This Cathie Wood Etf Is Crushing The Market In 2024. Is It Still A Buy?

Cathie Wood focuses on disruptive tech stocks in her exchange-traded funds (ETF), and she's developed a following of investors who are interested in tracking her thoughts and ideas. She's not afraid to take chances on new companies and trends, and that has led to incredible performance -- at times.

For example, her internet-focused ETF, Ark Next Generation Internet (NYSEMKT: ARKW), is crushing the market this year, up 59% vs. 29% for the S&P 500 index. Can investors expect more of the same in 2025?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Driven by AI

Cathie Wood's ETFs are chock-full of high-growth stocks that have massive opportunities. She bet big on Tesla, for example, before many other investors, and she has developed a name for herself as someone who can identify trends.

Her company, Ark Invest, has several ETFs, each focused on a different category, but her interest is disruptive technology. The Next Generation internet ETF comprises stocks that broadly cover products and services related to the Internet, such as hardware, payments, infrastructure, cloud, and social media.

Image source: Getty Images.

Although this ETF wasn't created with the purpose of benefiting from artificial intelligence (AI), some of its sectors are heavily shifting into AI, specifically cloud companies like Microsoft and Amazon. It also has a position in Nvidia. These are smaller positions, though. Some of its top holdings are Tesla, Roku, and Coinbase Global, and it's a fairly well-rounded ETF as far as high tech. However, it does have a high exposure to cryptocurrency.

This actually isn't the Ark ETF that's most directly related to AI. That would be the Autonomous Technology & Robotics ETF, which seeks to benefit from developments in automation and AI. That ETF is also beating the market this year, but not by as much as the internet ETF -- it's up 41%. That might be because it includes a wide variety of sectors like energy and transportation, instead of just the more traditional tech categories in the internet ETF.

Risk vs. reward

In general, when the market is up, growth stocks outpace it. In strong bull markets, it's typically the growth stocks that drive the gains in the market, and an overall benchmark indicator like the S&P 500 is picked up by the growth stocks and pulled down by the value stocks.

Cathie Wood's brand of growth stocks leans toward risky and disruptive. In good times, these can skyrocket. But because they're risky, often young and unproven, they can be volatile. In challenging times, they can plunge.

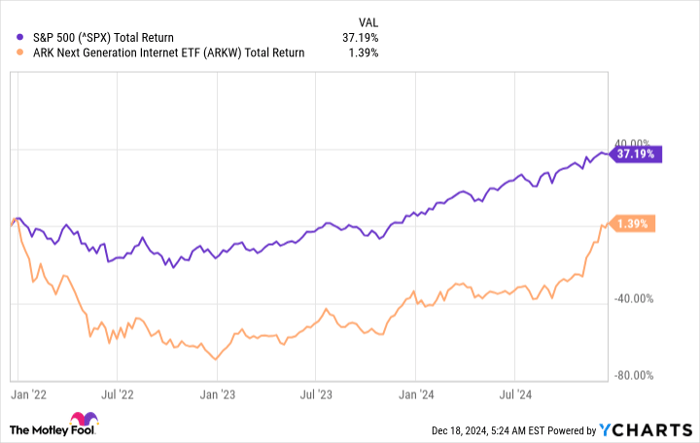

Even though the internet ETF has doubled the broader market's gains this year, it trails the S&P 500 over the past three years.

The past three years include a bear market, which is often when these kinds of growth-focused ETFs face their greatest challenges. However, over its lifetime, the internet ETF has significantly outperformed the market with a gain of 638% vs. the market's 270% gain.

Cathie Wood believes in the power of technology to change the world, and she has been proven right on a number of occasions. However, while the long-term performance of the internet ETF seems to vindicate her approach, not all of her ETFs have beaten the market over their lifetimes or over specific periods. Some have, some haven't. That makes any of them quite risky. These ETFs can be quite volatile, and they only work for investors who can handle the risk and the potential for their investments to take pretty strong dips along the way to high gains.

Getting back to the original question, it does look like the internet ETF has robust growth drivers heading into 2025. It's well diversified as far as tech goes, and AI is just getting started. But you should only consider investing in it if you have confidence in cryptocurrency and you understand that the ETF could flop in the event of unforeseen circumstances, and that it's likely to drop if there's a market crash or correction.

Should you invest $1,000 in Ark ETF Trust - Ark Next Generation Internet ETF right now?

Before you buy stock in Ark ETF Trust - Ark Next Generation Internet ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ark ETF Trust - Ark Next Generation Internet ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $790,028!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Jennifer Saibil has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Coinbase Global, Microsoft, Nvidia, Roku, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.