3 Incredible Vanguard Etfs That Can Serve As A Complete Portfolio

Building a powerful investment portfolio doesn't require complex strategies or dozens of holdings. A straightforward approach using three exchange-traded funds (ETFs) can deliver remarkable results through market cycles. This three-fund portfolio strategy has gained popularity among investors seeking simplicity without sacrificing returns.

Vanguard pioneered index investing and maintains a unique ownership structure that sets it apart in the investment industry. Its funds collectively own Vanguard itself, creating a strong alignment between the company's success and investor returns. This unique structure has helped Vanguard maintain some of the lowest expense ratios in the industry, a crucial advantage for long-term investment success.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

These market-leading low costs, combined with Vanguard's deep expertise in index investing, make it an ideal provider for a three-fund portfolio strategy. Let's examine how three specific Vanguard ETFs work together to create a powerful investment approach that can serve as a foundation for building lasting wealth.

The foundation of U.S. market returns

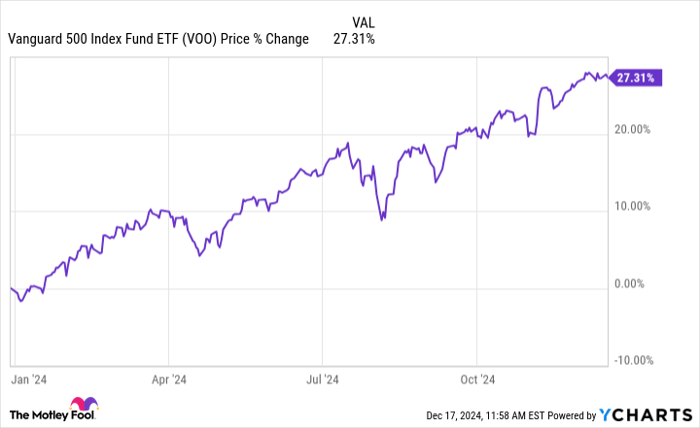

At the heart of most successful long-term investing strategies lies the Vanguard S&P 500 ETF (NYSEMKT: VOO), a powerhouse investment vehicle that opens the door to America's corporate elite. This foundational fund doesn't just track 500 companies -- it provides direct access to the innovative engines driving the world's largest economy. Industry titans like Microsoft, Apple, and Berkshire Hathaway form the backbone of the fund's portfolio.

What makes the Vanguard S&P 500 ETF particularly compelling for investors is its remarkable cost efficiency. With an expense ratio of just 0.03%, it exemplifies the power of low-cost investing. Imagine paying only $3 annually to manage $10,000 of your wealth. This cost advantage compounds significantly over time, allowing more of your capital to work for you.

The true magic of the Vanguard S&P 500 ETF lies in its elegant simplicity and powerful reach. Through a single investment, you gain exposure to every major sector of the U.S. economy, from cutting-edge technology to established industrial giants. Many of these companies have evolved into global powerhouses, generating substantial revenue streams from international markets while maintaining the stability and transparency of U.S.-based operations.

This Vanguard fund has also consistently demonstrated its worth against active management strategies. Even sophisticated professional investors, armed with extensive research and resources, rarely outperform this indexed ETF over extended periods, making it a cornerstone holding for long-term wealth building.

Capturing global growth opportunities

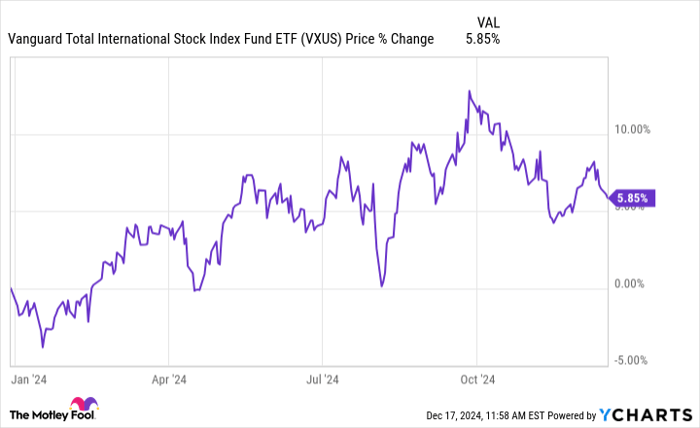

The Vanguard Total International Stock ETF (NASDAQ: VXUS) unlocks a world of opportunity beyond American shores. This powerhouse fund opens doors to thousands of innovative companies across developed and emerging markets, from European stalwarts like Nestlé to Asia's rising tech giants. With a minimal 0.08% expense ratio, it offers an efficient gateway to global wealth creation.

The strategic beauty of international exposure lies in its natural hedging power. When U.S. markets face headwinds, growth engines in Europe, Asia, or Latin America often continue to thrive, providing crucial portfolio resilience. This makes the Vanguard Total International Stock ETF not just a diversification tool, but also a vital component of forward-thinking wealth building.

Stability through fixed-income

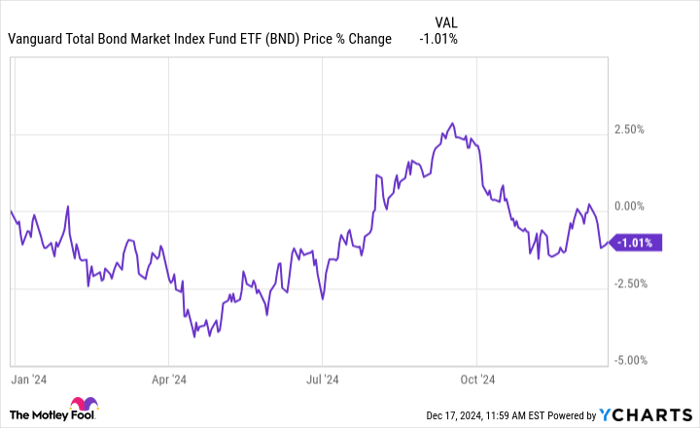

The Vanguard Total Bond Market ETF (NASDAQ: BND) serves as the portfolio's stabilizing force by investing in U.S. government and high-quality corporate bonds. This fund helps reduce portfolio volatility while generating steady income through interest payments. The rock-bottom 0.03% expense ratio ensures investors keep more of their bond returns.

Fixed-income investments typically move differently from stocks, providing crucial portfolio balance during market turbulence. This relationship helps investors maintain their long-term strategies during the inevitable drawdown in stock markets.

The zen of long-term wealth-building

A winning investment approach combines the best of established market wisdom with disciplined execution. Through a powerful combination of the Vanguard S&P 500 ETF for U.S. market exposure, the Vanguard Total International Stock ETF for global opportunities, and the Vanguard Total Bond Market ETF for stability, investors can gain access to a comprehensive wealth-building framework. Moreover, this strategy removes emotional decision-making from the investment process, which can significantly improve returns over the long haul.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $808,966!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

George Budwell has positions in Apple, Berkshire Hathaway, Microsoft, Vanguard S&P 500 ETF, and Vanguard Total Bond Market ETF. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Microsoft, Vanguard S&P 500 ETF, Vanguard Total Bond Market ETF, and Vanguard Total International Stock ETF. The Motley Fool recommends Nestlé and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.