Chevron Stock: Buy, Sell, Or Hold?

A couple of years ago, oil prices soared following Russia's invasion of Ukraine, and producers capitalized on the opportunity. With profits at their peak, companies like Chevron (NYSE: CVX) used that windfall to pay down debt and reward shareholders with generous dividends and massive share buybacks.

However, the narrative for oil companies has since shifted. Since the start of 2023, Chevron's performance has been lackluster, with the stock falling 13%. Compare this to the S&P 500, which has climbed 57% over that same period.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Slowing global demand has put downward pressure on prices. On top of that, the U.S. is cranking out record amounts of oil. With Chevron facing these challenges, is it time for investors to buy, sell, or hold the stock? Let's dive in and find out.

Reasons to buy or hold Chevron stock

Energy drives our economy, powering everything from cutting-edge data centers to bustling factories and vital transportation networks. At the core of this lies oil, which fuels nearly 38% of U.S. energy consumption, according to the Energy Institute.

Chevron is a powerhouse in the energy sector. At the heart of its business is exploration and production, where it extracts crude oil and natural gas from resource-rich regions like the Permian Basin using enhanced recovery techniques. This upstream operation is just one part of Chevron's integrated business.

Once extracted, Chevron transforms these raw resources into everyday essentials: gasoline, diesel, jet fuel, and lubricants. It operates refineries in California and Mississippi, and also transports, markets, and operates gas stations around the globe. These are its midstream and downstream operations, which help stabilize its volatile business.

Commodity-based businesses like Chevron face unpredictable price fluctuations, greatly affecting their profits and margins. Operating an integrated structure and balancing upstream, midstream, and downstream operations provides Chevron with multiple revenue sources that help balance the oil and gas price swings. This integrated model is why Chevron has raised its dividend payout for 37 consecutive years.

Over the past few years, Chevron has reduced its debt from $45.4 billion to $25.8 billion and implemented significant share repurchases. Its lackluster stock performance means it trades pretty cheap, at 15.6 times earnings and 1.34 times sales, both of which are below its 10-year average.

CVX PE Ratio data by YCharts

Chevron's dividend currently yields investors 4.6% and the company has a long history of growing its payout. While the stock has underperformed in recent years, its cheaper valuation makes it appealing for value-focused investors in a market of overvalued stocks.

Reason to sell Chevron stock

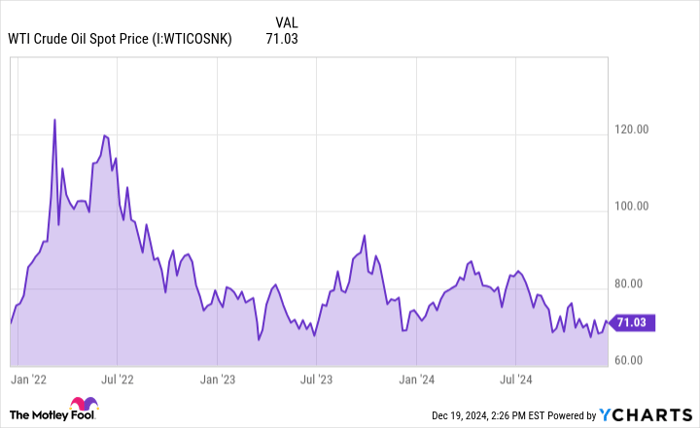

Chevron remains susceptible to the prevailing market forces. Since the price of WTI Crude Oil soared to $120 per barrel following Russia's invasion of Ukraine in 2022, it has since plummeted to about $71 per barrel.

Data by YCharts.

A few factors are driving this drop in oil prices. One is the declining demand from China. According to Reuters, China's refinery output has fallen over six consecutive months. This could stem from an economic slowdown, although the surge in electric vehicles in the region could also be impacting fuel demand.

Additionally, OPEC has revised its global oil demand forecast for the upcoming year, adjusting its expectations due to sluggish markets in China and India. The organization now anticipates an increase of just 1.4 million barrels per day (bpd), lowering its previous estimate by 90,000 bpd.

This comes at the same time that non-OPEC countries like the U.S., Canada, and Brazil are significantly ramping up production. According to the Energy Information Administration, U.S. crude oil production hit a record 13.5 million barrels per day in October.

According to analysts at Wells Fargo, global oversupply could keep pressure on oil prices. The bank projects Brent Crude to average around $70 per barrel next year, which could squeeze oil companies' profit margins.

Buy, hold, or sell Chevron?

Oil prices may face continued pressure in the upcoming year, especially if there is a global economic slowdown. While Chevron could benefit from record levels of U.S. oil production, declining prices could squeeze its profit margins and reduce net income.

That said, Chevron trades at a relatively low valuation and offers a robust dividend yield. Despite its recent underperformance, the company has done a good job managing its balance sheet and reducing debt. Following its recent sell-off, I think Chevron is a solid value stock to add to your diversified portfolio today.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $825,513!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Wells Fargo is an advertising partner of Motley Fool Money. Courtney Carlsen has positions in Chevron. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.