Should You Buy Nvidia Before Jan. 6, 2025?

Nvidia (NASDAQ: NVDA) has delivered investors a year full of records, milestones, and successes. The top artificial intelligence (AI) chip designer has reported its highest revenue ever quarter after quarter and was invited to join the prestigious Dow Jones Industrial Average. In addition, Nvidia says demand for its new Blackwell architecture is soaring. On top of this, the tech giant's stock has climbed about 160% this year, making it the best performer in the Dow.

As the AI boom continues, Nvidia looks like the perfect stock to buy in order to benefit. The company holds 80% of the AI chip market and has built an entire portfolio of related products and services. Today's $200 billion AI market is forecast to reach beyond $1 trillion by the end of the decade, and Nvidia's well-positioned to benefit.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

But when exactly should you buy Nvidia stock? It's true the stock could react to any comments from the company about its innovations, general demand for its products, or the progress of the Blackwell launch. And that makes me think of a particular event that's coming up on Jan. 6, 2025. Should you buy Nvidia shares before that date?

Image source: Getty Images.

Nvidia's GPUs

First, here's a quick summary of Nvidia's path so far. This tech powerhouse's graphics processing units (GPUs) mainly powered video games in their earlier days, but their ability to handle multiple tasks at once made them ideal for other areas, too -- particularly AI. And because they're the fastest around, they quickly became a favorite of AI customers.

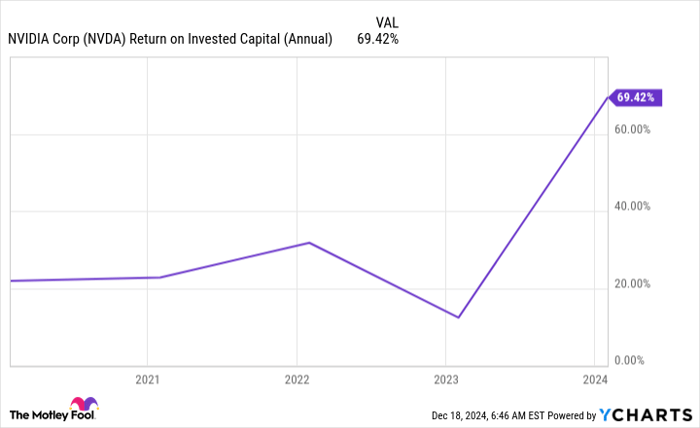

This has resulted in triple-digit revenue growth in most of the recent quarters, with revenue reaching a record of more than $35 billion in the latest period, and this is with gross margin of more than 70%. This means Nvidia is highly profitable on sales. Nvidia's return on invested capital (ROIC) over the past few years shows the company has made wise investments.

NVDA Return on Invested Capital (Annual) data by YCharts.

Time to consider what's coming up on Jan. 6, and that's CES 2025, otherwise known as the Consumer Electronics Show in Las Vegas where Nvidia Chief Executive Officer Jensen Huang will give the keynote speech. Then, from Jan. 7 through Jan. 10, Nvidia will meet with journalists and analysts and be present on the show floor, where attendees can see how the company is powering products of today and tomorrow.

In the past, Nvidia has offered an early look at its technology at CES (for example, the Nvidia Shield streaming media device and the Nvidia Drive platform for autonomous vehicles). The chip giant hasn't offered any hints of what it may present this time around, but a report from Wccftech, citing Nvidia partner Inno3D, suggests Nvidia may showcase AI innovations like "neural rendering" in the consumer-gaming GPU market.

Nvidia's strength in the gaming market

Though Nvidia generates most of its revenue from its data center business these days, it's important to remember that its video games business saw revenue climb 15% in the most recent quarter to $3.3 billion. So this still represents a solid growth market for the company.

It's also possible that analysts or journalists will ask Huang about the Blackwell launch during CES. I wouldn't expect any major news since Nvidia gave a full update during its earnings report on Nov. 20, but even a brief comment on demand or product rollout could impact the stock's performance. Blackwell is a customizable platform, with more than seven different chips, various networking options, and more -- and demand so far has been "insane," according to comments Huang recently made during a CNBC interview.

Now let's get back to the question: Should you buy Nvidia before Jan. 6? It's possible the stock will rise during or after CES on optimism about the company's innovations, so if you've been planning on buying Nvidia, you might want to get in on the stock ahead of the event.

However, if you're a long-term investor, short-term price movements won't impact your returns over, say, five or 10 years. This means you don't have to rush to get in on Nvidia before CES. If you buy the stock before or after the show, you're still likely to win over the long run, thanks to Nvidia's market leadership and innovation and the AI market's solid growth potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $338,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,306!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $486,462!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.