This Software Stock Could Be The Best Investment Of The Decade

Every consumer knows about the growing role of artificial intelligence (AI) and wirelessly enabled digital technologies in our daily lives. But not everyone knows about the seismic shift these developments are having on the manufacturing industry and the role that an industrial software company like PTC (NASDAQ: PTC) is playing in it.

The increasing adoption of these technologies will amplify the value added by PTC to its manufacturing customers and lead to significant growth for the company for many years to come.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Welcome to the fourth industrial revolution

The first Industrial Revolution was characterized by the development of steam power and the beginning of mechanical production. The second began with the ushering in of electricity and mass production, and the third with the development of the information age (semiconductors, computing, and the internet).

The fourth industrial revolution refers to the new age of integrated smart digital technologies that work together iteratively in real time. These technologies greatly benefit the manufacturing industry, and PTC's software plays a pivotal role in them.

The closed-loop digital thread

The so-called closed-loop digital thread lies at the heart of PTC's software. This refers to how digital technology gathers data across a product's entire life cycle, monitoring and analyzing it iteratively to improve the process. This process runs from initial design to manufacturing, servicing, and disposal.

For example, a product is designed using PTC's computer-aided design (CAD) software. The design then develops a manufacturing process using PTC's product life-cycle management (PLM) software, which monitors and controls production.

Meanwhile, PTC's Internet of Things (IoT) software connects the process to the digital world, and its augmented reality (AR) solutions digitally augment manufacturing. PTC's software life cycle management (SLM) then manages the product's servicing.

Image source: Getty Images.

These processes and seemingly disparate software solutions work together to improve the whole closed loop iteratively. For example, a PLM analysis might indicate a need to change the design (CAD) to improve manufacturing productivity or quality, or a change in design might result in a change in the servicing or manufacturing of a product, which can be digitally predicted.

In the words of CEO Neil Barua on a recent earnings call, PTC's customers have said they need: "to shorten our development timelines as quickly as possible with the highest quality to remain competitive. This includes our hardware, mechanical, electronic, and embedded software processes that all need to come together for a final product."

A transformational technology

According to market researcher and consultancy IDC, spending on digital transformation is likely to have a 16.2% compound annual growth rate from 2022 to 2027, reaching $3.9 trillion, compared to $1.9 trillion in 2022. While that assumption is subject to the vagaries of overall economic growth, it reflects the underlying demand for digital technology and industrial software.

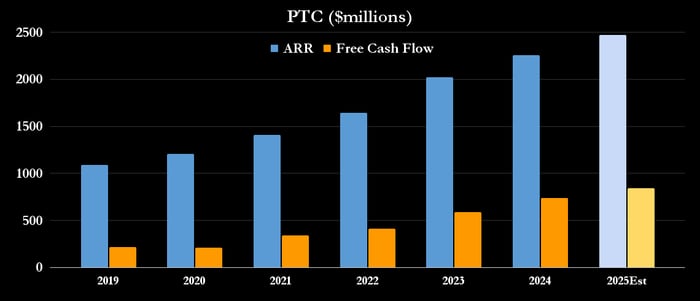

It's fair to say that the last couple of years have negatively affected PTC's growth as manufacturers have scaled back investment plans due to a slowing economy. Still, the company continues to have double-digit growth in its annual run rate (ARR), or the annualized value of its subscription software, software as a service (SaaS), and support contracts at the end of a period.

ARR is the key metric to follow for PTC, and as you can see below, it's the key to growing its free cash flow.

Data source: company presentations, marketscreener.com.

PTC's growth ambition

Moreover, management is restructuring the business to drive ARR growth by refocusing on its five key industry verticals: industrial products, aerospace and defense, electronics and technology, automaking, and medical technology and life sciences.

To that end, the company recently appointed Microsoft's former vice president for global healthcare and life sciences, Robert Dahdah, to be its chief revenue officer. According to the press release announcing the appointment, Dahdah will be responsible for sales and customer success for PTC's Digital Thread group and its new focused market strategy.

PTC's growth prospects

The fourth industrial revolution is ushering in an age of investment in digital technology, and PTC's software suite plays across the closed-loop digital thread. As such, don't be surprised if the company can grow by at least as much as the mid-teens rate that industry forecasters expect over the next decade.

And PTC's refocusing on core end markets and the prospects of a pick-up in industrial spending amid lower interest rates are potential benefits, meaning it looks set to grow significantly in the medium and long term.

Should you invest $1,000 in PTC right now?

Before you buy stock in PTC, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and PTC wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $800,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

Lee Samaha has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Microsoft. The Motley Fool recommends PTC and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.