Should You Buy Berkshire Hathaway While It's Below $480?

Under the leadership of legendary investor and Chief Executive Officer Warren Buffett, Berkshire Hathaway (NYSE: BRK.B)(NYSE: BRK.A) has displayed a long track record of incredible success. For more than 6 1/2 decades, this powerhouse conglomerate has delivered annual returns of almost 20%, outpacing the S&P 500 by a wide margin.

The company's investment success under Buffett makes it a wellspring of investment ideas for both seasoned and novice investors. However, Berkshire's success isn't solely due to its investment portfolio. A big part of Berkshire's long-term success is attributed to its diverse portfolio of wholly owned businesses, which provide significant cash flows to power its ever-growing investment portfolio.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: The Motley Fool.

Nevertheless, the stock has struggled along with the broader market in recent weeks, as investors anticipate that the Federal Reserve won't cut interest rates as much as expected this year. Additionally, Berkshire is a major player in the insurance sector, and the financial implications of the recent California wildfires have weighed on the stock.

With Berkshire trading about 7% off its 52-week high, today could be a good buying opportunity for long-term investors. Here's why.

Berkshire is an incredibly diverse company

Investing in companies has been a cornerstone of Berkshire Hathaway's incredible success for more than a half-century. This is why many investors eagerly await the conglomerate's quarterly public 13-F filings to see what stocks it is investing in and see them as an indicator of what Buffett and his team think about the overall market.

Berkshire Hathaway has built a vast portfolio of closely held companies that generate consistent cash flows. That's because it invests heavily in industries vital to the overall economy that can perform well across economic cycles. Those industries include materials, energy, railroads, consumer goods, and insurance.

What helps these companies succeed is Berkshire's approach to management. Buffett has a unique, hands-off approach to management. That's because he invests in executive teams he trusts and lets operate independently. This contrasts with activist investing, like that done by Carl Icahn or Bill Ackman, who buy stakes in companies and take an active role in making changes and unlocking value for investors.

This is Berkshire's secret to success

Insurance is one industry that has contributed significantly to Berkshire's success. The conglomerate owns numerous insurance companies, including GEICO, Alleghany Corporation, General Re, and Berkshire Hathaway Reinsurance. Berkshire Hathaway is the second largest property and casualty insurer in the U.S. today; only State Farm is larger.

As a student of value investing legend Benjamin Graham, Buffett has been a vocal advocate for insurance and often attributes Berkshire's turnaround to its pivotal acquisition of National Indemnity in 1967. According to Buffett, the conglomerate's insurance holdings are "a very large chunk of Berkshire's value."

Insurance is a timeless product sought by individuals and businesses to protect themselves against losses. Many regulations require insurance policies, such as those for automobiles or homeowners with mortgages, which is why insurance products enjoy consistent demand. This business grows alongside expanding economies and inflation, which is why it has such robust cash flows.

Through the first three quarters of 2024, Berkshire raked in $77.3 billion in revenue from its insurance operations.

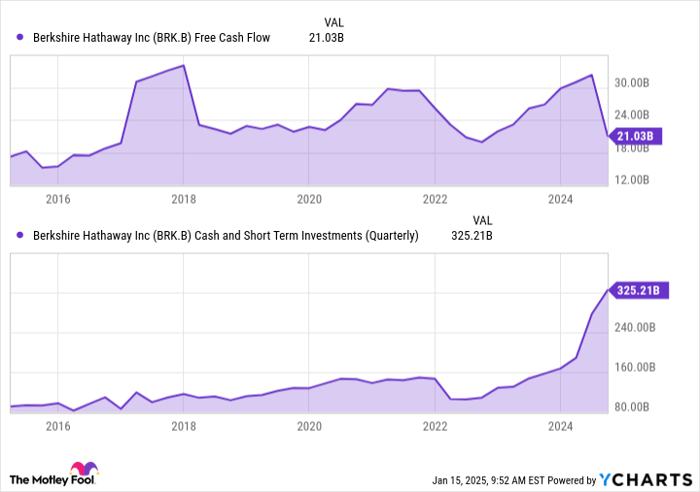

Its insurance holdings and numerous other holdings and investments are why the company generated $21 billion in free cash flow during the past year. This is the cash left after operating and capital expenses, and it can use this money to pay dividends, repurchase stock, or make fresh investments.

BRK.B Free Cash Flow data by YCharts.

Is Berkshire Hathaway a buy?

Owning Berkshire is an investment in a company with broad exposure to the U.S. economy. What makes it appealing is its cash position, especially as interest rates remain elevated.

After a selling spree last year, Buffett and his team at Berkshire are sitting on $325 billion in cash and short-term investments. Most of the conglomerate's money is in Treasuries, which provide it with cash flow, while interest rates on Treasury bills remain above 4%.

This also gives the company the flexibility to use this cash stockpile to pursue appealing investment opportunities. This patient, long-term approach is why Berkshire Hathaway has been able to withstand the test of time, which is why I think it's an excellent stock to buy today.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $353,272!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $45,049!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $457,459!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Berkshire Hathaway. The Motley Fool has a disclosure policy.