The Ultimate High-yield Reit Turnaround Stock To Buy With $1,000 Right Now

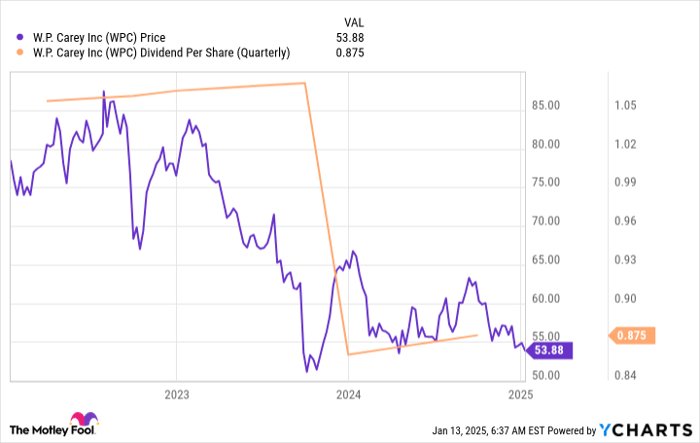

After 24 consecutive annual dividend increases, W.P. Carey (NYSE: WPC) did something that seemed unthinkable -- it cut its dividend by 20%. That decision, which was made in 2023 but impacted the first dividend in 2024, has resulted in dividend investors avoiding this net lease real estate investment trust (REIT).

That could be a buying opportunity if you have $1,000 or $100,000 to invest right now. Here's what you need to know.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

What did W.P. Carey do?

At its core, W.P. Carey uses the fairly simple net lease approach, which means that it generally owns single-tenant properties for which the tenants are responsible for most property-level operating costs. Across a large enough portfolio this is a pretty low-risk business model. W.P. Carey, for reference, is the second-largest player in its niche and has a portfolio of over 1,400 properties.

Image source: Getty Images.

That said, not all property types have the same dynamics. The most common net lease property is retail, where buildings can be easily bought, sold, and released. Among the most difficult net lease properties to deal with are offices, which made up 16% of W.P. Carey's portfolio in the third quarter of 2023.

Given the problems that sector was facing following the coronavirus pandemic, the high costs of redevelopment for new tenants or to facilitate a sale, and the long lead times for sales, W.P. Carey decided to exit office in one quick move.

That process played out over the fourth quarter of 2023 and into the first half or so of 2024. And, given the size of the office segment of W.P. Carey's portfolio, it had little choice but to cut the dividend to a size its portfolio could support after all of the offices were sold off.

It was a reset, not a cut -- and here's the proof

A lot of dividend investors see a dividend cut and run for the hills. That's understandable and is probably appropriate most of the time. But it isn't always the right call. In this situation, W.P. Carey's cut was really a reset. That's borne out by the fact that the dividend has been increased each quarter since the reset, which is the exact same increase cadence that existed prior to the reduction.

In fact, you could easily argue that this move was made from a position of strength, not a position of weakness. It has certainly strengthened the REIT's business, as it removed a troubled property type from the portfolio. The divestiture of the office assets also left W.P. Carey with cash to spend on more desirable properties. In 2024 alone, it bought $1.6 billion in new assets with around half of that occurring in the fourth quarter of the year.

There are two notable takeaways here. First, exiting the office assets happened pretty quickly, but buying assets tends to take time and can be a bit lumpy. Second, the large value of the assets bought in the fourth quarter won't start really benefiting the REIT until 2025, which means growth is on tap as the new year gets underway.

This is why now is a great time to look at W.P. Carey. Investors are still downbeat on the stock, highlighted by its 6.5% dividend yield compared to the average REIT yield of 3.8%. But W.P. Carey's dividend is growing again, and so is its business. The risk/reward ratio of this turnaround play looks very low for investors that think in decades and not days.

Turnarounds don't have to be risky

The choice to rip the bandage off and exit office in one quick move was a bit of a shock to investors. It pushed W.P Carey into the turnaround category, but that was really more about perception than reality. The business remains strong and management is already building back the portfolio. This was a business reset for sure, but it was made from a position of strength.

And that's why W.P. Carey is perhaps the ultimate turnaround stock to buy in the REIT sector right now. Collecting the high yield while you wait for Wall Street to catch up to the real story is icing on the cake.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $341,656!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,179!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $446,749!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Reuben Gregg Brewer has positions in W.P. Carey. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.