The Best High Yield Reit To Invest $2,000 In Right Now

The average real estate investment trust (REIT) offers a dividend yield of roughly 3.8% today. That's well above the S&P 500's 1.2%.

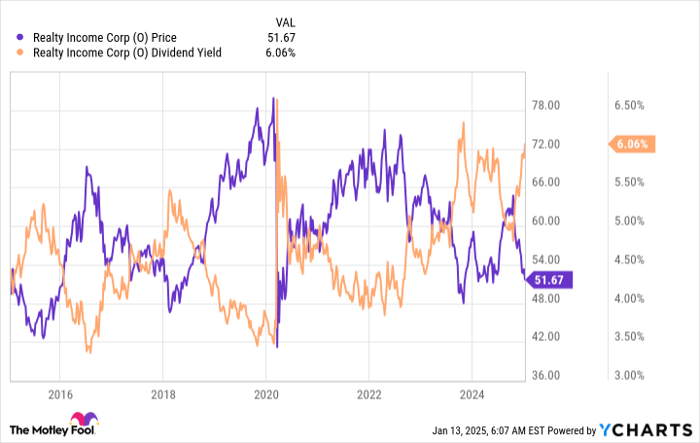

But you can still do better. Real estate bellwether Realty Income (NYSE: O) is yielding 6.1%. Here's what you need to know and why now is a good time to put $2,000, or more, to work in this high-yield REIT.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

What does Realty Income do?

Realty Income is a net lease real estate investment trust. That means that its tenants are responsible for paying most property-level operating costs. Although virtually all of its properties are single tenant -- meaning there's a high risk if the tenant leaves -- over a large enough portfolio, the risk is pretty low. The REIT is the largest player in the net lease space with over 15,400 properties.

Image source: Getty Images.

Outside of Realty Income's size, however, there's not a whole lot that sets it apart when you look at individual metrics. For example, W.P. Carey, the second largest net lease REIT, offers a dividend yield of 6.5%.

Meanwhile, Realty Income's dividend growth over time has averaged around 4.3% a year, while peer Agree Realty has increased its dividend by roughly 6% over the past decade. As for the dividend streak, Realty Income's 30 consecutive annual increases fall behind NNN REIT's 35 years.

Even Realty Income's general approach to its portfolio isn't really unique. It has assets in the retail and industrial sectors with a large "other" category. And it invests both domestically and in Europe. That's exactly what W.P. Carey does, too.

At the end of the day, you can probably find net lease REITs that are better than Realty Income on any individual metric you like. What sets it apart is its size (with a $45 billion market cap, it is nearly four times larger than its next closest peer) and the fact that it manages to score well across so many different industry metrics, even if it isn't the top-performing REIT on a particular metric.

Realty Income is reliably boring

Realty Income is, in the end, a foundational investment. It is the kind of reliable company that tends to perform fairly well year in and year out. You won't brag about it at a cocktail party, but you'll be happy you have it in your portfolio, sending you attractive dividend checks month in and month out.

You can reinvest those dividends to compound your growth. Or you can use that cash to pay for living expenses, since a monthly dividend is as close to a paycheck replacement as you can get.

There's just one more thing: Size matters in the net lease sector. Net leases are usually financing transactions for the seller, which is often an operating business like a retailer or a manufacturer.

The seller needs to raise cash for some reason (funding growth or strengthening the balance sheet), and it is often cheaper to do a sale/leaseback than to issue stock or sell debt. Realty Income's size and financial strength (it has an investment-grade balance sheet) make it a well-known and reliable partner for such transactions.

But REITs pay out most of their earnings as dividends, so they have to tap the capital markets for cash when they make acquisitions. Being large and financially strong means Realty Income can raise growth capital at attractive rates.

This, in turn, leads to a generally low cost of capital. So it can make profitable deals where its peers might not be able to. And it can take on deals that are larger than most of its peers could handle. Having strong overall business metrics coupled with Realty Income's size does, in fact, set it apart from the pack in an important way.

Realty Income isn't exciting, and that's good

If you need, or simply want, a reliable income stream, Realty Income has you covered. And it will let you sleep well at night while you collect a dividend yield that's well above the market average (and above the REIT average).

It is hard to complain about the combination of positives this REIT has to offer. But, right now, the most attractive fact could be that the dividend yield is near 10-year highs, suggesting Realty Income is currently on sale.

Should you invest $1,000 in Realty Income right now?

Before you buy stock in Realty Income, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Realty Income wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $843,960!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

Reuben Gregg Brewer has positions in Realty Income and W.P. Carey. The Motley Fool has positions in and recommends Realty Income. The Motley Fool has a disclosure policy.