Is Palantir Going To Plunge 50% (or More)? History Offers A Blunt Answer.

It's been a phenomenal year for Wall Street and investors. Whereas the stock market's major indexes have historically averaged annual returns that range from the high single digits to around 10%, the ageless Dow Jones Industrial Average, benchmark S&P 500, and growth-propelled Nasdaq Composite have respective rocketed higher by 16%, 27%, and 33% on a year-to-date basis, as of the closing bell on Dec. 13.

While the latest leg of this bull market rally has been fueled by Donald Trump's November victory, the lion's share of this two-year ascension for the major stock indexes can be attributed to the artificial intelligence (AI) revolution.

Image source: Getty Images.

The ability for AI-fueled software and systems to become more proficient at their tasks over time, as well as evolve to learn new skills, should give this technology utility in virtually all industries around the globe. It's why the analysts at PwC are forecasting a $15.7 trillion addressable market for artificial intelligence by 2030.

Though Nvidia has been the most front-and-center beneficiary of the rise of AI, it's actually been outshone by another AI stock recently: data-mining specialist Palantir Technologies (NASDAQ: PLTR).

Shares of Palantir have soared 343% on a year-to-date basis and are up a scorching-hot 935% over the trailing-two-year period. In fact, Palantir has done so well that it's being added to the Nasdaq-100.

However, Wall Street is a forward-looking entity. This means the million-dollar question is: "Can these monstrous gains can hold up in 2025 and beyond?"

Based on what history tells us, this unabashed optimism may soon come to a screeching halt.

Palantir's unique positioning drives investor excitement

If there's a prevailing catalyst that's most responsible for Palantir's enormous outperformance of Wall Street's major stock indexes over the last two years, it's the company's irreplaceability at scale.

Though there are other businesses that tackle bits and pieces of what Palantir's platforms and services cover, there is no one-for-one replacement for what this company provides. Businesses with a secure moat tend to command a hearty valuation premium on Wall Street, and they typically enjoy predictable operating cash flow.

Palantir's core operations are broken into two segments: Gotham and Foundry. The former is driven by AI and helps federal governments collect data, as well as plan and execute missions. Meanwhile, Foundry is the company's enterprise-focused segment that relies on AI and machine learning to help businesses make sense of their data.

Palantir's Gotham platform has primarily been responsible for lifting the company to recurring profitability, based on generally accepted accounting principles (GAAP). Government contracts with the U.S. often span four or five years, resulting in transparent operating cash flow and steady double-digit sales growth.

But there's also plenty of excitement for Foundry. This platform is still in its early stages of growth, with Palantir's commercial customer count surging 51% on a year-over-year basis in the latest quarter to 498. As businesses shift their data (and that of their customers) online and into the cloud, making sense of big data to streamline operations should become increasingly important. In short, the table is set for Foundry to deliver a superior growth rate to Gotham moving forward.

Lastly, investors have to be impressed with Palantir's treasure chest. The company closed out the third quarter with $4.6 billion in cash, cash equivalents, and U.S. Treasuries, with no debt. This capital provides financial flexibility in any economic climate and may allow Palantir's board to reward shareholders via buybacks from time to time.

Image source: Getty Images.

History weighs in on Palantir's parabolic climb

While there's no denying that a lot has gone right for Palantir, it's also hard to ignore the historic precedent that it's contending with.

During the mid-1990s, the internet began changing the corporate landscape and growth trajectory much in the same way we're witnessing artificial intelligence alter corporate growth strategies for businesses today. However, every next-big-thing technology and innovation that's followed in the internet's footsteps over the last three decades has endured an early innings bubble-bursting event.

Investors have consistently overestimated the adoption and utility of game-changing technologies since the mid-1990s. Regardless of whether or not these trends went on to be successful over the long-term doesn't change the outcome that businesses leading next-big-thing trends have lost 80% to 99% of their value on a peak-to-trough basis.

The silver lining for Palantir is that its multiyear contracts with the U.S. government and select allies may potentially soften the blow if an AI bubble took shape and eventually burst. But history bluntly suggests the decline expected in Palantir's stock would still be significant.

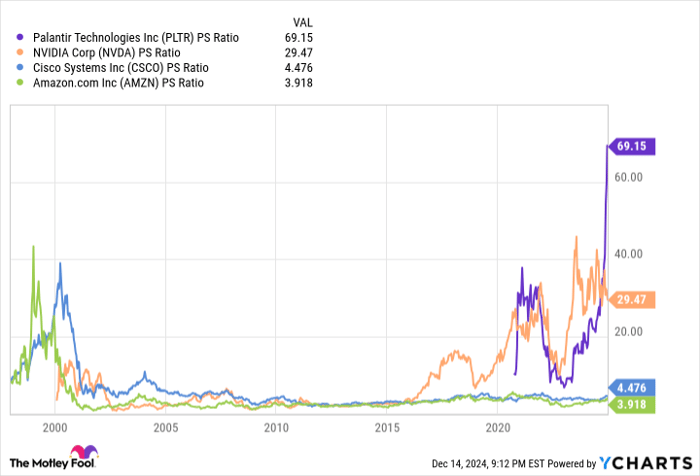

To make matters worse, Palantir's valuation is at a level that's historically consistent with market leaders of next-big-thing trends reversing course. Prior to the dot-com bubble bursting, Amazon and Cisco Systems peaked in the neighborhood of 40 times trailing-12-month sales. We've also witnessed Nvidia recently hit a price-to-sales (P/S) ratio of more than 40.

PLTR PS Ratio data by YCharts.

Palantir has them all beat, with a P/S ratio of more than 69 on a trailing-12-month basis. History clearly shows that market-leading businesses -- even those with sustainable moats -- haven't been able to maintain this much of a valuation premium for an extended period.

Though it's not history-specific, the other issue for Palantir is that its most-profitable segment, Gotham, has a natural ceiling. As I've pointed out in the past, Gotham is only available to the U.S. government and its immediate allies. Palantir's management team isn't going to allow foreign governments, such as China or Russia, access to its AI-driven software-as-a-service (SaaS) solutions. This limits the long-term growth runway for Gotham and places the burden of future profit growth squarely on Foundry's shoulders.

To reiterate, there's no question that Palantir deserves some level of valuation premium given its successful integration of AI, its push to recurring GAAP profits, and its irreplaceability. But with market leaders of next-big-thing innovations continually failing to live up to expectations in the early going, a halving in Palantir's stock, if not a larger percentage decline, would be par for the course, historically speaking.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $348,112!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,992!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Sean Williams has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Cisco Systems, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.