This Dow Jones Dividend King Has A Lot To Prove On Jan. 22. Here's Why Investors Should Take Note.

Procter & Gamble (NYSE: PG) is the largest household and personal products company by market cap in the U.S. It has dozens of brands spanning several daily-use categories, including family care, home products, hair and grooming needs, oral hygiene, baby care, feminine products, skin care, and more.

P&G has historically been an ultra-reliable dividend stock. With 68 consecutive years of dividend increases, it is one of the longest-tenured Dividend Kings. It is also the oldest component of the Dow Jones Industrial Average, having joined the index in 1932.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

But sales growth has slowed. And last quarter (the period from July through September 2024), volume growth was flat.

Here's what to watch when management reports 2025 second-quarter earnings on Jan. 22 -- and whether the dividend stock is a buy now.

Image source: Getty Images.

P&G isn't at the top of its game

P&G's last report wasn't great. The consumer goods company kicked off fiscal 2025 with just 2% organic sales growth and, as mentioned, flat volume growth. Its beauty and grooming segments saw a negative 3% change in product mix.

Mix refers to buyer behavior trends within a category. A positive mix shows that consumers are gravitating toward more expensive options, whereas a negative mix shows a shift to value.

The company has a diverse lineup of brands within multiple categories, making it well positioned to retain customers even as they shift preferences. But still, a negative mix in key categories is a sign that consumers are tightening spending.

P&G's full-year forecast is also fairly weak. It sees 2% to 4% sales growth, 5% to 7% core earnings per share (EPS) growth, and 10% to 12% diluted EPS growth.

EPS outpacing revenue growth is a great sign because it indicates pricing power and strong margins. The company's EPS growth also benefits from consistent stock repurchases. Over the last decade, P&G has spent over $146 billion on dividends and buybacks.

Management also does a good job converting earnings to free cash flow (FCF). As you can see in the following table, the company typically grows earnings faster than organic sales and is converting most of its earnings, if not all, to FCF.

|

Metric |

Fiscal 2019 |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

Fiscal 2023 |

Fiscal 2024 |

|---|---|---|---|---|---|---|

|

Organic sales growth |

5% |

6% |

6% |

7% |

7% |

4% |

|

Core EPS growth |

7% |

13% |

11% |

3% |

2% |

12% |

|

Currency neutral core EPS growth |

15% |

17% |

11% |

5% |

11% |

16% |

|

Adjusted free cash flow productivity |

105% |

114% |

107% |

93% |

95% |

105% |

Data source: Procter & Gamble November 2024 investor presentation.

Adjusted FCF productivity is calculated by dividing FCF by net earnings. It helps gauge the affordability of P&G's capital return program (dividends and share buybacks) and if the company has extra cash available to fund acquisitions or reinvest in the business.

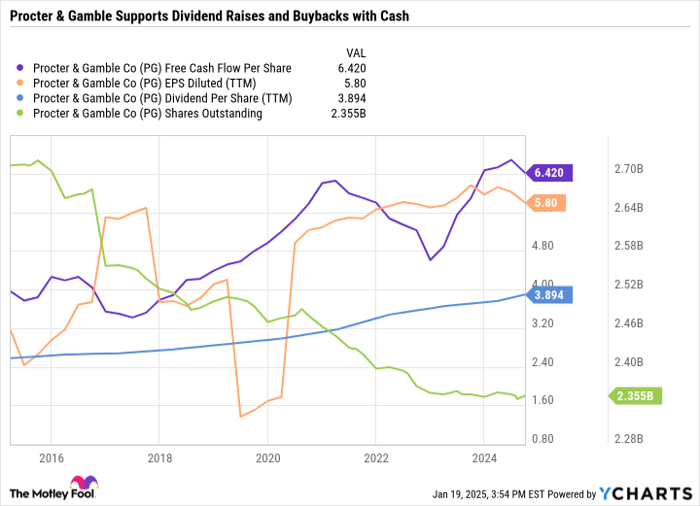

As you can see in the following chart, P&G's FCF per share usually exceeds EPS.

PG free cash flow per share, data by YCharts; TTM = trailing 12 months.

This means it can easily afford its growing dividend with cash and still have dry powder left to repurchase stock -- which is why its outstanding share count has consistently ticked down year after year. P&G's long-term targets call for organic sales growth ahead of the market average, core EPS growth in the mid to high single digits, and adjusted FCF productivity of at least 90%.

The fewer the outstanding shares, the greater the EPS, which makes P&G a better value for long-term investors.

Room for improvement

The main thing to watch for in P&G's upcoming earnings call is volume growth. The company has proved time and time again that it can grow earnings faster than sales growth. But without volume growth, P&G faces an uphill climb to make good on full-year expectations.

The company also faces significant currency risk, given its global exposure. When P&G sells products in a foreign currency, it must convert those profits back into U.S. dollars when it reports earnings. So, a strong dollar dilutes the value of international sales.

To offset a challenging demand cycle, the company will likely continue leaning on its "noticeable superiority" big-picture strategy, which calls for superior products, packaging, brand communication (through marketing efforts), and retail execution, which conveys better value for customers and helps P&G justify price increases.

However, in the near term, the biggest benefit for P&G would be a rebound in its weakest regions. Over the last four quarters, Greater China, Asia, the Middle East, and Africa -- which make up 15% of total company sales -- saw a 7.5% decline in organic sales growth, whereas the other 85% of the business saw 4.8% organic sales growth. If you take out those underperforming regions, the business is doing far better than it appears at first glance.

Investors should take note of management's commentary on these underperforming regions in the upcoming earnings call. Economic challenges and currency headwinds are eroding the company's pricing power in these underperforming regions. So, any improvement would go a long way for the broader business.

P&G remains a solid income stock

P&G is down over 10% from its all-time high reached on Nov. 27. But the stock isn't cheap by any means, with a 27.8 price-to-earnings ratio (P/E) and a 23.3 forward P/E. However, it's not a bad buy for investors looking for an ultra-safe form of passive income: The Dow stock yields a decent 2.5%. But as mentioned, it generates a ton of FCF, supporting dividend raises and buybacks.

The results don't look great at first glance. But once factoring in the huge headwind from China, Asia, the Middle East, and Africa, the business is doing very well even in a challenging operating environment.

P&G continues to demonstrate why it is the undisputed leader across several key daily-use consumer categories. The stock remains a decent buy now -- but not a screaming buy until it can overcome the discussed challenges.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $357,084!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,554!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $462,766!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of January 13, 2025

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.