Better New Nasdaq-100 Buy: Palantir Vs. Microstrategy

The holidays have come early for a couple of this year's most-watched technology companies. I'm talking about Palantir Technologies (NASDAQ: PLTR) and MicroStrategy (NASDAQ: MSTR), software players that have soared more than 300% and 500%, respectively, this year. The Nasdaq-100, an index of the top 100 nonfinancial stocks trading on the Nasdaq Stock Market, invited the two companies to join as of Dec. 23.

That's fantastic news for Palantir and MicroStrategy and their investors for a couple of reasons. First, funds that track the Nasdaq-100 have to buy shares of these companies so they can continue accurately tracking the index. Second, inclusion may be seen as a sign that these companies have made it into an elite group -- and that may boost investors' confidence in them.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

So, you might be thinking of buying one of these technology stocks in the days leading up to their Nasdaq-100 entrance. Which makes the better buy? Let's find out.

Image source: Getty Images.

The case for Palantir

Palantir is a software company that helps government and commercial customers make better use of their data so that they can gain in efficiency and even make game-changing decisions. The company last year launched its Artificial Intelligence Platform (AIP), and demand has soared, resulting in record profit for Palantir in the most recent quarter.

The company, traditionally associated with government contracts, has made great progress in the commercial area in the past few quarters -- with commercial growth even surpassing the still-strong double-digit growth of government revenue. For example, in the latest quarter, U.S. commercial revenue rose 54%, while U.S. government revenue growth advanced 40%.

And the rapid growth in commercial customers along with demand for AIP suggest we may be in the early stages of this growth story. Just four years ago, Palantir only had 14 U.S. commercial customers, and the company now has almost 300. That's impressive, yet leaves plenty of room for expansion ahead.

The stock looks expensive at 200x forward earnings estimates, but its forward PEG ratio, a measure that considers earnings growth, shows the stock still may be reasonably priced. A PEG ratio of over 1.0 suggests a stock is overvalued -- Palantir's is 0.6.

The case for MicroStrategy

MicroStrategy was started as a software company focused on data and analytics, and this continues to be part of the business. For example, MicroStrategy offers customers its MicroStrategy ONE platform, an artificial intelligence-driven analytics system to power efficiency and help clients make better decisions.

But this business hasn't been a winner for the company, and the recent quarter offers us a taste of that: Software revenue slid 10% to $116 million during the period. And the company's net loss deepened year over year to more than $340 million.

In recent times, though, when investors think of MicroStrategy and consider investing in the company, they don't necessarily think of the software business and instead look at another area -- one where the company is excelling. And that's in Bitcoin investing. MicroStrategy even calls itself "the world's first and largest Bitcoin treasury company."

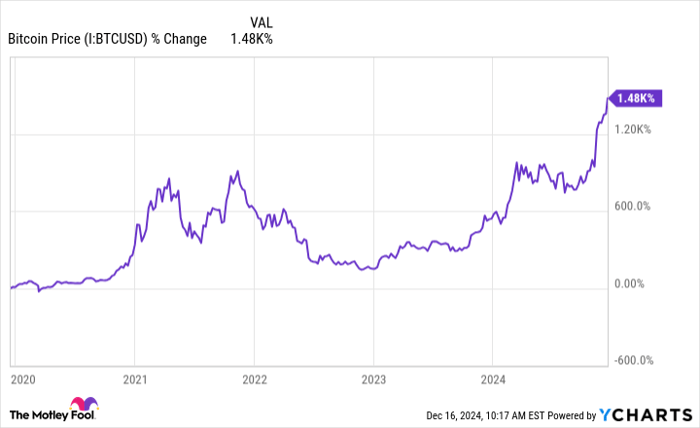

This started when founder Michael Saylor announced in 2020 that the company would make its first Bitcoin purchase with $250 million. Since that time, Saylor has led the company through more and more Bitcoin buys, and MicroStrategy held 279,420 Bitcoins as of Nov. 11. They're valued at $29 billion as of this writing.

MicroStrategy clearly has grown its investment as the value of Bitcoin has increased over the past few years, and many investors have viewed buying MicroStrategy stock as a way to bet on the top cryptocurrency.

Bitcoin Price data by YCharts

Which software company makes the best buy?

The key word here is "software company." Both players operate in this area, but only one of them is growing there right now, and that's Palantir.

Yes, MicroStrategy has seen its Bitcoin investment take off, and the company could win as a Bitcoin treasury player over time. But in the meantime, risk is high, with MicroStrategy's fortunes tightly linked to the path of Bitcoin. MicroStrategy has increased debt, and the company even announced a new plan in October to sell $21 billion of equity and $21 billion of fixed-income securities -- all to finance more Bitcoin purchases.

All of this means that right now, for investors seeking growth and aiming to minimize risk, Palantir, as a profitable software company, makes the better new Nasdaq-100 stock to buy.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $342,278!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,543!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $496,731!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Palantir Technologies. The Motley Fool has a disclosure policy.