This Biotech Stock Soared 116% In 2024, But Is It A Buy In 2025?

One of the hottest growth areas in the healthcare landscape these days is the obesity drug market because of a class of drugs that's proven to be both efficacious and safe in clinical studies and in the real world. You might be familiar with the top sellers, such as Eli Lilly's Zepbound or Novo Nordisk's Wegovy -- they've made headlines as demand for them soared.

In fact, demand for these drugs has been so strong that it even surpassed supply until the drugmakers took action to scale up manufacturing capacity -- and this may not let up. The obesity drug market may reach beyond $100 billion by 2030, according to Morgan Stanley Research.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

All of this has prompted investors to look for the next Lilly or Novo Nordisk -- a company that may join those giants in this high-growth market. Viking Therapeutics (NASDAQ: VKTX) seems to fit the bill, as it announced fantastic data from trials of its weight loss candidate last February -- and the stock delivered a 116% gain for the full year.

Now, as the obesity drug market opportunity remains strong, is Viking a buy in 2025?

Image source: Getty Images.

Elli Lilly and Novo Nordisk weight loss drugs

First, I'll talk about this class of drugs, known as GLP-1 receptor agonists or dual GIP/GLP-1 receptor agonists. Novo Nordisk drugs are in the former category, while Lilly's are in the latter. In both cases, these drugs act on hormones involved in the digestion process, helping to reduce appetite and regulate blood sugar levels. They're easy to use, self-administered weekly, and have proven to help patients shed pounds.

Both of these drugs have seen enormous demand and brought in blockbuster revenue. Demand has been so high, that these drugs were on the U.S. Food and Drug Administration's (FDA) list of drugs that are in short supply. The FDA recently removed Lilly's treatment from the list after the company significantly ramped up manufacturing capacity, ensuring greater supply.

Now let's talk about the new kid in town. Viking focuses on GIP/GLP-1 receptor agonists and has a candidate, VK2735, in late-stage clinical trials. As an injectable (like the Novo Nordisk and Lilly commercialized drugs), VK2735 has completed phase 2, and the next step will be phase 3.

In phase 2, Viking's candidate showed up to a 14.7% reduction in mean body weight after 13 weeks. The company also is developing VK2735 in an oral tablet formulation, and that candidate just entered a phase 2 study. In an earlier trial, the oral candidate demonstrated weight loss of up to 8.2% after just 28 days.

Viking versus the market leaders

So is Viking a buy in 2025?

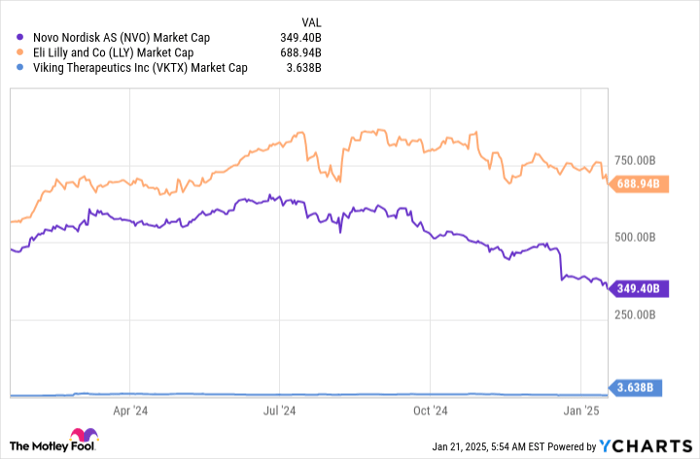

It's important to remember that Novo Nordisk and Lilly, as big pharma players, have the financial resources and infrastructure to remain in leadership positions in the weight loss drug market. They're profitable companies with full portfolios of products, and revenue has climbed over the years. Their market values top $300 billion and $600 billion, respectively, while Viking has a market cap of less than $4 billion.

NVO Market Cap data by YCharts.

All of this means it's unlikely Viking will upset the market's current leaders. That said, this newer biotech player could eventually carve out a spot if all continues to go well in clinical studies. As I mentioned earlier, weight loss drugs are in high demand, and this is expected to continue, so there's room for more than a couple of players in this space.

Viking's weight loss candidate won't reach commercialization as soon as this year -- but something else this year could boost the stock price -- promising clinical-trial data. Viking shares have been known to surge on strong clinical-trial results.

When the company reported VK2735's phase 2 results last year, the stock jumped 121% in one trading session. Viking gave back some of those gains, but still finished the year, as mentioned above, with a triple-digit increase. And the solid results we've seen so far from Viking offer us reason to be optimistic about VK2735.

That said, anything can happen during a clinical trial, so investing in a biotech company that doesn't yet have products on the market involves some risk. But if you can accept that, scooping up shares of Viking could offer you great rewards -- down the line, and even as early as 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 21, 2025

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool recommends Novo Nordisk and Viking Therapeutics. The Motley Fool has a disclosure policy.