Prediction: This Unstoppable Vanguard Etf Will Crush The S&p 500 Again In 2025

The S&P 500 delivered a return of some 23% in 2024, which is more than double its average annual gain of 10.6% since it was established in 1957. However, had you invested in the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG), you would have earned a whopping 38% return instead. This exchange-traded fund (ETF) directly tracks the performance of the S&P 500 Growth index, which only holds 233 of the best-performing growth stocks from the regular S&P 500 and ignores the rest.

In other words, it assigns much higher weightings to surging stocks like Nvidia, which has led to better overall returns. High-growth trends, like artificial intelligence (AI), are entering 2025 with lots of momentum, and I predict the Vanguard S&P 500 Growth ETF will crush the S&P 500 yet again this year.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Image source: Getty Images.

Large holdings in America's top tech stocks

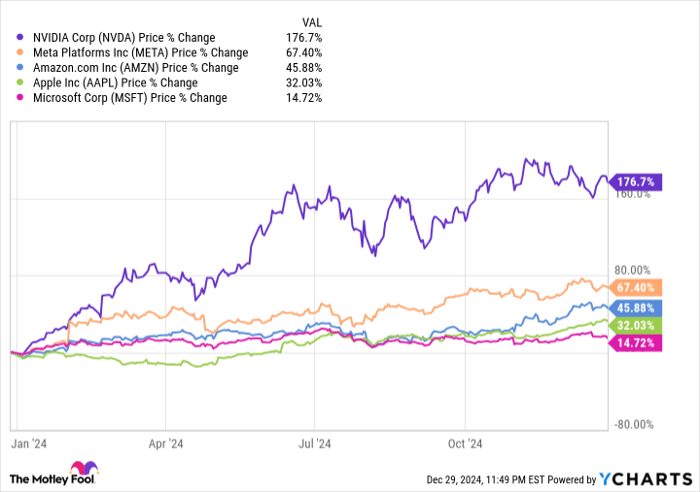

The S&P 500 Growth index selects its holdings based on factors like their momentum and the sales growth of the underlying companies. Below is a chart of the top five positions in the index (and by extension, the Vanguard S&P 500 Growth ETF), and their returns over the past 12 months:

As you can see, all of them delivered a better gain than the S&P 500 except one. Since the Vanguard ETF assigns each of them a much higher weighting than does the S&P 500, the ETF's outperformance over the past year isn't a surprise:

|

Stock |

Vanguard ETF Portfolio Weighting |

S&P 500 Weighting |

|---|---|---|

|

1. Apple |

12.38% |

7.06% |

|

2. Nvidia |

11.67% |

6.66% |

|

3. Microsoft |

10.80% |

6.16% |

|

4. Amazon |

6.66% |

3.80% |

|

5. Meta Platforms |

4.31% |

2.46% |

Data source: Vanguard. Chart by author. Portfolio weightings are accurate as of Nov. 30, 2024 and subject to change.

The information technology sector has a weighting of 49.1% in the Vanguard ETF, whereas its weighting in the S&P 500 is just 31.3%. The top three stocks in the above table are the only ones in the world with market capitalizations of $3 trillion or more, and each of them is from the information technology sector.

The new year could be the biggest for AI so far, which means tech is likely to remain the dominant sector in the Vanguard ETF. According to Morgan Stanley, four companies alone -- Microsoft, Amazon, Meta, and Alphabet -- could spend a combined $300 billion on AI chips and infrastructure this year.

That should benefit Nvidia, which is the largest supplier of AI graphics processors (GPUs) for data centers. However, the spending will also flow through to other companies in the Vanguard ETF, like Broadcom, Advanced Micro Devices, and Texas Instruments.

But the ETF isn't entirely about tech. It also holds powerhouse stocks from other industries, including pharmaceutical giant Eli Lilly, retail behemoth Costco Wholesale, and fast-food titan McDonald's.

This Vanguard ETF can beat the S&P 500 again in 2025

This Vanguard ETF delivered a compound annual return of 16.4% since its inception in 2010, which is comfortably higher than the average annual gain of 14.1% in the S&P 500 over the same period. That 2.3 percentage-point difference each year might not sound like much, but it had a big impact in dollar terms thanks to the effects of compounding:

|

Starting Balance (2010) |

Compound Annual Return |

Balance at the End of 2024 |

|---|---|---|

|

$50,000 |

16.4% (Vanguard ETF) |

$419,094 |

|

$50,000 |

14.1% (S&P 500) |

$316,934 |

Chart and calculations by author.

As I highlighted at the top, the Vanguard ETF soared by 38% in 2024, which represented an even wider gap to the S&P 500, compared to the historical average highlighted above. In other words, if AI stocks like Nvidia continue to lead the market higher in 2025, the ETF is likely to outperform the S&P yet again.

On the flip side, the Vanguard Growth ETF might temporarily underperform in the event of a stock market slump or following an economic shock. High-flying growth stocks tend to fall more sharply in those scenarios because investors flock to the perceived safety of dividend stocks, instead. That will provide some support for the S&P 500, whereas the S&P 500 Growth index has less exposure to those safer stocks.

Since there's no sign of an impending negative event on the horizon right now, I think the Vanguard S&P 500 Growth ETF is poised for another strong year in 2025.

Should you invest $1,000 in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $823,000!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 30, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Costco Wholesale, Meta Platforms, Microsoft, Nvidia, and Texas Instruments. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.