% year-over-year increase in sales to $25 million in Q3. The company expects at least $82 million in sales for the full year of 2024 and $155 million to $175 million in 2025.

Potentially doubling sales next year is exciting, and I expect that speech recognition ordering will eventually become the standard rather than a novelty. Still, I look to what Warren Buffet said about price and value.

With a market cap of $5.15 billion, the stock trades at more than 60 times the sales forecast for 2024 and more than 30 times the midpoint of 2025's sales guidance. This is steep for a company that isn't profitable.

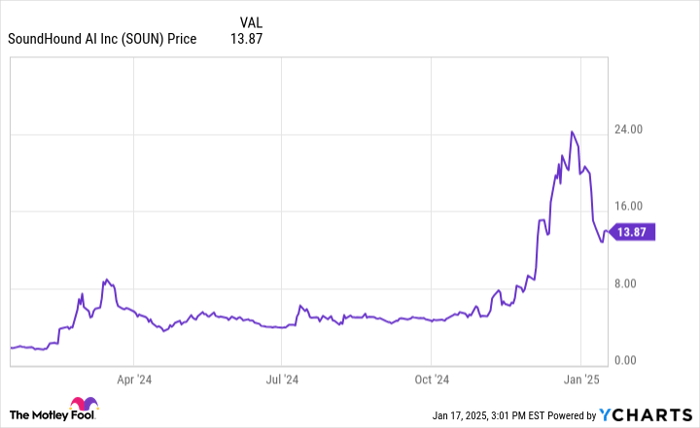

The good news is that investors may not have to wait long. The stock price is down significantly from its recent highs, as shown below.

Investors should consider initiating or adding to a position if the decline continues.

AI is a tremendous market expanding rapidly, and investors should own several AI stocks. However, the fervor that captivated the market in 2024 won't last forever. A dip is always on the horizon; we just don't know when it will come. Keeping a list of stocks to buy when the opportunity arises is a terrific plan.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $365,174!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,164!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $469,011!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 21, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Bradley Guichard has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet and Meta Platforms. The Motley Fool has a disclosure policy.