Sofi Technologies: Buy, Sell, Or Hold?

The S&P 500 has been on fire, consistently reaching record highs and showcasing strong performance over the last two years. But when it comes to standout stocks, SoFi Technologies (NASDAQ: SOFI) has rocketed up by 261% since the beginning of 2023.

SoFi's ability to expand its customer base and grow revenue has set it apart. After achieving its first quarterly net income a year ago, the fintech has maintained a streak of profitability, delivering several consecutive quarters of solid earnings.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

SoFi is reaping the rewards of higher interest rates, which have played a pivotal role in accelerating its customer growth. With multiple avenues for further expansion, the company is well positioned for continued success.

However, with the stock soaring significantly this year, potential investors might hesitate due to its elevated valuation. Let's examine SoFi more closely to determine whether it's a buy, hold, or sell at the current price point.

Reason to buy or hold

In recent years, SoFi has transformed from a student loan refinancing company into a financial services powerhouse. This pivotal shift began during the pandemic when student loan forbearance made its original bread-and-butter business significantly less appealing.

SoFi significantly expanded into personal loans, catering to the growing demand. But the real game-changer came in 2022 when SoFi acquired Golden Pacific Bancorp. This acquisition provided SoFi with a foundation for deposits and loans while giving it the advantages of a traditional bank.

With a banking charter, SoFi has attracted countless customers by offering annual yields of up to 4.5% on their deposits. As a result, SoFi customer growth exploded, and deposits now stand at $24.4 billion.

The acquisition also means SoFi can retain more of its loans, a considerable advantage in the recent high-interest-rate environment. This move has allowed the company's net interest income to skyrocket to $431 million in its most recent quarterly results.

SOFI Total Deposits (Quarterly) data by YCharts

Moreover, the banking charter has enabled SoFi to build out its technology infrastructure for non-banking entities. The fintech has made substantial investments in platforms like Galileo and Technisys, transforming the fintech landscape.

Through Galileo, SoFi provides the essential back-end services that other fintech companies rely on. At the same time, Technisys helps support multiple products simultaneously, runs on the cloud, and allows banks to process and analyze data in real-time. With this technology stack, SoFi aims to be the Amazon Web Services (AWS) of finance.

SoFi has expanded rapidly and is executing extremely well, which is why the stock has run up so much. Investors optimistic about this could find the stock a buy today even after its significant run-up.

Reasons to sell

Investors' concerns coming into this year primarily focused on SoFi's lending business. As noted above, the fintech has dramatically expanded its personal lending operations. Earlier this year, CEO Anthony Noto recently hinted at a more cautious outlook amid ongoing macroeconomic uncertainty.

SoFi boasts a $16.7 billion personal loan portfolio, making credit quality an important aspect of its business. In the third quarter, the company reported $147 million in charged-off personal loans, resulting in a net charge-off (NCO) rate of 3.52%. While this marks a slight increase from last year's NCO rate of 3.44%, it shows improvement from the previous quarter's 3.84%.

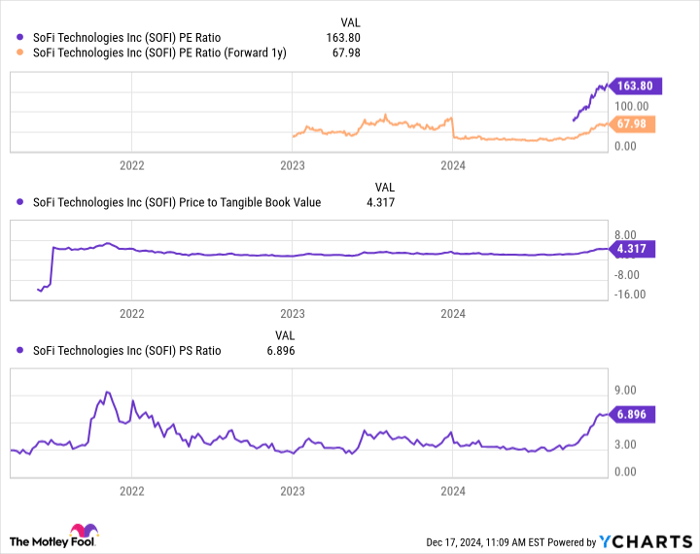

In addition, SoFi stock has experienced a significant surge and trades at a lofty valuation. The stock is currently priced at 163 times earnings and 4.3 times its tangible book value, an exorbitant number compared to traditional bank stocks. Even when you factor in forecast results for next year, the stock is priced at 68 times those expected earnings.

SOFI PE Ratio data by YCharts

While SoFi's loan portfolio continues to show resilience, the swift rise of its stock price could signal that it's time to take some chips off the table.

Buy, sell, or hold SoFi?

SoFi has posted several profitable quarters and continues to grow its customer base and earnings. Its execution has yielded impressive results for investors.

However, the stock has experienced a significant surge and trades at a premium valuation. While I'm optimistic about SoFi's long-term growth potential, this elevated valuation brings with it increased volatility -- both upward and downward.

Following the recent run-up, investors may consider this a good time to trim their position and take some profit off the table. That said, I still like the long-term outlook for SoFi over the next decade, so I give it a hold rating today.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $825,513!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.