The Smartest Growth Etf To Buy With $1,000 Right Now

There are all sorts of exchange-traded funds (ETF) you can buy on the market. State Street pioneered the idea of the ETF when it launched the SPDR S&P 500 ETF Trust in 1993, and today, there are a plethora of ETFs, some of which track indexes with hundreds or even thousands of stocks, and others with hand-picked portfolios.

ETFs offer investors broad exposure to certain trends or industries, or they can be a simple way to invest in a category or market index. Vanguard has some of the most popular ETFs, and the Vanguard S&P 500 Growth ETF (NYSEMKT: VOOG) is an excellent choice if you have $1,000 to invest right now.

Want to beat the market?

There are various ways to invest in the market, with many different index funds and index ETFs available to investors. Warren Buffett recommends that most investors buy a fund that tracks the S&P 500 because it's hard to beat the market. Berkshire Hathaway itself owns shares of both the SPDR ETF and the Vanguard S&P 500 ETF.

Image source: Getty Images.

But there are ETFs that do beat the market. Some are very risky, and they might beat the market one year but then fall short the next year. But some have demonstrated long histories of outperformance.

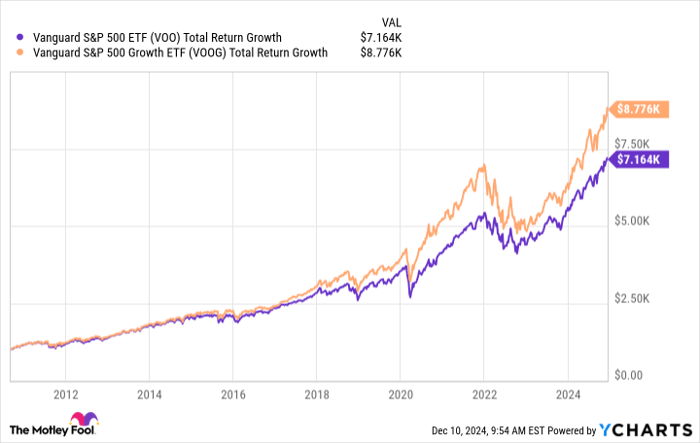

The Vanguard S&P 500 Growth ETF has a long track record of market-beating performance. Annualized, it has returned 16.4% for investors since its inception in 2010, while the standard S&P 500 ETF has an annualized return of 14.9% over the same time.

Here's how that translates into dollars if you'd invested $1,000 in each of them when they started 24 years ago:

VOO Total Return Level data by YCharts

The best of the best

You might think that it performs well but has a lot of risk. But even though it does have more risk than an ETF that tracks a larger index, it still boasts a good amount of safety.

One of the reasons the Vanguard S&P 500 Growth ETF is so successful, compelling, and low risk is that it has only the best growth stocks in the S&P 500, which itself is already a selection of the 500 top companies on the stock market. It tracks the S&P 500 Growth Index, a group of the top 230 or so stocks in the broader index. That amount of stocks still provides a fair bit of diversification in general, and it's also well diversified across industries. However, because it's a weighted index, it is heavily weighted toward the larger-cap stocks in the index. Its largest positions are the most valuable companies in the market, starting with Apple, Microsoft, Nvidia and Amazon, which collectively account for 41.7% of the total.

I would point out, though, that each of these stocks has tremendous opportunity in artificial intelligence (AI), and that creates opportunity for shareholders going into 2025. In fact, the ETF is up 40% this year, and it has the AI tailwinds that make it likely it could do well next year, too. Even if it doesn't, shareholders should feel confident about its long-term potential considering its track record.

Low cost and foolproof

Vanguard ETFs are easy to buy and come with low expenses instead of high fees for money managers. The Growth ETF has an expense ratio of 0.1%, whereas it says the average for similar ETFs is 0.94%. ETFs are easier to buy and sell than standard mutual funds because they're traded on the market like stocks, making them a good choice for ease of use.

The Vanguard S&P 500 Growth ETF could be an excellent investment for almost every investor except the most risk averse, and if you have $1,000 to invest right now, I highly recommend taking a look.

Should you invest $1,000 in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF right now?

Before you buy stock in Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Admiral Funds - Vanguard S&P 500 Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $822,755!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jennifer Saibil has positions in Apple. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.