Microstrategy Stock Rose More Than 2,800% In The Past 5 Years Due To 1 Simple Decision. This Other Little-known Technology Company Just Made The Same Move.

Aug. 11, 2020, is a day that changed the cryptocurrency market forever, for better or for worse. For technology company MicroStrategy (NASDAQ: MSTR) and its shareholders, it seems that it was a change for the better.

That was the day that MicroStrategy first bought Bitcoin (CRYPTO: BTC). A few weeks prior, then-Chief Executive Officer Michael Saylor said the company was exploring the cryptocurrency as a way to fight inflation. But as the chart below shows, Bitcoin has been far more than an inflation hedge.

As of this writing, the market capitalization for MicroStrategy is more than $100 billion, making it one of the most valuable companies in the world. For perspective, it was worth less than $1 billion just five years ago. Its revenue is actually down during this time, meaning that all of its stock market gains are attributable to its Bitcoin strategy.

MicroStrategy's Bitcoin strategy has worked so far. And for this reason, it shouldn't be surprising that Marathon Digital (NASDAQ: MARA) is following in its steps.

How MicroStrategy's Bitcoin strategy works

Here's what Saylor said in a 2021 interview with Family Office Association:

The only use of time is, 'How do I buy more Bitcoin?' Take all your money. Buy Bitcoin. Then take all your time, figure out how to borrow money to buy more Bitcoin. Then take all your time and figure out what you can sell to buy Bitcoin.

Saylor almost appeared to be speaking tongue-in-cheek when he suggested using all cash and taking on debt to buy Bitcoin. But MicroStrategy did just that.

At the end of 2019, MicroStrategy had $566 million in cash, cash equivalents, and short-term investments. It was also debt-free. But as of Dec. 8, the company held nearly 424,000 Bitcoins that it purchased for a whopping $25.6 billion. Where on earth did it get that much money?

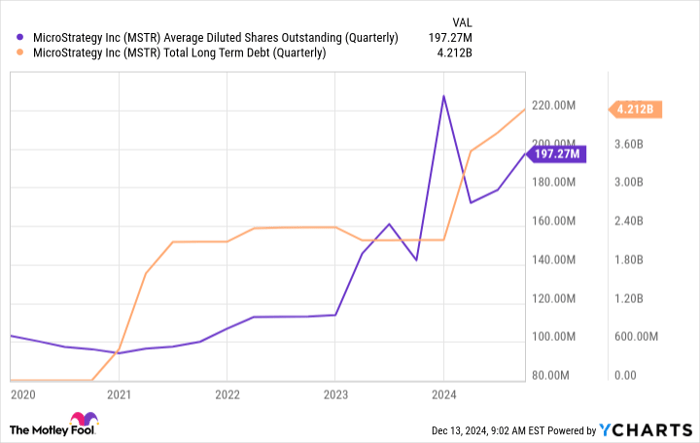

MicroStrategy obviously used all the cash on its balance sheet. And until recently the business generated positive operating cash flow, which was also used. But the much bigger sources of cash have been selling stock and taking on debt.

MSTR Average Diluted Shares Outstanding (Quarterly) data by YCharts

These moves can often destroy shareholder value. But in fairness, much of MicroStrategy's debt has been in the form of convertible notes at 0% interest -- those terms aren't bad. Moreover, selling stock hasn't been as bad as it could have been for a simple reason.

MicroStrategy calls it "Bitcoin yield." In short, if MicroStrategy stock goes up much faster than Bitcoin, management sees an opportunity. Just to keep things simple, let's say that management could increase its Bitcoin holdings per share by 20% if it diluted shareholders by 10% to raise the money. That's a move that management is going to make all day.

What Marathon Digital is doing

For its part, Marathon Digital is a Bitcoin mining company, which means that it regularly gets bitcoins just from its normal business operations. In fact, at the end of the third quarter of 2024, the company had more than 20,000 bitcoins that it had mined and held.

Marathon Digital, perhaps after seeing the big gains with MicroStrategy stock, isn't content to only acquire Bitcoins through mining operations. It seems the company is ready to take Saylor's advice of doing whatever it can to get even more.

In the second quarter, Marathon updated its Bitcoin strategy. Management then wrote in its Q3 letter to shareholders, "Our strategy is to strike a balance between mining BTC and buying BTC, factoring in market conditions."

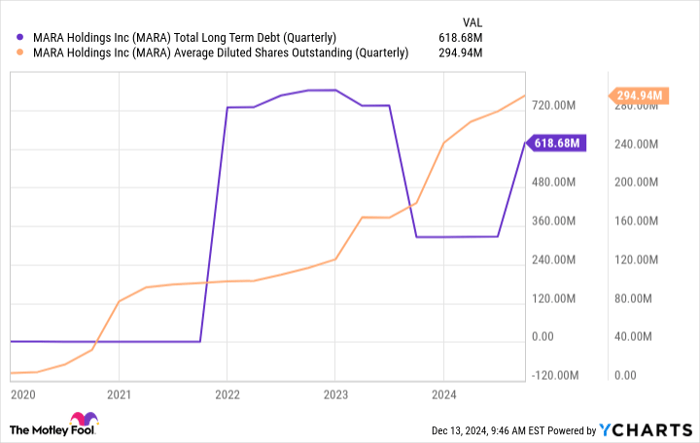

Here's the interesting thing: As a Bitcoin miner, Marathon's revenue is Bitcoin. The company has a policy of holding all of the Bitcoins that it mines. But it still has expenses that are in dollars. To get dollars to pay the bills, it takes on debt and sells stock.

MARA Total Long Term Debt (Quarterly) data by YCharts

The recent change to Marathon's strategy is essentially this: It intends to get more Bitcoin by the most efficient means. Consider that there's a cost to mining Bitcoin. If it's ever cheaper to just buy it instead of mine it, then it will use its cash that way.

It's a logical move on Marathon's part. This could have second-order impacts on Bitcoin as more miners opt to do this, but that's a subject for another time. For this discussion, if Marathon's goal is to get more Bitcoin, then it should aim to get it as cheaply as possible. Given its stated objective, management is making the right move.

What should investors do now?

Any strategy that requires leverage is inherently risky and cryptocurrency always is more risky than other assets. I believe that investors should approach all of this with a healthy appreciation of how things could go wrong.

That said, the strategy for MicroStrategy and Marathon can work barring a catastrophic and prolonged drop in the price of Bitcoin. Personally, I believe there's good reason to expect Bitcoin to keep rising in 2025.

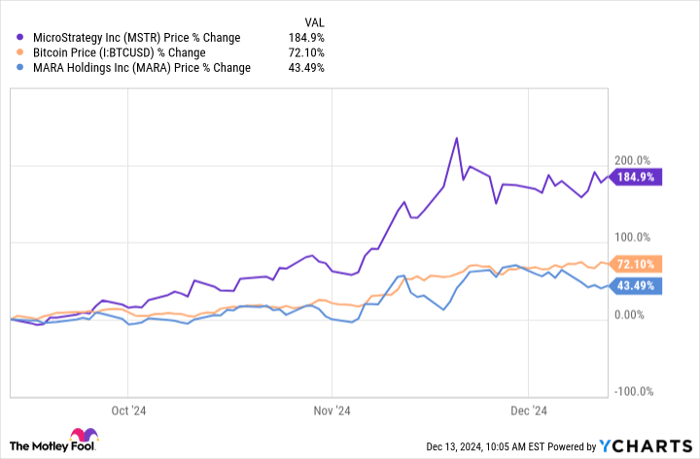

I would say this assumption is good reason to just buy Bitcoin. But if one were choosing between MicroStrategy stock and Marathon stock, I'd consider Marathon here for a simple reason: During the last three months, MicroStrategy stock is outperforming Bitcoin by a wide margin whereas Marathon stock is underperforming.

The valuation relative to Bitcoin is improving for Marathon whereas it's getting more expensive for MicroStrategy. All other things being equal, I would say that this makes Marathon stock one to consider for investors who understand the company's goals and are comfortable with the inherent risks of the approach.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $348,112!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,992!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,539!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 9, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.