This Luxury Goods Superstar Is Making A $4 Million Supercar. Is The Stock A Buy Today?

Meet Ferrari's (NYSE: RACE) newest supercar, the F80. While it might be nearly impossible to get your hands on one, considering Ferrari's notorious exclusivity with selling its vehicles, it's likely to help power the automaker's future profits. And if you can't buy a Ferrari F80, buying the stock might just be your next best option.

Here's why.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Ferrari's F80. Image source: Ferrari.

Ferrari is powering profits

The F80 packs a punch, no matter how you look at it. Whether it's the sharp red paint Ferraris are known for, the top speed of nearly 220 miles per hour, or the engine built off tech from the company's Formula One efforts, the vehicle is a stunning supercar.

Another stunning thing about the F80 should be music to investors' ears: The price tag starts at a staggering $3.9 million before options. Ferrari unveiled the F80 in October, and already the company has sold out its order book for all 799 vehicles it plans to sell initially.

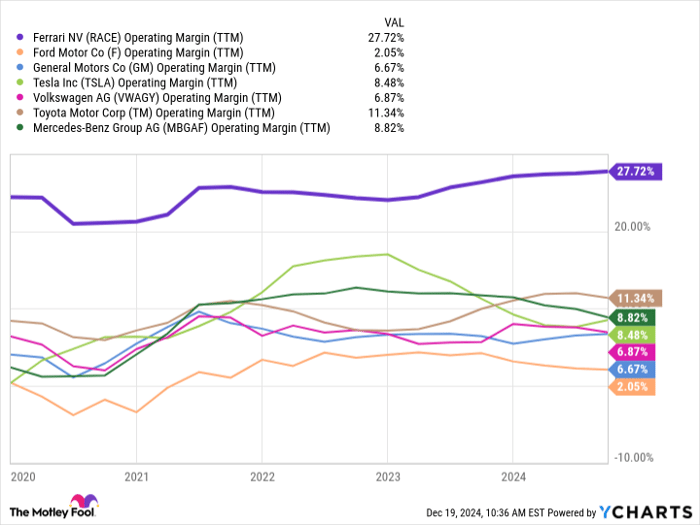

Remember that Ferrari keeps a lid on sales figures to keep its pricing power and brand exclusivity. It's that pricing power that helps the company maintain lucrative margins compared to standard automakers.

Data by YCharts.

As you can see, Ferrari has a history of blowing the competition out of the water when it comes to margins. The good news for investors is that the F80 might even improve margins. Anthony Dick, who covers the automotive sector for the Paris-based private bank ODDO BHF, told Barron's that margins on the F80 might be so lucrative the vehicle could generate 2% of units sold but 20% of Ferrari's profit. While the F80 isn't planned to start shipping until late in 2025, analysts still expect Ferrari's earnings per share to grow 10% to $9.35 in 2025.

Is Ferrari stock a buy?

Right now many automakers are struggling overseas, both in China and in Europe. In November, Ford Motor Company announced it would reduce its European workforce by 4,000 positions by the end of 2027 and would restructure its business to create a more cost-competitive structure. General Motors has watched its sales in China spiral from its 4 million units peak in 2017 down to about half of that for 2024, and it will take a $5 billion charge to restructure its struggling business.

Fortunately for investors, Ferrari doesn't have a China problem. In fact, it's one of the company's smallest regions. China, Hong Kong, and Taiwan only generated 8% of shipments during the third quarter, down slightly from the prior year's 11%. That means Ferrari can escape the country's headwinds currently and still have an opportunity for growth in the region down the road.

For investors worried Ferrari's focus on internal combustion engine (ICE) supercars would leave it trailing competitors as the world transitions to electric vehicles, fear not. In fact, you might be surprised to know that Ferrari's shipments during the third quarter were 55% hybrid and 45% ICE. Further, the iconic automaker plans to roll out its first full EV late in 2025 at a price tag of at least $535,000, according to Reuters.

Ferrari is an incredibly unique automaker that trades at a premium thanks to its branding, pricing power, and racing prowess. Currently, the stock trades at a price-to-earnings ratio of 52 times, and it rarely trades at a discount, especially to its peers in the auto industry. Until a recent dip in stock price, Ferrari had nearly tripled the S&P 500 index's return over the past three years. If you're looking for a rock-solid stock with a catalyst for growth, the F80 could help drive the company's bottom line sooner, rather than later. Ferrari remains my favorite auto stock -- or maybe it's time to call Ferrari what it is, a luxury goods superstar.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $349,279!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $48,196!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $490,243!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of December 16, 2024

Daniel Miller has positions in Ford Motor Company and General Motors. The Motley Fool has positions in and recommends Tesla. The Motley Fool recommends General Motors and Volkswagen Ag and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.