The Best S&p 500 Etf To Invest $200 In Right Now

As of this writing, the S&P 500 has risen around 27% in 2024. That's an incredible performance. But there are some caveats that investors need to consider, including the fact that such a swift advance may be pushing the boundaries on the valuation front.

This is why value-conscious investors might want to buy Invesco S&P 500 GARP ETF (NYSEMKT: SPGP) right now, even if you are just dipping your toes in with a modest investment of $200. Here's what you need to know about this S&P 500 index variant.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

What does the S&P 500 index do?

From a big-picture perspective, the S&P 500 index is meant to represent the U.S. economy. The stocks in it are selected by a committee based specifically on this goal, with a bias toward larger and more important businesses. For the most part, the index does a solid job and is considered the key gauge of stock market performance.

Image source: Getty Images.

That said, there are some problems that arise. One of the most notable is that the index is market capitalization weighted. That's not inherently bad and is, in fact, a better choice than the stock price-weighting method used with the Dow Jones Industrial Average.

However, a market cap weighting leads to the largest companies having a disproportionate impact on performance. When certain sectors get particularly frothy, they can be the main driving force of performance.

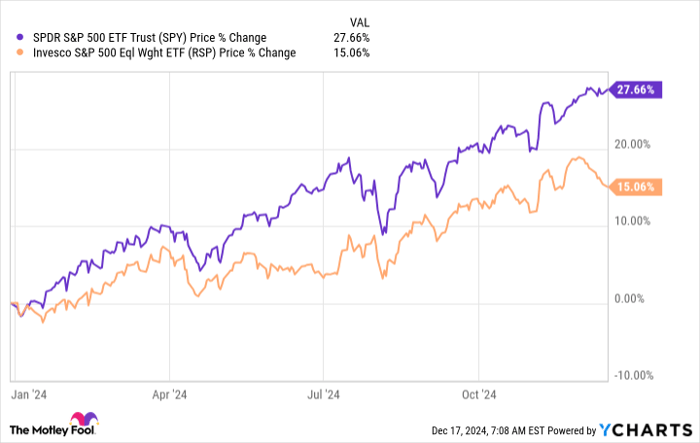

That's what appears to be happening right now, and one of the best ways to see it is by comparing the S&P 500 index to an equal-weighted version of the index. As the chart shows, Invesco S&P 500 Equal Weight ETF (NYSEMKT: RSP) hasn't done nearly as well as the market cap-weighted version of the index. For investors who care about valuation, this is a sign that you might want to think about broadening your search if you are considering buying a generic S&P 500 index fund.

GARP is an attractive alternative

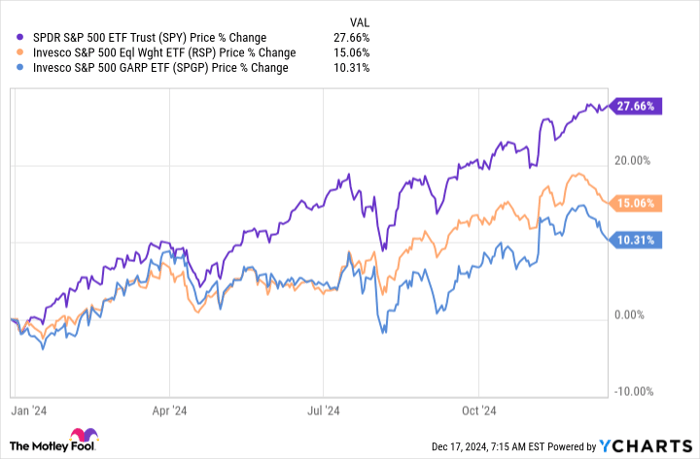

Growth at a reasonable price (GARP) is an investment approach that attempts to balance growth and value when making stock selections. With the S&P 500 index, a solid GARP option is Invesco S&P 500 GARP ETF. As the chart shows, it has performed even worse than the equal-weight version of the index so far in 2024.

That's not shocking at all, given the small number of large companies driving the S&P 500 index higher. Those stocks, which are looking a bit expensive today, would mostly fall out of the Invesco S&P 500 GARP ETF's pool of options. The ETF starts with the S&P 500 index, as you would expect, and then takes sales per share growth, earnings per share growth, P/E ratios, financial leverage, and return on equity into consideration. Not to be redundant, but it is trying to find growing companies trading at reasonable prices.

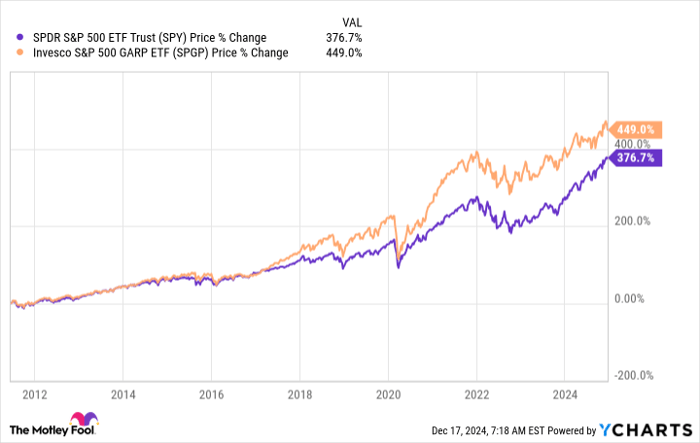

That's not doing as well as focusing on the stocks Wall Street loves right now, but over time, the GARP approach has done very well, as the chart highlights.

While past performance is not a guarantee of future performance, as Wall Street is legally required to say, Invesco S&P 500 GARP ETF's approach has clearly been a winner over time. And there's no reason to believe that buying reasonably priced growth stocks is going to permanently go out of style. It seems likely that, at some point, investors will again care about valuation.

On that front, Invesco S&P 500 GARP ETF's average price-to-earnings ratio is around 14.5 versus around twice that level for the S&P 500 index. If, perhaps when, value regains favor again, the S&P 500 index could be in for a shellacking.

GARP has its benefits, but you have to accept some negatives

Invesco S&P 500 GARP ETF's approach has worked well over time and is currently providing investors with a more value-conscious way to invest in S&P 500 stocks. But it holds a subset of the index, with just 75 or so holdings. That's not going to be representative of the U.S. economy in the same way as the S&P 500 index.

However, it does allow investors to shift the emphasis of their portfolio away from the small number of large companies that are currently pushing the S&P 500 index higher. That could be just what you want today if you are worried that the bull market has gone too far, too fast.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $338,855!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $47,306!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $486,462!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.