Super Micro Computer Stock Has Soared Almost 100% In The Past Month. Is A Bigger Rally Coming?

Super Micro Computer (NASDAQ: SMCI) has been one of the hottest stocks to own during the past month. Since plummeting to $18 a month ago, the stock has rallied in a big way -- almost doubling in value, closing at over $33 on Dec.17. Investor sentiment has done a complete reversal as concerns have seemingly evaporated about the company's auditor resigning (it has since found a new one), as well as around the state of its financials after it delayed filing it's annual report. As a result, the bulls are back.

Shares of the tech company, however, are still down more than 70% from its 52-week high of $122.90. Given the renewed optimism surrounding the stock, could this be just the start of a much bigger rally?

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Trading activity has been picking up

Not only has Supermicro's stock price been soaring of late, but trading volumes have also increased significantly. This can be a positive sign, putting the stock on the radar of more investors.

SMCI 30-Day Average Daily Volume data by YCharts

The stock's beaten-down price may also make it an appealing contrarian play, especially for investors who believe the stock may be likely to get back to the highs it reached earlier in the year.

Supermicro is, after all, still a potentially promising artificial intelligence (AI) investment, as it provides companies with servers and the necessary IT infrastructure they need to build out their operations and prepare for new AI deployments. But that doesn't mean everyone is convinced it's out of the woods just yet.

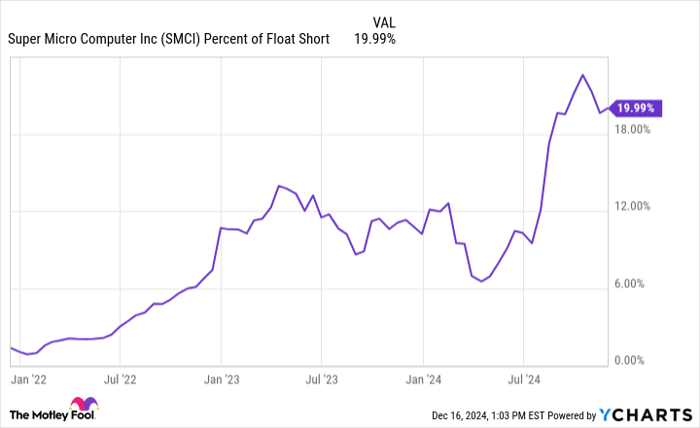

Plenty of investors are still betting against Supermicro

A big reason there's a lot of volatility with this stock is that there's a high short interest in it. Many investors want to profit from a falling share price, and perhaps they believe its audit-related concerns aren't going away.

SMCI Percent of Float Short data by YCharts

To add fuel to the fire, the stock was recently removed from the Nasdaq-100 index, which means it will be included in fewer institutional portfolios and funds. And that only bolsters the pessimistic case against Supermicro.

If the company fails to file its required reports by February, including its annual report, which it is late on, the short interest could increase yet again -- as well as the likelihood that it gets delisted from the Nasdaq exchange. If that happens, that could send the stock back into a tailspin.

Is Supermicro stock worth the risk?

Supermicro is proving to be a volatile stock to own this year, which is why it isn't suitable for most long-term investors. If you do have a high risk tolerance, however, this is a stock that may have a lot of upside, and that may be worth some consideration; at just 10 times next year's estimated profits, if those numbers prove to be true, the stock could be a steal right now.

But I wouldn't take a chance on the stock because there are a lot of fires for Supermicro to put out for it to convince investors that it's a safe buy again. And with its scorching-hot rally of late, some investors may already be expecting that the worst is behind the company, which could be a dangerous assumption.

Supermicro is an intriguing stock, but you may want to put it on a watch list rather than in your portfolio, given the uncertainty surrounding it. It may be tempting to buy into the rally, but until it files its financial reports and it gets its new auditor to sign off and say that the numbers are accurate and can be relied upon, investors should tread carefully with the stock; there's still plenty of downside risk here.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $338,103!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,005!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $495,679!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Nasdaq. The Motley Fool has a disclosure policy.