Chexsystems Security Freeze: Login, Report, And Score

We all should assume by now that our names, addresses, phone numbers, and Social Security Numbers are all out there in the open after all the hacks. We can only protect ourselves by adding two-factor authentication to all our accounts (ideally with security hardware or Google Voice numbers protected by security hardware).

ChexSystems Security Freeze

Freezing our credit helps prevent identity thieves from applying for credit in our names. Getting an IP PIN from the IRS helps prevent thieves from filing a fraudulent tax return using our information.

It’s less known that we should also place a security freeze with ChexSystems. ChexSystems is a credit reporting agency that provides information about the use of bank accounts. Banks and credit unions may report you to ChexSystems if you bounce checks or otherwise cause a negative balance in your bank account. When you open a new account at another bank or credit union, they may check your reputation with ChexSystems. According to Wikipedia, 80% of commercial banks and credit unions in the U.S. use ChexSystems to screen applications for checking and savings accounts.

If someone opens a bank account in your name and defrauds the bank, the bank will report the incident under your name and Social Security Number. It will make it more difficult when you want to open a new account. Placing a security freeze at ChexSystems helps prevent fraud by someone opening a bank account in your name.

Opening a fake account in your name is also often the first step in stealing money from your real accounts. Banks scrutinize transfer requests less when they see the money is going to another account in your name (but the receiving account is actually controlled by the thieves). You make your accounts safer by blocking that exit path when you prevent thieves from opening a fake account in your name.

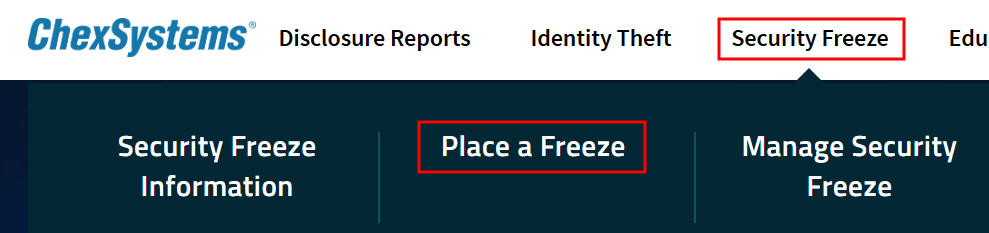

To place a security freeze with ChexSystems, go to chexsystems.com, click on “Security Freeze” at the top, and then click on “Place a Freeze.” You’ll be asked to register with ChexSystems. You’ll receive a 12-digit Security Freeze PIN after you place the freeze. This PIN is required to thaw the freeze before you open a new bank account.

Consumer ID from the Past

I placed a security freeze with ChexSystems several years ago. ChexSystems sent me an 8-digit Consumer ID and a 12-digit Security Freeze PIN by mail at that time. I saw something like this when I tried to use the 8-digit Consumer ID to log in at ChexSystems:

It threw me off for a minute because I didn’t recognize the displayed phone numbers or the email address. Then I read the footnote and realized it only meant that I couldn’t use the 8-digit Consumer ID to log in. ChexSystems changed its system. The new consumer portal requires a username and a password separate from the Consumer ID. It displays random phone numbers and email addresses when it doesn’t recognize the username.

I needed to re-register with the new consumer portal and create a username and a password when I only had an 8-digit Consumer ID from the past. The existing 12-digit Security Freeze PIN is still good.

Disclosure and Score

Banks and credit unions only report negative feedback to ChexSystems. They don’t say how good you are. They only give you a black mark when they don’t like something. You should see nothing has been reported to ChexSystems.

You can check your records after you place the security freeze. You see these two options on the top under “Request Reports”: Consumer Disclosure and Consumer Score Report.

You can request the Consumer Disclosure but you won’t get it instantly. ChexSystems will email you in a few days when the report is ready. The Consumer Disclosure report lists any negative information ChexSystems received from banks and credit unions. A blank section is a good report. You should file a dispute if you see something inaccurate there. This disclosure report also shows who inquired about your reputation with ChexSystems in the last five years.

The Consumer Score Report is available right away after you request it. It shows a score similar to a credit score. The consumer scores range from 100 to 899. A higher score indicates a lower risk.

My score was 648. It sounds low but it’s apparently a good enough score. I never had any problems with opening bank accounts. I found another blogger saying his ChexSystems score was 652 and he had never been declined for a bank account either. It sounds like I’m in good company.

Check your ChexSystems score if you’re curious but the most important part here is to place the security freeze.

Learn the Nuts and Bolts

| I put everything I use to manage my money in a book. My Financial Toolbox guides you to a clear course of action. |

The post ChexSystems Security Freeze: Login, Report, and Score appeared first on The Finance Buff.