All It Takes Is $3,500 Invested In Jpmorgan Chase And 3 Other Dividend Stocks To Help Generate Over $300 In Passive Income A Year

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Banks are kicking off the fourth-quarter 2024 earnings season with a bang, with JPMorgan Chase (NYSE: JPM), Bank of America (NYSE: BAC), Wells Fargo (NYSE: WFC), and Citigroup (NYSE: C) all hovering near 52-week highs.

Investing $3,500 into each stock will generate about $308 in passive income a year, likely even more if each company continues raising its payout.

Here's what's driving bank stocks higher and the best dividend-paying bank stock to buy now.

Image source: Getty Images.

The stars have aligned for big banks

The financial sector can be cyclical based on a variety of economic factors. Banks are affected by Federal Reserve policy, interest rates, commercial and residential real estate, corporate debt, consumer financial health, economic growth, and regulatory policy. In 2024, the macro backdrop was about as favorable as it gets.

Perhaps the simplest reason the financial sector surged in 2024 and is continuing the momentum in 2025 is because a highly anticipated recession never came, setting the stage for deal-making and strong profits amid higher interest rates.

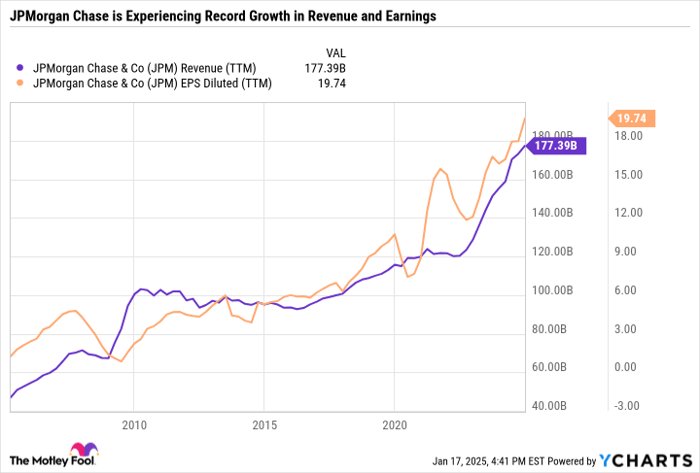

Wells Fargo blasted 6.7% higher on Jan. 15 thanks to solid results, including 11% higher diluted earnings per share and 15% growth in fee-based revenue. JPMorgan Chase popped 2% on Jan. 15 and reached an all-time high on Jan. 17 in response to excellent results and another year of record revenue and net income.

The good news is that earnings, not speculation, are driving big banks higher. However, it's a mistake to assume a business at the top of its game will stay that way forever. Myriad economic factors could lead to challenges for banks in 2025. JPMorgan Chase Chief Financial Officer Jeremy Barnum said on the fourth-quarter earnings call: "We think it's important to acknowledge the tension between the risks and uncertainties in the environment and the degree of optimism embedded in asset prices and expectations. In that context, we remain upbeat about the strength of the franchise, but we are focused on being prepared for a wide range of scenarios."

When approaching the big banks, it's important to understand the composition of their revenue streams and exposure to capital markets and different industries. For example, JPMorgan Chase has a sizable banking and wealth management business, is involved in home lending, card services, and auto loans, has a huge commercial and investment banking division, and more. By comparison, Wells Fargo has spent the past four years simplifying its business through efficiency initiatives aimed at focusing on quality rather than quantity.

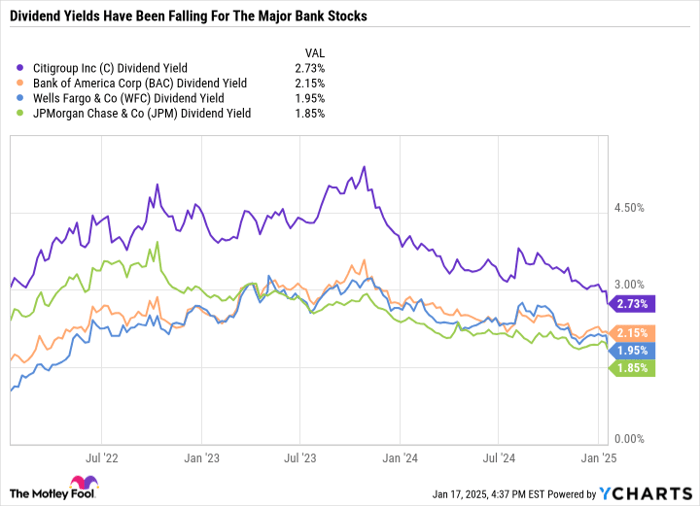

Yield compression

Not long ago, you could count on 3% or higher yields from the big bank stocks. But stock prices have outpaced the rate at which the big banks have raised their dividends -- leading to lower yields.

C Dividend Yield data by YCharts

The big banks don't exactly have the best ultra-long-term track records for consistent dividend raises. However, some banks have prioritized dividend growth since the financial crisis of 2008. JPMorgan has increased its payout every year since 2011, with its current annual dividend of $5 per share, more than triple the 2008 dividend.

Bank of America slashed its dividend during the financial crisis and began raising it again in 2014.

Similarly, Citigroup cut its quarterly dividend to just $0.01 per share in 2011 -- keeping it at that level till it gradually began raising the payout in 2015. Citi is a much smaller bank today than it was before the financial crisis. And even after last year's rally, the stock is still down slightly during the past five years.

Wells Fargo is the least reliable dividend payer of the group after it cut its quarterly dividend from $0.51 per share to just $0.10 per share in 2020, although it has since raised it to $0.40.

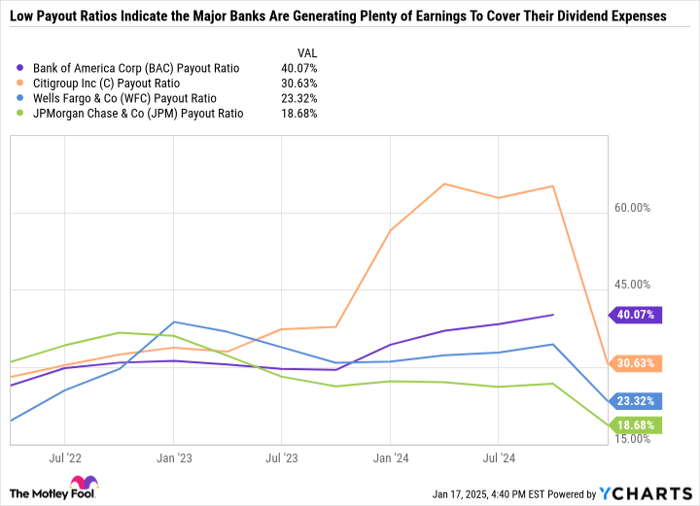

Despite the industry's rocky past, dividends are now an integral part of the investment thesis of each company. Low yields aside, all four companies have relatively low payout ratios, which measures the cost of a dividend as a percentage of net income.

BAC Payout Ratio data by YCharts

A low payout ratio indicates that dividend expenses are affordable, and there's room to make sizable increases in lockstep with earnings growth.

The best big bank to buy now

And while you could invest $3,500 in equal parts of each bank to generate more than $300 in annual passive income, some investors may want to focus on quality over dividend quantity by concentrating on JPMorgan, with the lowest payout ratio of the four.

JPMorgan is the most expensive of the banks in terms of forward price-to-earnings ratio, but it is also highly diversified and arguably the highest-quality bank. As you can see in the following chart, JPMorgan is experiencing its fastest growth since before the financial crisis -- showcasing just how favorable this period has been for its business.

JPM Revenue (TTM) data by YCharts

As valuations rise in the financial sector, it's paramount for value and income investors to focus on quality businesses that can perform well or even take market share during an industrywide slowdown. By maintaining diversification or concentrating on high-quality businesses like JPMorgan Chase, you can be well positioned no matter what the market brings in 2025.

Should you invest $1,000 in JPMorgan Chase right now?

Before you buy stock in JPMorgan Chase, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Chase wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $843,960!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Wells Fargo is an advertising partner of Motley Fool Money. Citigroup is an advertising partner of Motley Fool Money. Bank of America is an advertising partner of Motley Fool Money. Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and JPMorgan Chase. The Motley Fool has a disclosure policy.