If I Could Only Buy 1 Ai Stock, This Would Be It

Choosing just one artificial intelligence (AI) stock to own isn't an easy thing to do. There are multiple ways to invest in this trend, and many of them have their merits. Furthermore, investing in just one AI stock also isn't a great move, as putting all your eggs in one basket is an easy way to miss out on a trend as massive as AI if the pick fails. What this one pick boils down to is my favorite AI stock, which is the one I will add to first if the market suddenly drops.

If I had to only own one, I'd likely choose Nvidia (NASDAQ: NVDA). There are multiple reasons why, but my primary reason for it being my top AI pick is that it is actually making money from the trend.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Nvidia's growth is expected to extend into 2025

Many of the biggest AI companies stated that actual profits from their generative AI models and platforms may be years off. Considering how much money is being poured into this technology, that's not what investors want to hear. But where is all that money that they're investing going?

Nvidia.

While Nvidia isn't getting 100% of those investment dollars, it is getting a large chunk. Nvidia's GPUs (graphics processing units) are the tools these AI companies need to create these top-tier AI models. GPUs have a unique ability to process multiple calculations in parallel, allowing them to process information faster than a standard CPU. Furthermore, these GPUs can be connected in clusters to multiply their computing power.

With Nvidia's GPUs and software being the best in the business, it's no wonder that Nvidia captured a massive amount of the AI computing market share. Just take a look at how its revenue spiked over the past two years.

NVDA Revenue (TTM) data by YCharts

With that kind of increase, investors would be forgiven if they assumed that Nvidia was done growing, but that's not the case. AI computing demand hasn't been satisfied yet. AI hyperscalers like Meta Platforms warned investors that their computing infrastructure spending will increase in 2025. Additionally, the cloud computing providers have all said that as their demand grows, the need to purchase additional computing power also increases.

This means that Nvidia's revenue will continue to grow for years to come, which is great news for shareholders.

However, it's not like there isn't competition. As these AI models need less development, companies may switch to buying more CPUs for AI inferencing, which is when an AI model is prompted for an output but has already been trained on a data set. This is a far less intense process and can be accomplished with less computing power than one of Nvidia's GPUs needs.

Furthermore, many cloud computing companies and AI hyperscalers created their own versions of GPUs that they don't have to pay Nvidia for. While these AI accelerators have specific use cases, GPUs are much better at broader training tasks, making them incredibly versatile.

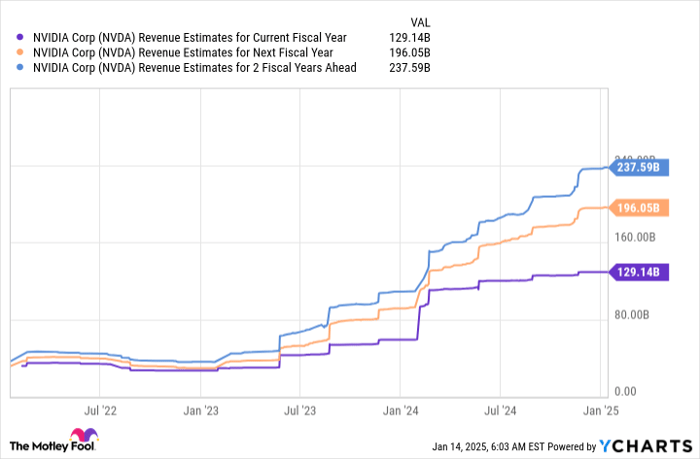

All of this suggests that Nvidia isn't done growing, but it may see more challenges in the future. Still, Wall Street analysts have strong growth projections.

NVDA Revenue Estimates for Current Fiscal Year data by YCharts

With revenue expected to increase 52% in FY 2026, Nvidia still has plenty of growth left to continue its AI stock market dominance if it can be bought at the right price.

Nvidia's stock isn't that expensive compared to many big tech stocks

With Nvidia's large run-up, you'd be forgiven if you'd assume the stock is expensive. And you'd be right. However, when growth is factored into the equation, it doesn't look all that bad.

Nvidia trades at 52 times earnings, which isn't a bad price to pay for a stock that's growing as fast as it is. With Nvidia trading for less than 30 times FY 2026 earnings, this stock starts to look like a bargain after the recent pullback.

Nvidia has been one of the best AI stocks to own for the past two years, and I think it could continue that in 2025. We're still at the beginning stages of AI, which means we'll need more Nvidia GPUs to continue training these models. As a result, Nvidia's stock is primed to rise even more, making it a fantastic pick in the AI investing space.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $818,587!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Meta Platforms and Nvidia. The Motley Fool has a disclosure policy.