This Vanguard Etf Could Be Your Complete Stock Portfolio Solution

Creating a well-diversified portfolio through individual stock selection requires extensive research, constant monitoring, and significant time commitment. Many investors find themselves overwhelmed by the complexity of analyzing financial statements, understanding competitive advantages, and staying current with market developments.

Low-cost exchange-traded funds (ETFs) offer a simpler path to diversification and staying invested for the long term. The Vanguard family of funds, in particular, stands out for its industry-leading low expense ratios. For instance, the popular Vanguard Total Stock Market ETF (NYSEMKT: VTI) provides comprehensive exposure to the U.S. market through a single investment in a cost-efficient manner.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. See the 10 stocks »

Image source: Getty Images.

Below I'll examine the key features that make this ETF a compelling choice for investors seeking market participation without the complexity of individual stock selection.

A true market representation

The Vanguard Total Stock Market ETF tracks the CRSP US Total Market index, encompassing 3,624 U.S. stocks across all market capitalizations and sectors. This comprehensive approach ensures investors gain exposure to both established market leaders and emerging growth companies, from large-cap stalwarts to promising small-cap enterprises.

The fund's top holdings include industry giants like Apple, Nvidia, and Microsoft, with Apple representing the largest position at 5.85% of the portfolio. This balanced approach helps protect investors from excessive concentration in any individual company while still capturing the growth potential of market leaders.

Cost efficiency that matters

The Vanguard Total Stock Market ETF charges a mere 0.03% expense ratio, significantly below the category average of 0.996%. For every $10,000 invested, annual management fees amount to just $3, compared to nearly $100 for the average fund in its category. This cost advantage becomes particularly significant for long-term investors building wealth for retirement.

The fund's low 2.2% turnover rate further reduces hidden costs associated with frequent trading. By minimizing portfolio changes, the ETF reduces transaction expenses and potential tax implications, allowing investors to retain more of their returns.

Performance that delivers

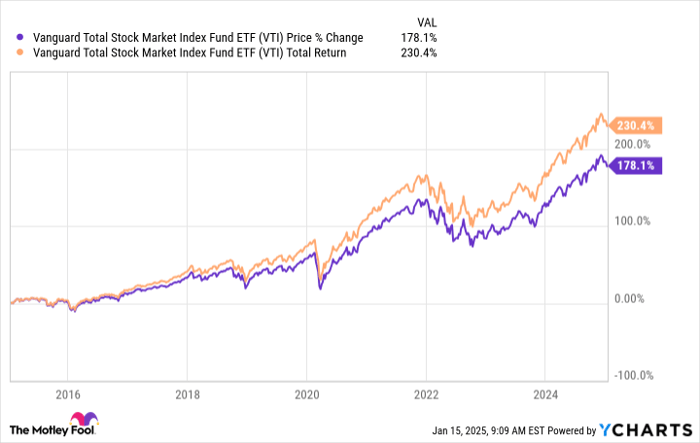

The ETF's 23.71% return over the past year demonstrates its ability to capture market gains efficiently. Looking at longer-term results, the fund has generated a 12.5% average annual return over the past 10 years, showcasing its effectiveness as a wealth-building tool.

This consistent performance stems from the fund's broad diversification across sectors. Technology leads at 32.1% of holdings, followed by consumer discretionary at 14.2% and industrials at 13.1%. This allocation adjusts automatically with market changes and requires no active management decisions from investors, making the fund an appealing option for busy individuals.

A complete stock portfolio cornerstone

The Vanguard Total Stock Market ETF's comprehensive coverage makes it an ideal foundation for long-term investing strategies. Its broad diversification across all market segments eliminates the need to hold multiple equity funds, simplifying portfolio management and reducing overall costs.

For investors seeking a balanced approach, pairing this ETF with a broad-based bond fund, like the Vanguard Total Bond Market ETF, creates a straightforward yet sophisticated portfolio solution. This two-fund combination provides exposure to virtually every publicly traded stock and investment-grade bond in the U.S. market, offering a level of diversification and stability once available only to institutional investors.

A foundation for growth

This ETF offers an elegant solution through a single investment for investors seeking comprehensive market exposure. Its broad diversification, minimal expenses, and proven performance track record make it an attractive choice for building long-term wealth.

With substantial daily trading volume, the fund provides excellent liquidity for both small and large investors. Whether used as a stand-alone investment or as the core of a broader strategy, this ETF offers an efficient way to participate in the growth potential of the U.S. stock market.

Should you invest $1,000 in Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $807,495!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of January 13, 2025

George Budwell has positions in Apple, Microsoft, Nvidia, and Vanguard Total Bond Market ETF. The Motley Fool has positions in and recommends Apple, Microsoft, Nvidia, Vanguard Total Bond Market ETF, and Vanguard Total Stock Market ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.