Prediction: This Artificial Intelligence (ai) Company Will Join Nvidia, Alphabet, Tesla, Amazon, Apple, And Broadcom As The Next Trillion-dollar Stock-split Stock

Right now, there are nine public companies with market capitalizations of at least $1 trillion. As of intra-day trading on Jan. 6, the trillion-dollar club in order from highest to lowest is made up of the following stocks:

- Apple: $3.7 trillion

- Nvidia: $3.7 trillion

- Microsoft: $3.2 trillion

- Alphabet: $2.4 trillion

- Amazon: $2.4 trillion

- Meta Platforms : $1.6 trillion

- Tesla: $1.3 trillion

- Taiwan Semiconductor Manufacturing: $1.1 trillion

- Broadcom: $1.1 trillion

Among these companies, Apple, Nvidia, Alphabet, Amazon, Tesla, and Broadcom completed stock splits in recent years. Besides each of these companies playing a pioneering role in the artificial intelligence (AI) revolution, each had big run-ups in their respective share prices before splitting their stocks.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

During the past year, shares of Meta Platforms (NASDAQ: META) have soared by 76% -- nearly double the gain of the Nasdaq Composite and almost triple that of the S&P 500.

Here's why I think Meta will be the next trillion-dollar stock to explore a split.

Why might Meta split its stock soon?

In the graph below, I've annotated the stock splits for each of the trillion-dollar stocks as indicated by the circles with the letter "S" in the middle. The overarching trend that can be seen below is that each of these stocks witnessed pronounced and prolonged gains before the split.

One thing investors have learned during the past year is that Meta's management is serious about investing in AI infrastructure to bolster both its social media and virtual reality ecosystems. Considering Meta has never split its stock, unlike many of its big tech cohorts, I think now is a good time for the company to consider doing one as its AI ambitions begin to take shape and bear fruit.

How would a stock split affect investors?

Stock splits themselves do not change the overall valuation of a company. The reason for this is because during a split, a company's shares outstanding and stock price move by identical but opposite proportions.

For example, if a company announced a 5-for-1 split, its outstanding share count would increase fivefold while its stock price would decrease by a factor of five. At the end of the day, the company's market cap remains unchanged.

Nevertheless, after a split the company's lower share price is perceived as cheaper, so many stocks tend to rise after a split amid increased buying. These dynamics can also be seen in the chart in the prior section.

While share prices alone aren't enough to determine if a stock is overvalued or undervalued, I wouldn't be surprised if some investors see Meta's price of about $620 as expensive. Moreover, given the company's positive momentum during the past year, retail investors in particular may feel that they've missed the boat and that the shares are too pricey. The lower share price upon completing a split should broaden Meta's investor base, and could potentially inspire more enthusiasm for the company amid intense competition in the AI realm.

Image source: Getty Images.

Regardless of a split, Meta is a solid buy among AI opportunities

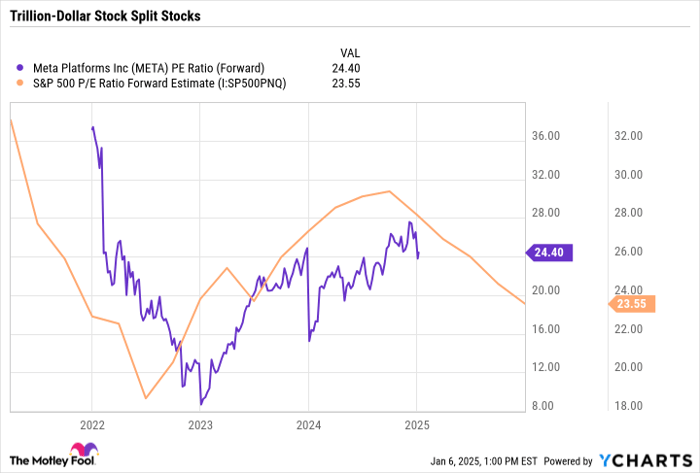

The chart below shows the forward price-to-earnings (P/E) ratio for Meta benchmarked against the average forward P/E of the S&P 500. Interestingly, Meta's forward P/E of 24 is little different from that of the S&P 500 -- suggesting investors may see an investment in the company as the same as an investment in the broader markets.

META PE Ratio (Forward) data by YCharts

Taking this a step further, Meta's valuation could suggest that investors have not yet fully bought into the company's AI aspirations, and so they do not think the company deserves to be trading at a premium.

I don't agree with this assessment. Although Meta has made it clear that its infrastructure investments in chips, hardware, and more will be costly in the near term, I see these as necessary moves for the company to remain competitive.

Meta stock is one to buy hand over fist for investors with a long-term horizon, regardless of a split. Furthermore, I think Meta will continue generating market-beating returns in the long run, and so I would take advantage of its current price action right now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $387,474!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $46,399!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $475,542!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 6, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.