5 Ultra-safe High-yield Dividend Stocks To Buy Even If There's A Stock Market Sell-off In 2025

Five-year, 10-year, and multi-decade charts of market movements all show that stock market sell-offs happen. No one knows when they'll begin, how severe the downturn will be, or how long they'll last. However, we do know that sell-offs of 20% or more from recent highs, known as bear markets, occur about every 3.5 years but don't last nearly as long as bull markets. That means sell-offs create tremendous buying opportunities for long-term investors.

Sell-offs can also be scary. Some investors turn to buying what are considered safer stocks if they are worried about a sell-off. This is especially true for risk-averse investors looking for stocks to supplement income in retirement or anyone more focused on capital preservation than capital appreciation. These safer stocks tend to hold up better in a sell-off.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

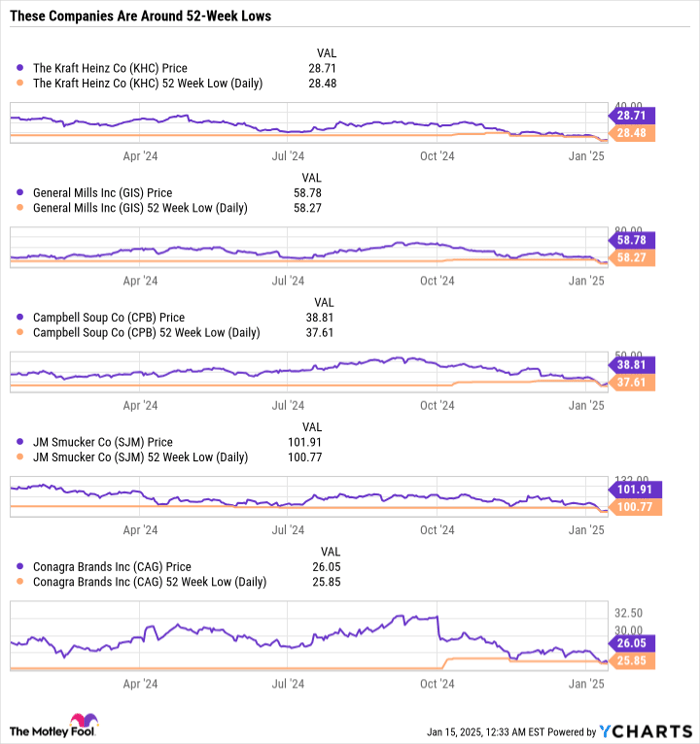

Kraft Heinz (NASDAQ: KHC), Campbell's (NASDAQ: CPB), General Mills (NYSE: GIS), J.M. Smucker (NYSE: SJM), and Conagra Brands (NYSE: CAG) are five packaged-food companies that are considered safe stocks. Right now, each offers high yields partly because they have missed out on the broader market rally over the last two years. In fact, all five companies trade within just a few percentage points or less of their 52-week lows, and most are within striking distance of their three- to five-year lows.

But sustained market rallies like we saw in 2023-24 inevitably lead to sell-offs at some point. Here's why these dividend stocks are a buying opportunity for income investors if there is a sell-off in 2025.

Image source: Getty Images.

Inflation's effect on the industry

Economic cycles tend to have the biggest effect on sectors like consumer discretionary, industrials, and financials. They occasionally even affect the technology sector. But the consumer staples sector is somewhat immune to economic cycles. Demand for packaged foods tends to be fairly recession-resistant. Consumers are less likely to change their purchasing behavior on favored brands like Kraft mac and cheese, Campbell's soups, General Mills' cereals, J.M. Smucker's Jif peanut butter, or Conagra Brands' Banquet frozen foods than they are on discretionary purchases like furniture and entertainment. That makes the packaged food industry fairly reliable no matter what the economy is doing.

This sector is still susceptible to inflationary pressures though and the last few years have been challenging for the industry. Many of these companies have overly relied on price increases to offset stagnating and declining volumes. So, while the S&P 500 overall trades near all-time highs, packaged goods companies have noticeably sold off while inflation remains slightly elevated.

Data by YCharts.

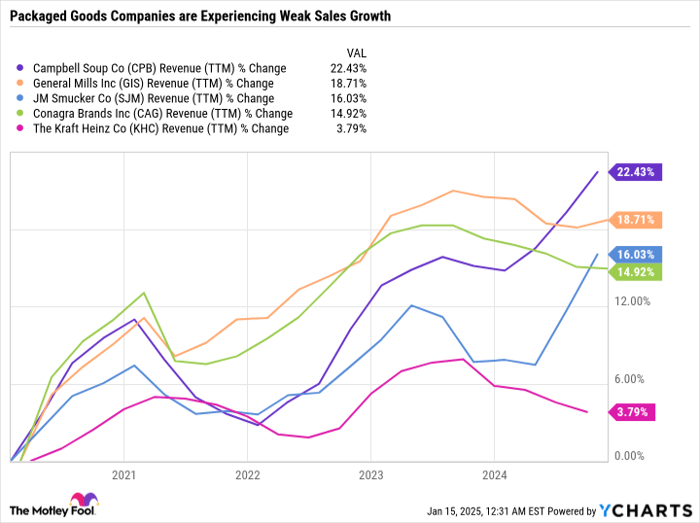

Sales growth for the group over the past five years has been volatile, significantly influenced by inflation.

Data by YCharts; TTM = trailing 12 months.

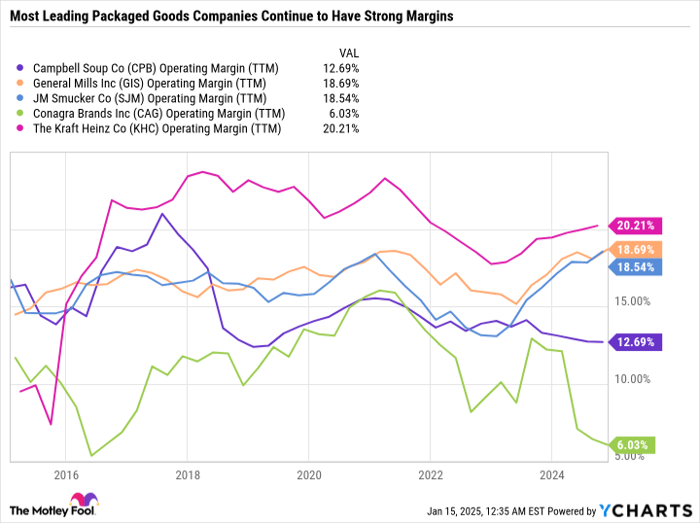

Despite the poorly performing stock prices and weak sales growth, margins for most of these companies have generally held up, especially for Kraft, General Mills, and J.M. Smucker.

Data by YCharts.

Good margins indicate that a company isn't overly relying on price cuts to spur volume growth. When looking at packaged goods companies, it's important to understand the balance between sales growth and margins. If Campbell's really wanted to grow sales, it could just undercut other soup companies. But that strategy would do more harm than good because it would be hurting its margins.

Dirt-cheap valuations with high yields

The sell-off across packaged goods companies, paired with steadily growing sales and earnings (albeit slowly), has pushed the industry's valuations down to bargain-bin levels.

Data by YCharts; PE = price to earnings.

What's more, it's pushed the dividend yields of all five companies above 3%, and significantly higher than their average levels over the last five years.

This combination of value and income may seem too good to be true for passive-income investors, and they wouldn't necessarily be wrong. There are valid risks to consider before diving headfirst into any of these stocks.

The biggest risk is the company's ability to afford the dividend expense let alone raise its dividend from year to year. The industry doesn't have the best track record for consistent dividend raises. Kraft has kept its payout the same for years. Campbell's has made modest raises over time but doesn't consistently increase its payout every year. General Mills and Conagra have raised their dividends every year since 2007. And J.M. Smucker has increased its dividend every year since it began paying one in 2000.

If you're looking for consumer staples companies with impeccable track records of dividend growth, then these packaged goods companies aren't the best fit. Instead, you might explore Procter & Gamble, Walmart, Coca-Cola, PepsiCo, Kenvue, Colgate-Palmolive, Hormel Foods, and Kimberly-Clark (among others). These stocks are all Dividend Kings that have paid and raised their payouts annually for at least 50 consecutive years.

Although investors shouldn't expect sizable raises from all five of these companies in the near term, they can take solace in knowing that all five companies should be able to afford their current payouts. Here's a look at fiscal 2025 projected earnings for each company, along with their forward dividends per share.

|

Company |

Forward Annual Dividend per Share |

Fiscal 2025 Projected EPS |

Forward Dividend Yield |

|---|---|---|---|

|

Kraft Heinz |

$1.60 |

$3.06 |

5.6% |

|

Campbell's |

$1.48 |

$3.14 |

3.3% |

|

General Mills |

$2.40 |

$4.41 |

3.6% |

|

Conagra Brands |

$1.40 |

$2.45 |

5.1% |

|

J.M. Smucker |

$4.32 |

$9.89 |

3.8% |

Data source: Yahoo Finance. Note: The projected EPS is based on consensus analyst estimates.

Power your passive income with packaged goods stocks

The most valuable and best-performing consumer staples stocks in 2024 -- Walmart and Costo Wholesale -- have low yields and expensive valuations. Whereas slower-growing giants like Coke, Pepsi, and P&G have solid yields and reasonable valuations. Then there are the ultra-inexpensive packaged goods companies that are essentially the lowest-growth pocket of the consumer staples sector.

Value and income investors are getting an excellent opportunity to buy shares of these high-yield packaged goods companies while they are out of favor. Investing in equal parts among the five stocks discussed in this article produces an average yield of 4.3% while still allowing investors to participate in the stock market. For context, the yield on a 10-year Treasury note is 4.8%. Of course, investing in equities is riskier than a Treasury note.

Kraft Heinz, Campbell's, General Mills, J.M. Smucker, and Conagra Brands aren't the kind of companies likely to keep pace with the S&P 500 over the long term due to their limited growth prospects. But they are excellent choices if you're more interested in passive income from relatively safer value stocks than the upside potential from rapidly growing businesses.

Should you invest $1,000 in Kraft Heinz right now?

Before you buy stock in Kraft Heinz, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Kraft Heinz wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $843,960!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Colgate-Palmolive, Costco Wholesale, J.M. Smucker, Kenvue, and Walmart. The Motley Fool recommends Campbell's and Kraft Heinz and recommends the following options: long January 2026 $13 calls on Kenvue. The Motley Fool has a disclosure policy.