Better Marijuana Stock: Aurora Cannabis Or Tilray Brands?

The global cannabis market tells a tale of survival and adaptation. After a brutal multiyear shakeout that saw dozens of companies fold or merge, the remaining players have emerged battle-tested and strategically transformed.

While early market euphoria has given way to operational reality, Grand View Research projects the global legal cannabis market will reach $102.24 billion by 2030. This represents a compound annual growth rate of 25.7% from 2024, driven by expanding medical programs and regulatory reform.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

Two companies that weathered this storm present intriguingly different paths forward: Aurora Cannabis (NASDAQ: ACB) and Tilray Brands (NASDAQ: TLRY). Their contrasting approaches to market expansion and operational efficiency offer valuable insights for investors seeking exposure to cannabis growth without the speculative fever of years past.

Armed with the latest financial results and clear strategic roadmaps from both companies, I'll examine their strengths and weaknesses to determine which stock offers the better investment opportunity right now.

Medical-cannabis powerhouse

Aurora Cannabis has reinvented itself through laser-focused execution in the high-margin medical market. This Edmonton-based producer has transformed from a Canadian recreational player into an international medical-cannabis force.

The company's strict quality controls and distribution networks span key European markets. Aurora's penetration into Germany's expanding medical program highlights its international growth strategy.

Recent financial results validate this approach. Aurora delivered record adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of 10.1 million Canadian dollars ($7.04 million in USD) in its latest reported quarter.

International revenue jumped 93% to CA$35 million ($24.4 million), surpassing Canadian medical sales for the first time. The company reported CA$152 million ($106 million) in cash at the quarter's end, with no cannabis-related debt.

Brand-builder's gambit

Tilray takes a markedly different approach, pursuing diversification across cannabis, beverages, and wellness products. The company's strategy centers on building consumer brands and leveraging distribution networks across multiple market segments.

Recent results tell a complex story. The first quarter of fiscal 2025 delivered 13% year-over-year revenue growth to $200 million, highlighting the company's transformation from a pure-play cannabis producer to a diversified consumer packaged-goods company.

The beverage division emerged as a standout performer in the most recent quarter. Alcohol sales surged 132% to $56 million, driven by strategic acquisitions and successful brand integration across U.S. distribution channels.

Cannabis operations remain a significant revenue driver, generating $61.2 million in sales during the three-month period. This core business benefits from Tilray's established production infrastructure and growing international presence.

European expansion shows particular promise for future growth. German medical cannabis flower revenue jumped 50% following regulatory changes that expanded market access and patient reach.

Tilray's brand-first strategy sets it apart from many cannabis peers. Rather than focusing solely on production capacity, the company has invested heavily in building recognizable consumer brands across multiple product categories.

The smarter cannabis play

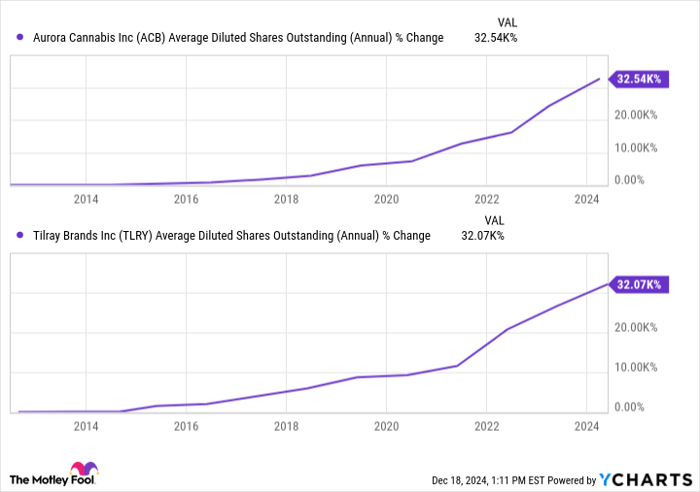

Aurora Cannabis emerges as the more compelling investment option heading into 2025, though investors must weigh significant industry headwinds. Most importantly, cannabis operations demand intensive capital investment, reflected in the stark reality of shareholder dilution in leading companies like Aurora and Tilray:

ACB Average Diluted Shares Outstanding (Annual) data by YCharts.

That said, Aurora's laser focus on high-margin medical markets creates a clearer path through industry headwinds. Moreover, the company's debt-free balance sheet and expanding international footprint, particularly in Germany, provide concrete advantages over Tilray's more diversified but less focused strategy.

With Aurora trading at 1.18 times trailing-12-month sales, compared to Tilray's 1.2 multiple as of December 2024, investors can access a more focused play on medical-cannabis expansion without paying a premium. Until U.S. federal legalization opens up the world's most valuable cannabis market, Aurora's strategic clarity and improving unit economics make it the stronger choice for investors seeking exposure to the next phase of global cannabis growth.

Should you invest $1,000 in Aurora Cannabis right now?

Before you buy stock in Aurora Cannabis, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Aurora Cannabis wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $799,099!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

George Budwell has no position in any of the stocks mentioned. The Motley Fool recommends Tilray Brands. The Motley Fool has a disclosure policy.