Should You Buy C3.ai Stock While It's Under $50?

C3.ai (NYSE: AI) was one of the first enterprise artificial intelligence (AI) companies in the world when it was founded in 2009. It has developed over 100 turnkey and customizable applications, which are used by businesses in 19 different industries to speed up their adoption of AI.

The company's revenue growth has accelerated for seven consecutive quarters thanks to a change to its business model from two years ago, which made it easier than ever for customers to sign up.

However, C3.ai stock is still trading 79% below its all-time high, which was set during the tech frenzy in late 2020, but it has more than doubled from its 52-week low. Investors can buy a share of this AI company for well under $50, but that might not be the case for much longer.

Helping businesses unlock the power of AI

Not every organization is equipped with the financial resources or the appropriate expertise to build AI software from scratch. That's why C3.ai's turnkey applications are popular in non-technology industries like financial services and manufacturing.

Its customer list features giants like Shell, ExxonMobil, Bank of America, and even the U.S. Department of Defense. They reply on the company for everything from equipment monitoring to fraud detection to improving efficiency. C3.ai can deliver a tailored AI application within three to six months after an initial consultation, which is likely faster than most of its customers can build an in-house solution.

C3.ai sells its software directly to customers, but it also has an extensive partnership network that includes Amazon Web Services, Microsoft Azure, and Alphabet's Google Cloud. C3.ai integrates with those cloud platforms and leverages their enormous computing power to provide customers the performance they need. Plus, since most businesses already use one of those three cloud providers, adopting C3.ai's applications is incredibly easy.

During the fiscal 2025 second quarter (ended Oct. 31), C3.ai closed 62% of its deals through its partners. It closed 20 deals through Google Cloud alone, which was a 180% increase from the year-ago period.

C3.ai also signed a blockbuster deal with Microsoft during Q2, which will run until 2030. It will make C3.ai's applications more widely available to Azure customers and introduce deeper integrations, especially as it relates to data. The two companies will also build new AI applications together for different industries, including manufacturing, healthcare, and financial services.

Accelerating revenue growth

At the start of C3.ai's fiscal 2023 (which began May 1, 2022), the company decided to shift away from its subscription-based revenue model and adopt a consumption-based model instead. The goal was to eliminate lengthy negotiating processes so customers could sign up more quickly and only pay for what they use.

The transition led to an expected but drastic slowdown in the company's revenue growth because it took time for consumption to scale up. However, the hope was that it would lead to faster growth over the longer term.

That's where C3.ai stands now -- it has delivered seven consecutive quarters of accelerating revenue growth:

Image source: C3.ai.

C3.ai generated a record $94.3 million in revenue during its fiscal Q2, which was a 29% increase from the year-ago period. The strong result prompted the company to raise its full-year guidance for fiscal 2025. It now expects to deliver $388.0 million in revenue (at the midpoint of the range), compared to its previous forecast of $382.5 million.

C3.ai continues to invest heavily in research and development, which was its largest operating expense in the quarter. Though it reported a net loss of $65.9 million, that was a slight improvement compared to the $69.7 million loss it generated in the same quarter last year.

On a non-GAAP (adjusted) basis, which excludes one-off and noncash expenses like stock-based compensation, the company's net loss shrank 49% to just $7.8 million.

Why C3.ai stock is a buy now

C3.ai stock trades at $38.25 as of this writing. That's 103% above its 52-week low of $18.85, but it's still significantly below its all-time high of nearly $184 from late 2020.

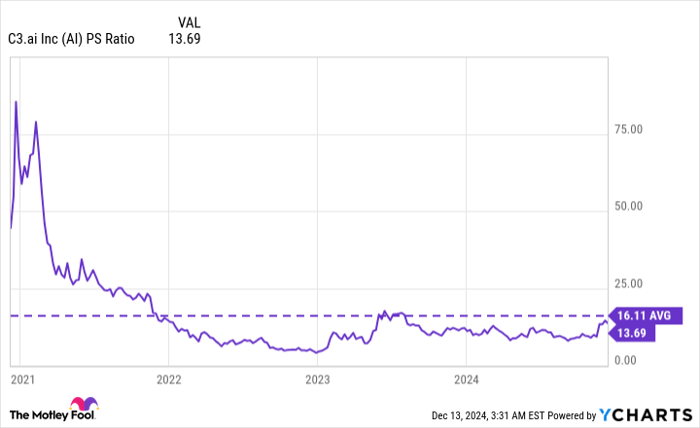

Though its price-to-sales (P/S) ratio of 13.7 is far from cheap, it does represent a modest discount to its long-term average of 16.1:

Data by YCharts.

And investors typically pay a premium valuation for companies that are growing quickly. Based on Wall Street's consensus forecast (per Yahoo! Finance), C3.ai could generate $473 million in revenue in fiscal 2026 (which will begin in May 2025), and that solid growth brings its valuation multiple down to 10.4.

C3.ai CEO Thomas Siebel thinks AI is a mega-market event, similar to the dawn of the internet or the smartphone. Citing Bloomberg, he thinks there could be a $1.3 trillion market for the technology by 2032, so the financial opportunity is enormous.

A recent study by McKinsey and Company suggests 72% of businesses have adopted AI in at least one business function. However, just 8% of businesses are using it in five functions or more. In other words, the AI revolution is merely getting started, and demand for C3.ai's applications could grow significantly as enterprises look to expand their usage.

With that in mind, I don't think C3.ai stock will trade under $50 for much longer, and investors should consider adding it to their portfolios.

Should you invest $1,000 in C3.ai right now?

Before you buy stock in C3.ai, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and C3.ai wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $822,755!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Bank of America is an advertising partner of Motley Fool Money. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Bank of America, and Microsoft. The Motley Fool recommends C3.ai and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.