Backdoor Roth In Freetaxusa: Recharacterize & Convert, Same Year

You may have contributed to a Roth IRA and then realized later in the same year that you would exceed the income limit. You recharacterized the Roth IRA contribution as a Traditional IRA contribution and converted it to Roth again before the end of the year. Your IRA custodian sent you two 1099-R forms, one for the recharacterization and one for the conversion. This post shows you how to put them into FreeTaxUSA.

If you had done the recharacterizing and converting in the following year, you would have to split the tax reporting into two years by following Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 1 and Split-Year Backdoor Roth IRA in FreeTaxUSA, Year 2. Now because you caught the problem soon enough before the end of the year, you can handle all of it in the same year by following this guide.

Here’s the example scenario we’ll use in this guide:

You contributed $7,000 to a Roth IRA for 2024 in 2024. You realized that your income would be too high later in 2024. You recharacterized the Roth contribution for 2024 as a Traditional contribution. The IRA custodian moved $7,100 from your Roth IRA to your Traditional IRA because your original $7,000 contribution had some earnings. The value increased again to $7,200 when you converted it to Roth before December 31, 2024. You received two 1099-R forms, one for $7,100 and another for $7,200.

If you didn’t do any of these recharacterizing and converting, please follow our guide for a “clean” backdoor Roth in How to Report Backdoor Roth In FreeTaxUSA (Updated).

If you’re married and both you and your spouse did the same thing, you should follow the steps below once for yourself and again for your spouse.

1099-R for Recharacterization

We handle the 1099-R form for the recharacterization first. This 1099-R form has a code “N” in Box 7.

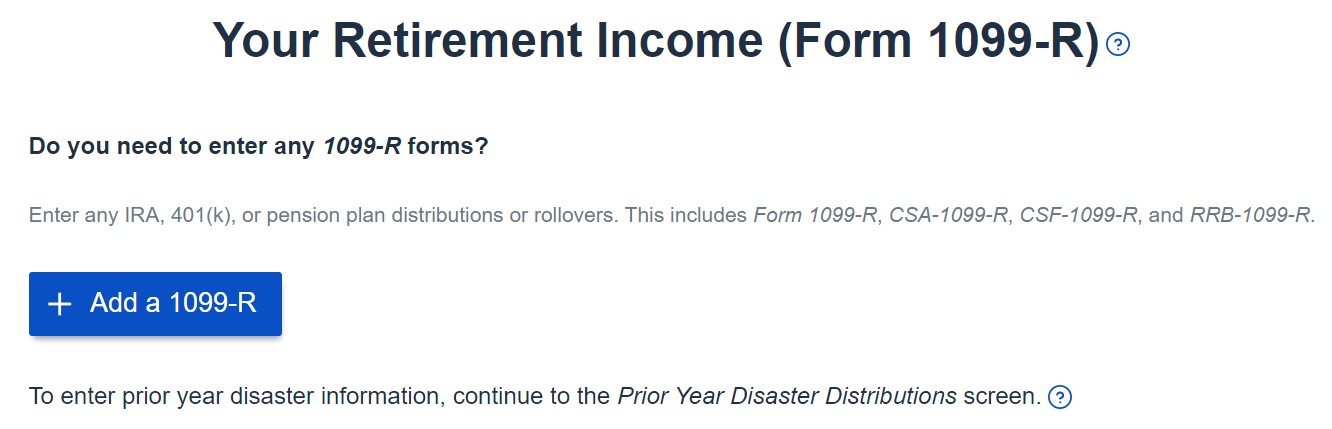

Find “Retirement Income (1099-R)” under the Income menu.

Click on the “Add a 1099-R” button.

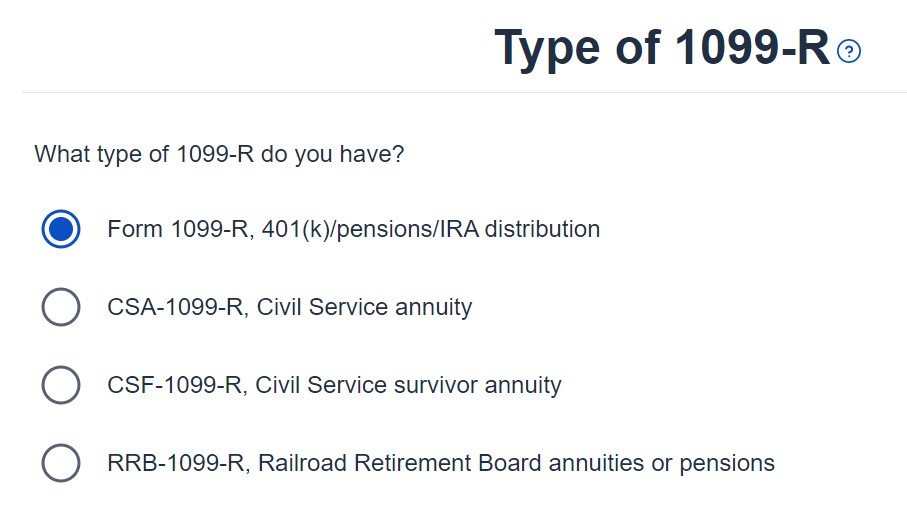

It’s just a regular 1099-R.

The 1099-R form for the recharacterization shows the amount moved from the Roth IRA to the Traditional IRA in Box 1. It’s $7,100 in our example. The taxable amount is 0 in Box 2a and the “Taxable amount not determined” box isn’t checked. The code in Box 7 is “N” and the “IRA/SEP/SIMPLE” box may or may not be checked. It isn’t checked in our sample form.

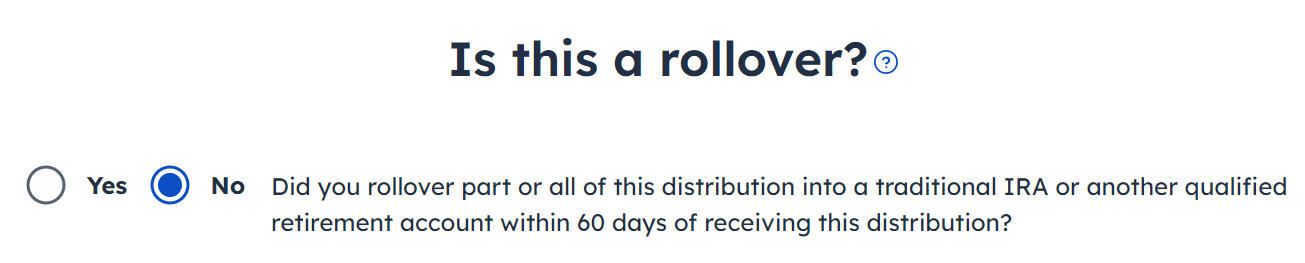

The recharacterization wasn’t a rollover.

FreeTaxUSA shows some alerts just to double-check. The zero taxable income on the 1099-R is correct. Code “N” in Box 7 is also correct.

You’re done with the 1099-R form for the recharacterization. Click on the “Add a 1099-R” button to add the other 1099-R for the conversion.

1099-R for Conversion

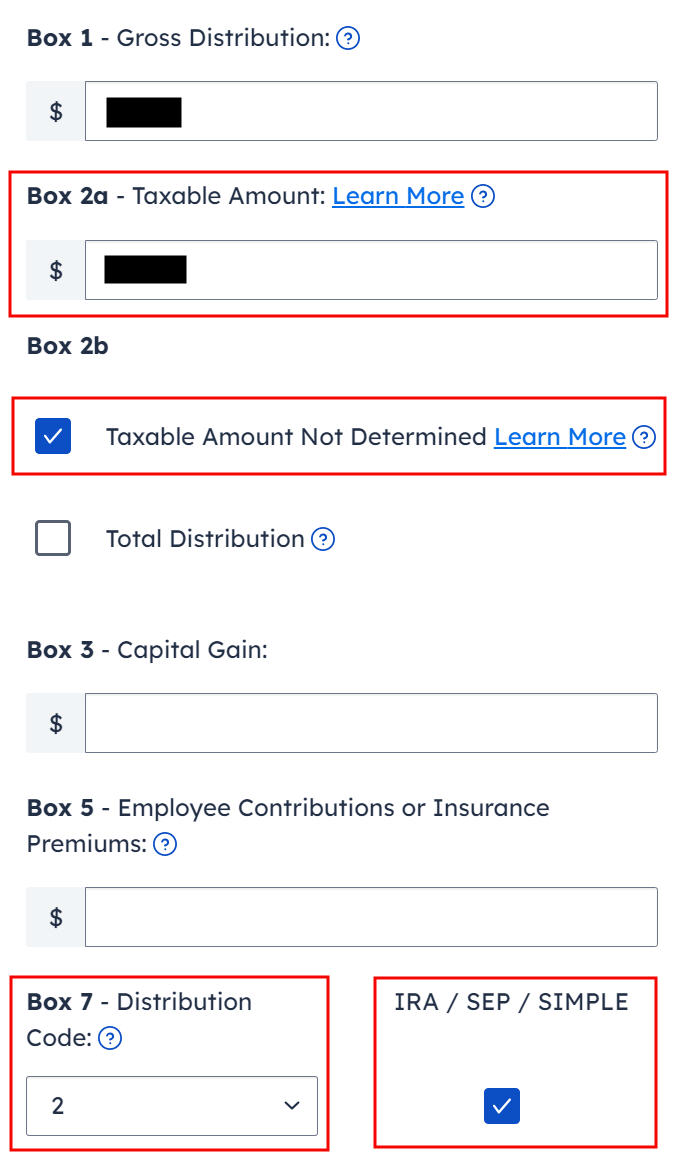

The 1099-R for the conversion has a code “2” in Box 7 if you’re under age 59-1/2 or a code “7” if you’re 59-1/2 or older.

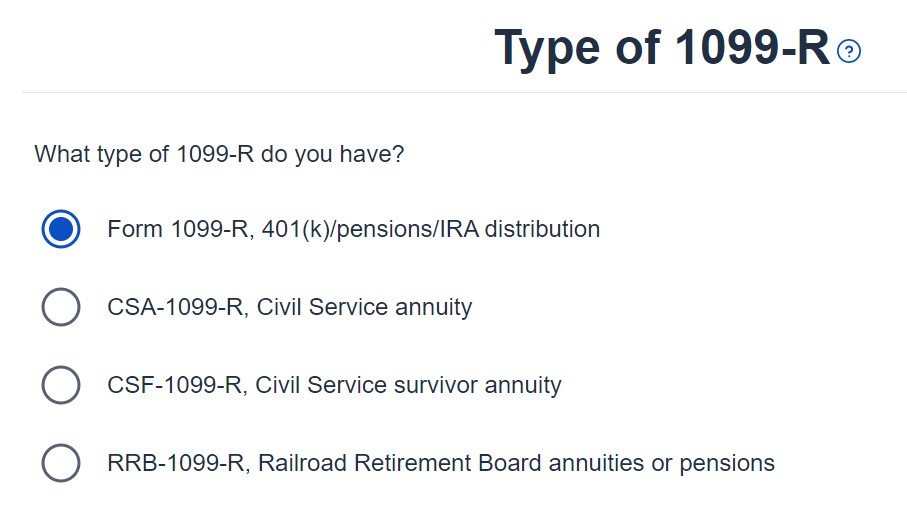

It’s also a regular 1099-R.

Box 1 shows the amount converted to Roth. It’s $7,200 in our example. It’s normal to have the same amount as the taxable amount in Box 2a when Box 2b is checked saying “taxable amount not determined.” Make sure to choose the correct code in Box 7 to match your 1099-R. The “IRA / SEP / SIMPLE” box is checked.

Your refund number drops after you enter this 1099-R. Don’t panic. It’s normal and temporary. The refund number will come up when we finish everything.

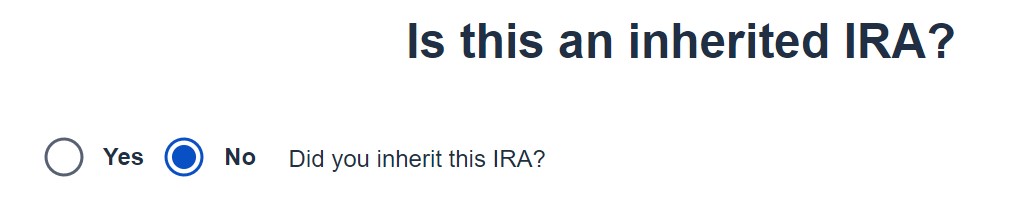

It’s not an inherited IRA.

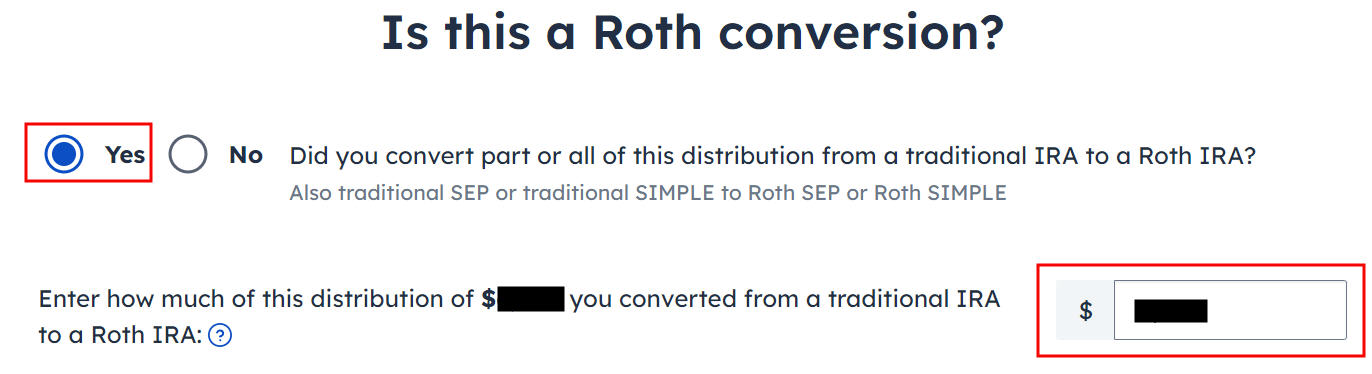

It’s a Roth conversion. 100% of the amount on the 1099-R was converted from a Traditional IRA to a Roth IRA.

You are done with this 1099-R for the conversion. Repeat if you have another 1099-R. If you’re married and both of you converted to Roth, pay attention to whose 1099-R it is when you enter the second one. You’ll have problems if you assign both 1099-R forms to the same person when they belong to each spouse. Click on “Continue” when you have entered all the 1099-R forms.

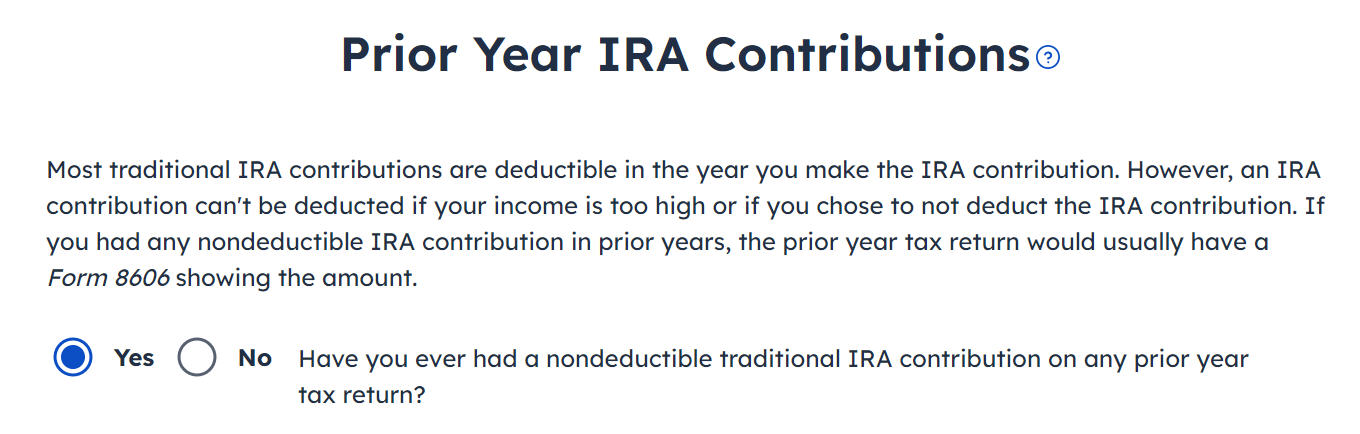

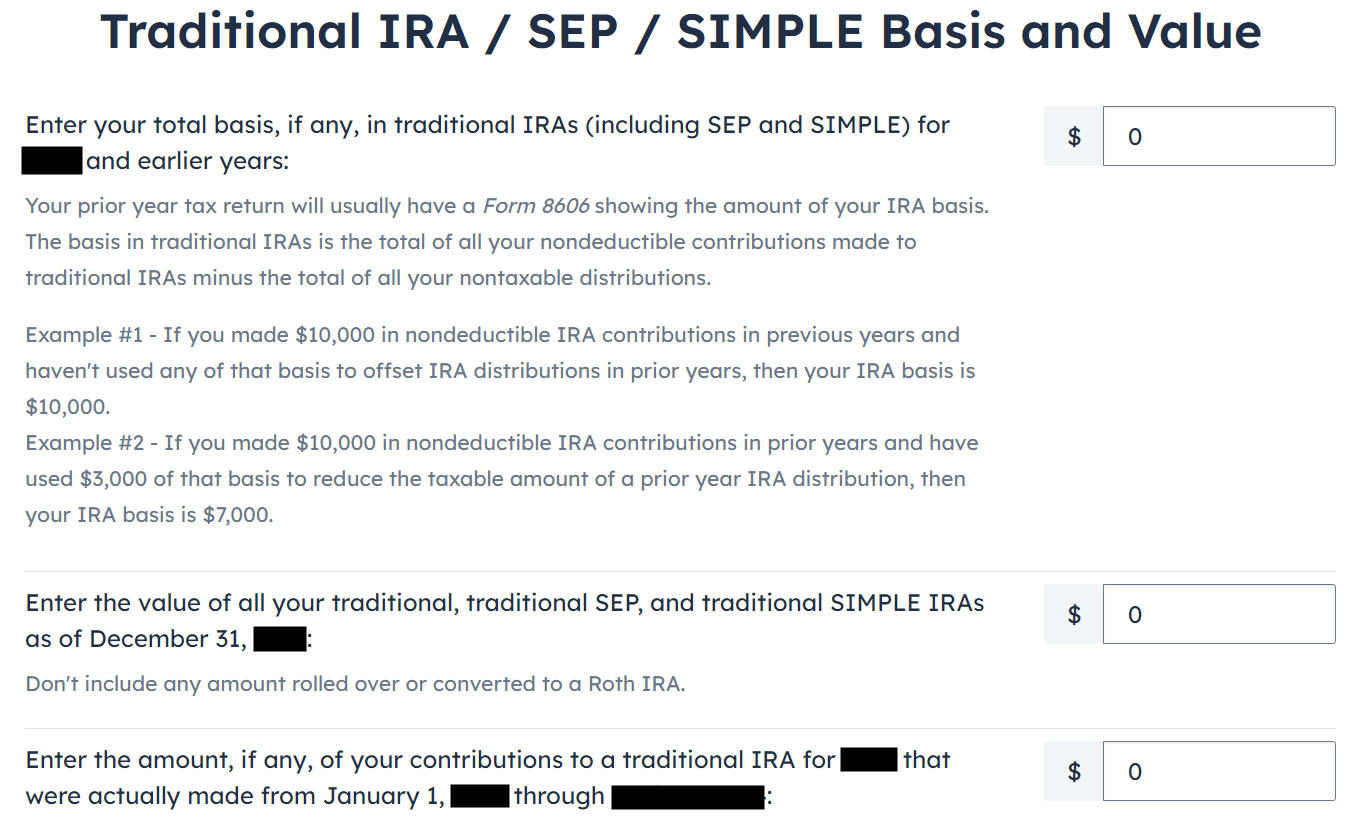

It asks you about the basis carried over from previous years. If you never contributed to a Traditional IRA in previous years, you can answer “No.” Answering “Yes” and entering a zero on the next page has the same effect as answering “No.” If you have gone back and forth before you found this guide, some of your previous answers may be stuck. Answering “Yes” here will give you a chance to review and correct them. If you have a basis carryover on line 14 of Form 8606 from your previous year’s tax return, answer Yes here and enter it on the next page.

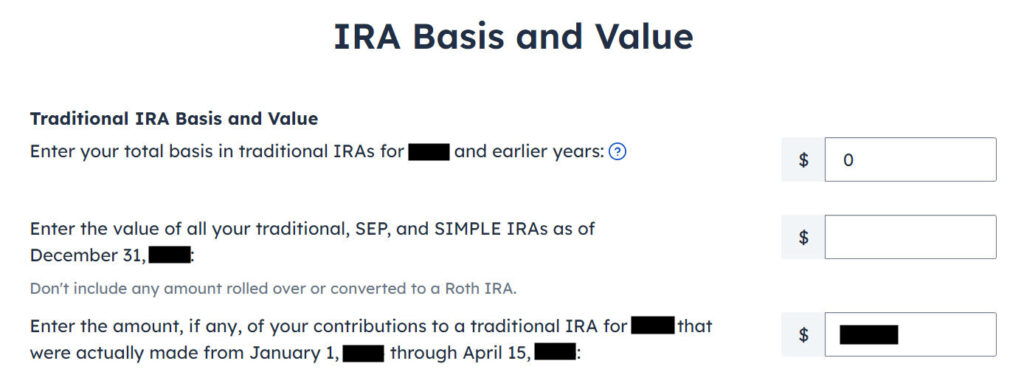

The value in the first box should be zero if you never contributed to a Traditional IRA in previous years. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you didn’t convert the earnings, enter the account’s value from your year-end statement in the second box. The third box should be zero because you recharacterized before the end of the year.

We didn’t take any disaster distribution.

Now continue with all other income items until you are done with income. Your refund meter is still lower than it should be but it will change soon.

Recharacterized Contribution

Now we tell FreeTaxUSA that we contributed to a Roth IRA before we recharacterized the contribution to a Traditional IRA.

Contributed to Roth IRA

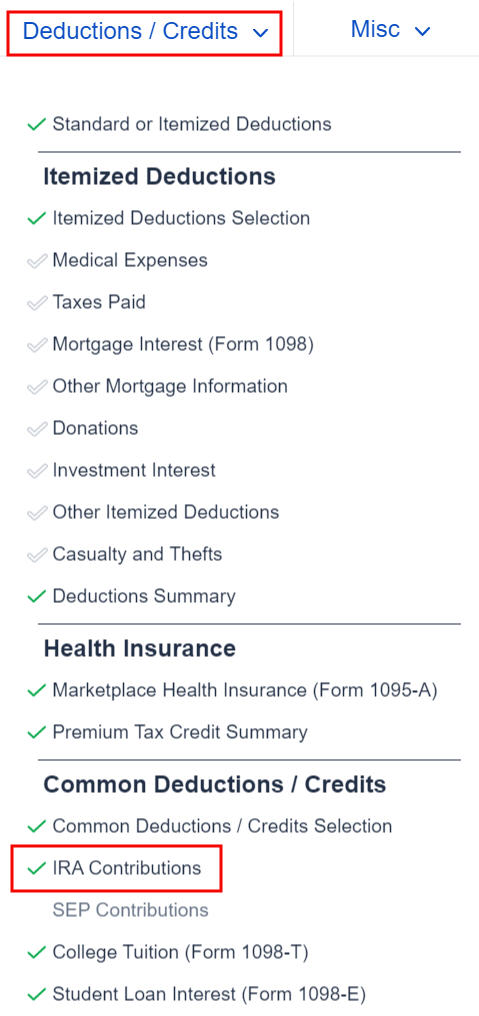

Find the IRA Contributions section under the “Deductions / Credits” menu.

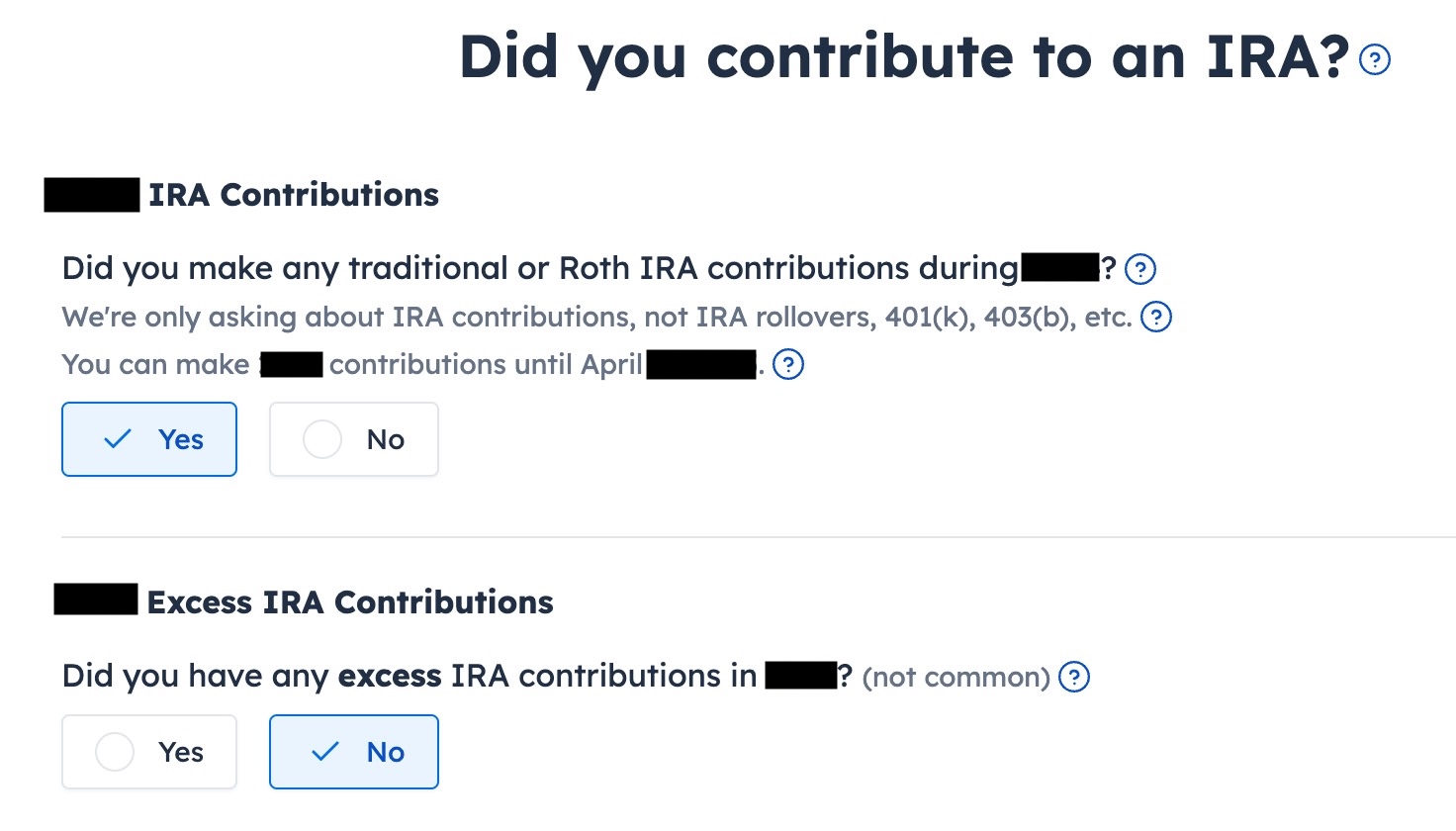

Answer “Yes” to the first question. An excess contribution means contributing more than you’re allowed to contribute. We didn’t have that.

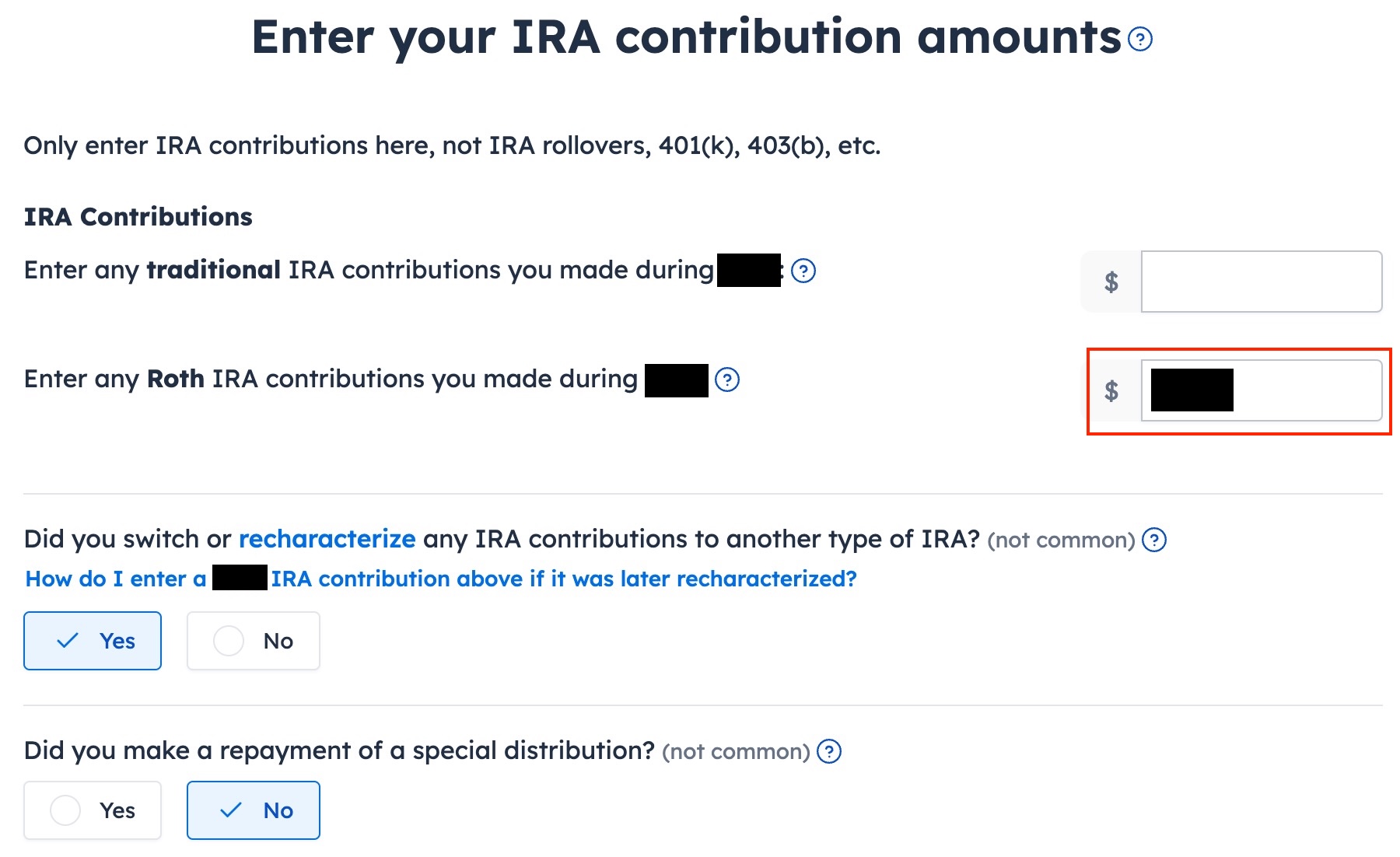

Enter your contribution in the second box because you originally contributed to a Roth IRA. Answer “Yes” to “Did you switch or recharacterize.” We didn’t repay any special distribution.

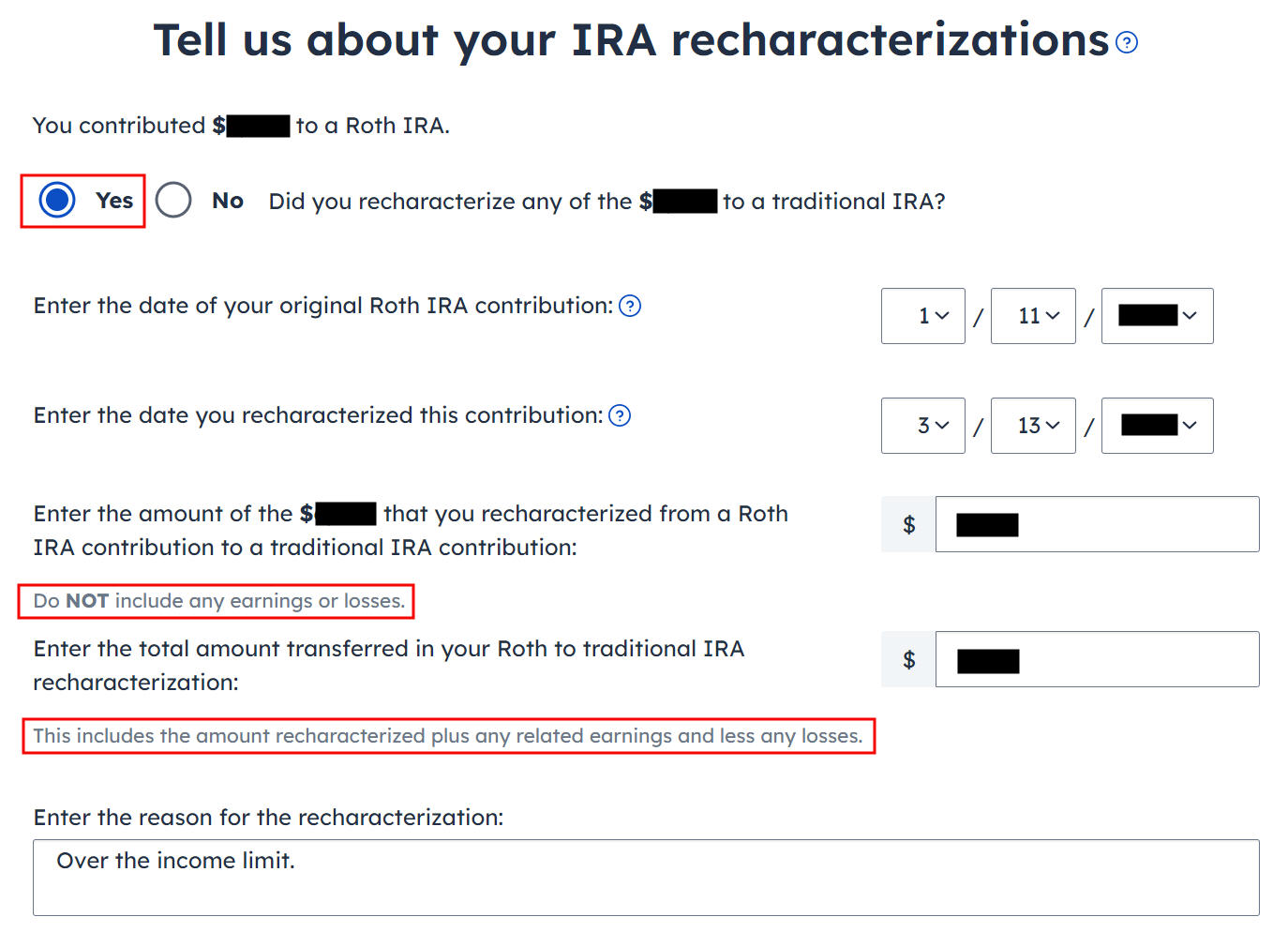

Recharacterized to Traditional

Select “Yes” to confirm you recharacterized a contribution. It opens up additional inputs for an explanation. If you recharacterized 100% of your original contribution, enter it in the first box. It’s $7,000 in our example. We enter $7,100 from our example in the second box, which is the amount that the IRA custodian moved from the Roth IRA to the Traditional IRA when we recharacterized.

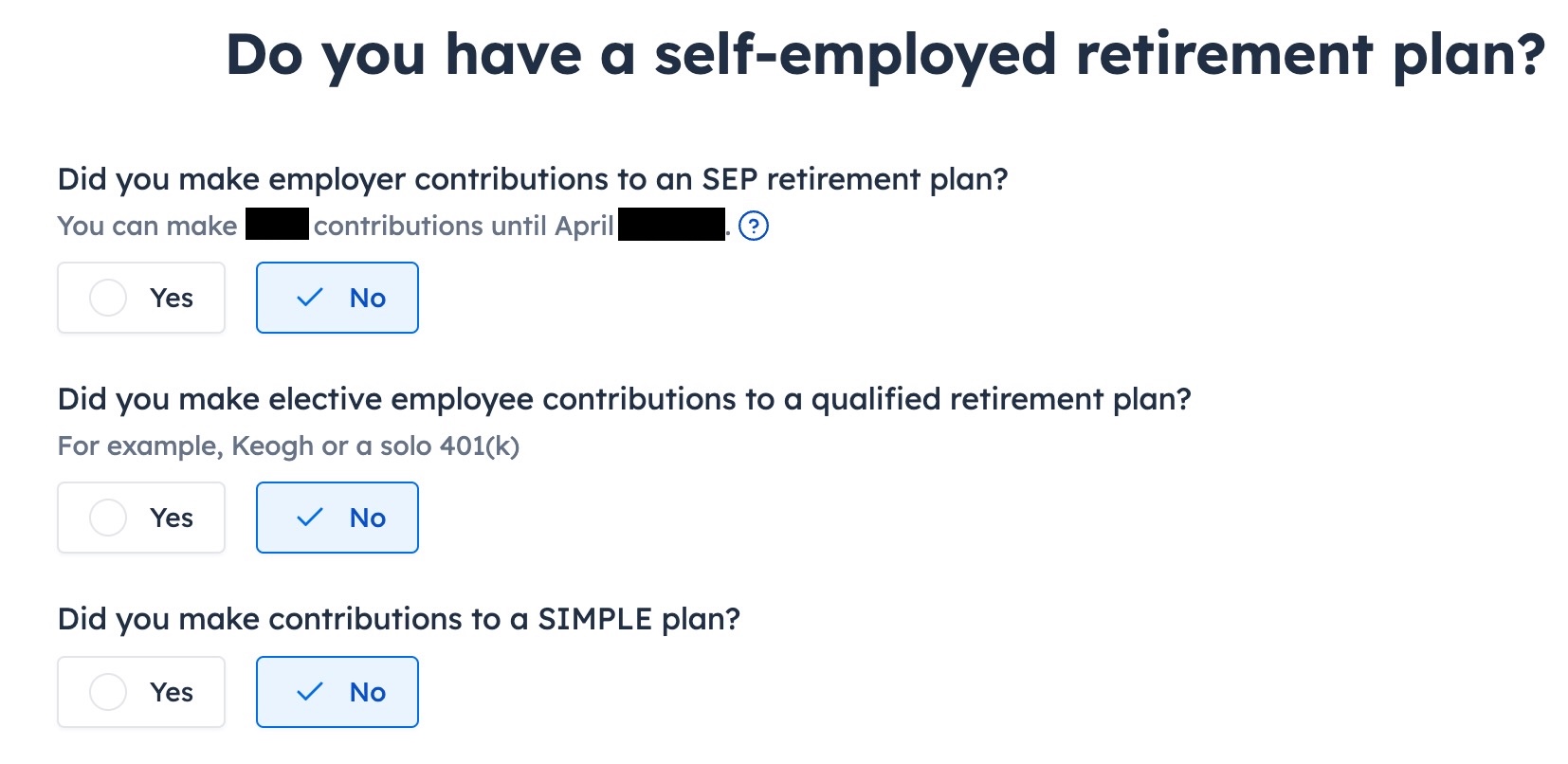

We didn’t contribute to a SEP, solo 401k, or SIMPLE plan. Answer “Yes” if you did.

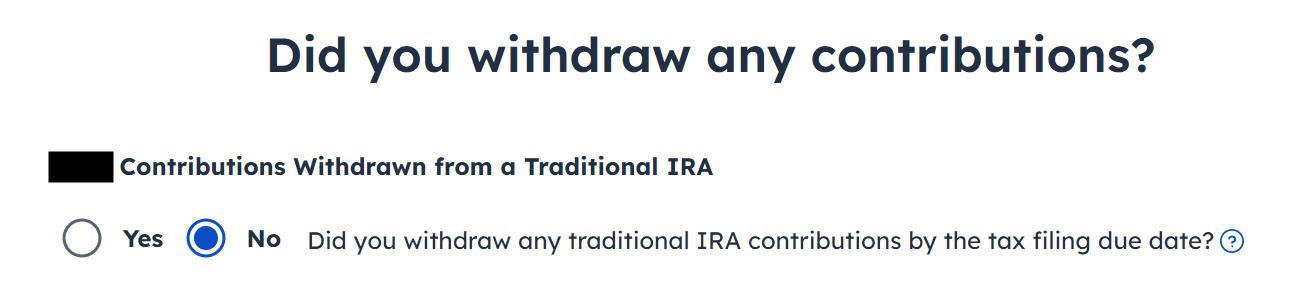

Withdraw means pulling money out of a Traditional IRA back to your checking account. Converting to Roth is not a withdrawal. Answer “No” here.

The value in the first box should be zero if you never contributed to a Traditional IRA in previous years. The value in the second box should also be zero if you converted everything. If you had a small amount of earnings posted to your Traditional IRA after the conversion and you didn’t convert the earnings, enter the account’s value from your year-end statement in the second box. The third box should be zero because you recharacterized before the end of the year.

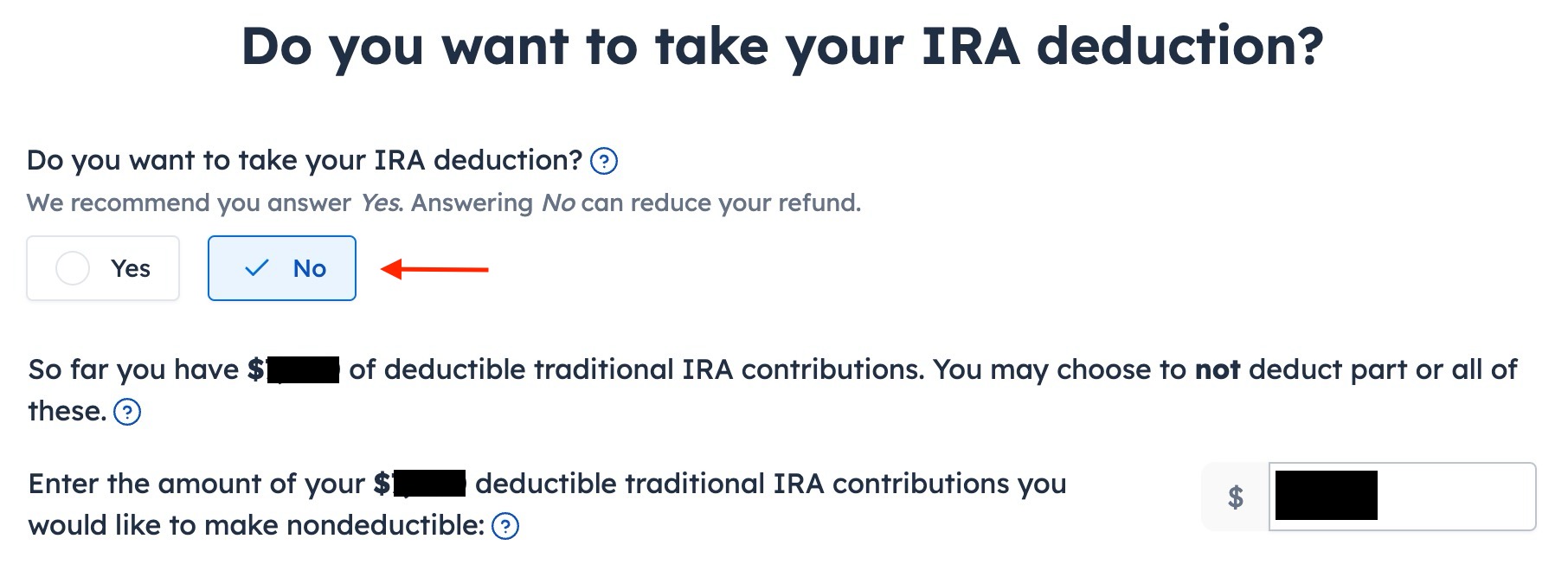

You see this screen only if your income falls below the income limit that allows a deduction for a Traditional IRA contribution. You don’t see this if your income is above the income limit. Answering Yes will make your contribution deductible but it will also make your Roth conversion taxable, which comes to a wash. It’s less confusing if you answer “No” here and make the entire amount that could be deducted nondeductible.

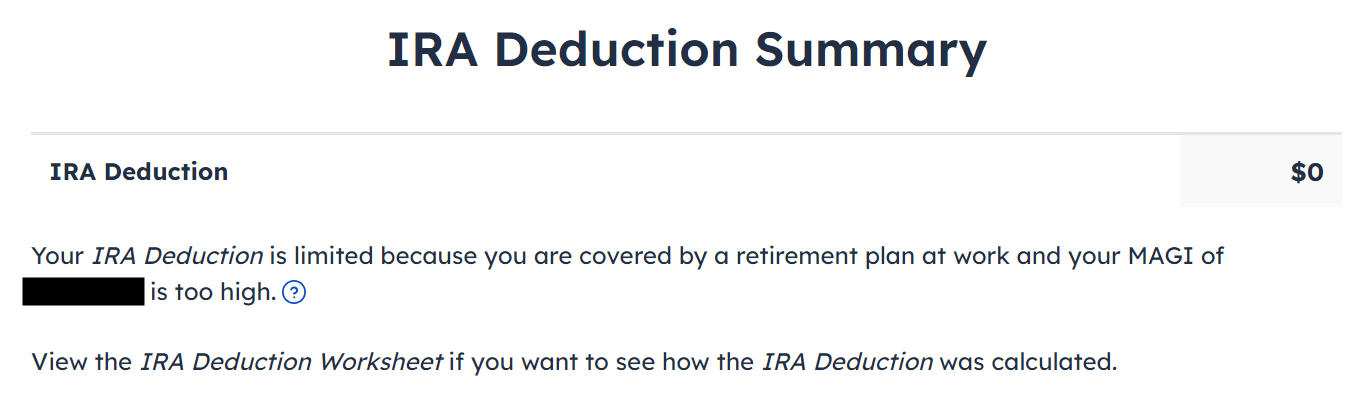

It tells us we don’t get a deduction because our income was too high or because we chose to make our contribution nondeductible. We know. That’s why we did the Backdoor Roth.

The refund meter should go back up now.

Taxable Income

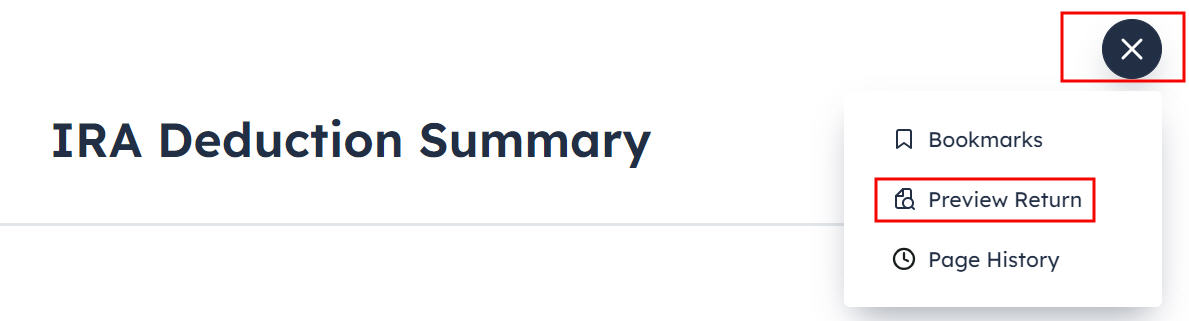

Let’s look at how these entries show up on our tax return. Click on the three dots on the top right above the IRA Deduction Summary and then click on “Preview Return.”

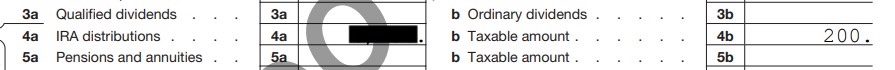

Look for Lines 4a and 4b in your Form 1040.

It shows the sum of your two 1099-R forms on line 4a and only $200 is taxable on line 4b. The taxable amount is the difference between the amount you converted to Roth and your original contribution.

Form 8606

Go toward the end of the pop-up to find Form 8606. It shows these for our example:

| Line # | Amount |

|---|---|

| 1 | 7,000 |

| 3 | 7,000 |

| 5 | 7,000 |

| 13 | 7,000 * |

| 16 | 7,200 |

| 17 | 7,000 |

| 18 | 200 * |

| footnote | * From Worksheet-1-1 in Publication 590 B |

There’s also a statement to describe your recharacterization at the end.

Troubleshooting

If you followed the steps in this guide and you are not getting the expected results, here are a few things to check.

The Entire Conversion Is Taxed

If you don’t have a retirement plan at work, you have a higher income limit to take a deduction on your IRA contribution. If you have a retirement plan at work but your income is low enough, you are also eligible for a deduction on your IRA contribution. FreeTaxUSA gives you the option to take a deduction if it sees that your income qualifies.

Taking the deduction makes a corresponding amount of the Roth conversion taxable. Answering “No” in the “Do you want to take your IRA deduction?” page will have you taxed only on the earnings in your Roth conversion.

Self vs Spouse

If you are married, make sure you don’t have the 1099-R and the IRA contribution mixed up between yourself and your spouse. If you inadvertently assigned two 1099-Rs to one person instead of one for you and one for your spouse, the second 1099-R will not match up with an IRA contribution made by a spouse. If you entered a 1099-R for both yourself and your spouse but you only entered one IRA contribution, you will be taxed on one 1099-R.

Learn the Nuts and Bolts

| I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action. |

The post Backdoor Roth in FreeTaxUSA: Recharacterize & Convert, Same Year appeared first on The Finance Buff.