Is Hershey A Millionaire-maker Stock?

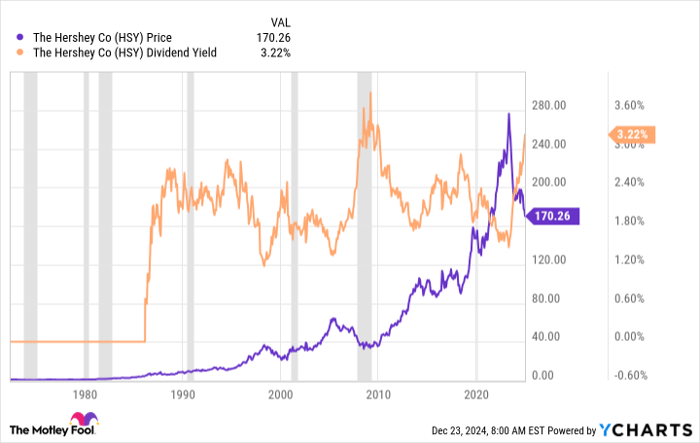

The Hershey Company (NYSE: HSY) is an iconic stock thanks in no small part to the tasty confectionary treats it produces. But there's so much more to know about this consumer staples giant, including that its dividend yield is historically high at 3.2% today. That suggests that the stock is on sale, something that doesn't happen very often.

Can buying Hershey today help you build a million-dollar portfolio? Let's find out.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

A big drawdown at Hershey

Hershey's dividend yield is so high today because the stock has lost around a third of its value since hitting all-time highs in 2023. But even after that drop, a $10,000 investment made at the start of 1980 would be worth around $1.6 million dollars today. Without question, Hershey is a millionaire maker. But that's the past. The real question is, can it do it again if you buy the stock today?

Image source: Getty Images.

While there are clearly no guarantees on Wall Street, Hershey has a very solid foundation on which to continue growing in the future. One important but often overlooked key is the company's relationship with The Hershey Trust, which basically controls all of Hershey's super-voting class B stock. That gives the charitable trust a huge say in the company's operations, effectively ensuring that Hershey remains a stand-alone company.

But there's more to this relationship than meets the eye. The Hershey Trust uses the dividends it collects to fund its philanthropic efforts. So, it has a vested interest in making sure that Hershey is run in such a way that it can continue to support and reliably grow its business and dividend over time. That's basically what most dividend investors want, too. Given the strong history of the stock, Hershey and The Hershey Trust have had a mostly mutually beneficial relationship over time.

Why buy Hershey today?

From a simplistic point of view, Hershey's historically high yield suggests that the stock is attractively priced today. In fact, the yield hasn't been this high since the Great Recession, as the chart below highlights. The problem is that the stock is cheap for a reason.

Right now, Hershey's bottom line is being pressured by a shockingly large surge in cocoa prices. This is a key ingredient in chocolate, which is one of the company's big products. Cocoa is a commodity and always has been, so Hershey is used to dealing with price volatility for this input. However, the cost increase has been outsized, and the company may take a few years to adjust. That is bad news, and it will most likely mean a period of relatively weak financial performance. However, in time, price increases and changes in the cocoa market will probably take care of this issue.

For the long term, many investors appear worried about new weight loss drugs and the impact they will have on consumer staples companies that make sugary snacks. There's no telling what will happen, but chocolate is a relatively low-cost indulgence that consumers have loved for years. It seems unlikely that weight loss drugs will materially change that fact, assuming that people taking the medication actually remain on it over the long term (which is a big assumption, given historical compliance rates when it comes to taking medication).

Meanwhile, Hershey is working to broaden its food portfolio so it can continue to grow. One approach has been expanding the portfolio's exposure to non-chocolate sweets. In addition, Hershey has been investing in salty snacks like popcorn and pretzels.

Beyond product diversification, it is also trying to expand its geographical reach by introducing its biggest brands in foreign markets. If successful, that should allow Hershey to bring out additional, smaller brands in the future. With The Hershey Trust in the picture, the company can act deliberately and slowly to make sure it gets these strategic efforts right because that will be in the best interests of its most important shareholder.

There are risks, but they seem reasonable

Every investment requires balancing risk against reward. Right now, Hershey is facing some notable risks. However, investors are being paid well via the historically high yield to take on the uncertainty here. Given the long-term success of the company and the vested interest of The Hershey Trust, dividend investors looking to build a seven-figure nest egg should probably take a long, hard look at buying this millionaire maker today.

Should you invest $1,000 in Hershey right now?

Before you buy stock in Hershey, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Hershey wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $859,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 23, 2024

Reuben Gregg Brewer has positions in Hershey. The Motley Fool has positions in and recommends Hershey. The Motley Fool has a disclosure policy.