Is Recursion Pharmaceuticals Stock A Millionaire Maker?

Successfully navigating the stock market requires patience and a long-term perspective. The key is sticking to a consistent plan and making regular contributions to a retirement account, allowing the power of compounding to work its magic over time.

Nevertheless, there's an undeniable allure in searching for potential multibagger stocks. Something is captivating about companies with disruptive innovations, whose stocks could be on the cusp of rapid growth and capable of delivering life-changing returns to shareholders.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Recursion Pharmaceuticals (NASDAQ: RXRX) is a clinical-stage biotech that may have that level of potential. The company harnesses artificial intelligence (AI) for drug discovery, promising to revolutionize medicine. Let's explore whether buying the stock could eventually help you become a millionaire.

AI-powered biotech

Recursion has rapidly established itself as a leader in the field of AI-enabled biotechnology. The company's BioHive-2 supercomputer, powered by Nvidia AI chips, is one of the world's most powerful accelerated computing systems.

Through advanced machine learning techniques, BioHive-2 analyzes vast amounts of biological data to identify drug targets, including proteins and genes involved in disease. Recursion's operating system (OS) evaluates millions of compounds to identify potential drug candidates, while also predicting drug molecule properties and optimal patient populations to enhance drug design.

These efforts allow accelerated research on treatments across a wide range of conditions, while reducing costs compared to traditional methods.

A major development for Recursion this year was its merger with Exscientia, another biotech company focused on AI-based drug discovery. Exscientia's expertise in advanced methods of chemical design complements Recursion's biology-driven approach. This combination has created a vertically integrated platform, resulting in a fundamentally stronger company.

Image source: Getty Images.

A promising pipeline of therapeutic candidates

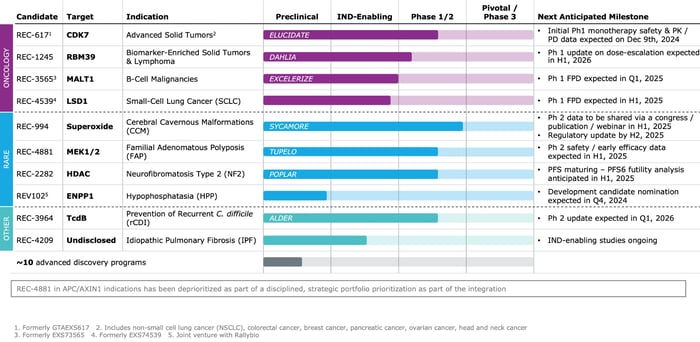

The good news is that Recursion's technology has already yielded promising results, with a robust pipeline of drug candidates that now incorporates Exscientia's legacy programs.

One of the most promising prospects is REC-994, which could become the first oral therapy for treating symptomatic cerebral cavernous malformation (CCM), a brain hemorrhaging condition that currently lacks any approved treatments.

REC-617 has also shown encouraging results, with a recent phase 1 interim study demonstrating positive patient responses and good tolerability in treating advanced solid tumors. The company believes this drug has "best in class" potential, one of several reasons that make Recursion an intriguing opportunity for investors.

Looking ahead to 2025, the market will be closely following clinical readouts and regulatory updates as catalysts for Recursion stock:

Source: Recursion Pharmaceuticals.

Reasons for caution

It seems likely that at least one of Recursion Pharmaceuticals' candidates could eventually gain approval as a novel therapy, transforming the company into a commercially sustainable operation over the next decade.

But making a much more bullish case for the stock, as an investment to multiply many times over, would be a significantly more challenging proposition. It would likely require Recursion to develop a blockbuster drug capable of generating billions of dollars in sales across multiple years.

The reality is that Recursion remains years away from bringing a drug to market. Currently, the company generates only limited revenue through partnership milestone payments and research grants, while facing substantially higher operating expenses. Wall Street analysts project continued financial losses for the foreseeable future, with negative earnings per share (EPS) expected to worsen from a projected loss of $1.54 this year to $1.65 in 2025.

| Metric | 2023 | 2024 (Estimate) | 2025 (Estimate) |

| Revenue (in millions) | $44.6 | $70.0 | $76.0 |

| Revenue change (YOY) | 12% | 57% | 9% |

| Earnings per share (EPS) | ($1.58) | ($1.54) | ($1.65) |

| EPS change (YOY) | N/A | N/A | N/A |

Data source: Yahoo Finance. YOY = year over year.

While the market can overlook a lack of profitability based on longer-term growth prospects, the dynamic may keep the stock under pressure. Shares of Recursion are down approximately 55% from their 52-week high, and any sort of regulatory setback could send the stock even lower.

Another consideration is the highly competitive industry landscape. Major biotech and pharmaceutical companies like Merck, AstraZeneca, and Pfizer, among others, are increasingly using artificial intelligence in their research and development processes. This widespread adoption raises questions about whether Recursion can maintain a technological advantage in the field.

Final thoughts

Although Recursion Pharmaceuticals offers compelling possibilities, I believe that without better visibility into its product approval pathway, it's just too early to buy this stock with conviction. In the meantime, 2025 will be a crucial year for the company to offer more clarity on its long-term potential. You may want to keep this one on your radar.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Dan Victor has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Merck and Pfizer. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.