Want Decades Of Passive Income? 3 Stocks To Buy Right Now

Are you looking for reliable long-term investment income? Consider starting your search here, with a closer look at three great dividend stocks that would be at home in nearly any investor's portfolio. These names also not only offer inflation-beating dividend growth, but solid capital appreciation potential as well.

1. Agree Realty

Agree Realty (NYSE: ADC) technically isn't a stock. Rather, it's a real estate investment trust, or REIT for short. Although these instruments are bought and sold just like stocks, their underlying companies own a bunch of rent-driving or revenue-bearing real estate. Most of their profits are just passed along to shareholders in the form of dividends.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

There are all sorts of REITs, ranging from apartment complexes to office building to hotels and more. Even by REIT standards, however, Agree Realty is something of a standout. Its focus is brick-and-mortar retailing. It owns a total of 2,271 properties covering 47 million square feet worth of various kinds of selling space.

At first blush, it seems a bit risky. The brick-and-mortar retail industry continues to struggle thanks to the ongoing growth of e-commerce. Industry research outfit Coresight reports more than 7,000 stores in the United States alone have been shuttered this year... the worst year since pandemic-riddled 2020.

Take a closer look at the data, though. This isn't so much a sign of the end of brick-and-mortar retailing as we know it as it is a shakeout of its laggards. Most of these vacated storefronts have since been reoccupied by retailers with better prospects for being able to stay put.

In this vein, as of the end of September, an impressive 99.6% of Agree Realty's properties were leased. Credit the caliber of Agree's renters mostly, which include Walmart, Tractor Supply, Dollar General, and TJX among its top tenants.

Of course, the real proof of this REIT's longevity is in the numbers, which shine. Agree Realty's dividend has grown at an average annualized pace of 5.7% over the course of the past decade. This recent payout growth, paired with the REIT's price appreciation, translates into an average annual net return of 12.3% since its initial public offering back in 2024.

Newcomers will be stepping into this monthly -- yes, monthly -- dividend while the stock's forward-looking yield stands at 4.1%.

2. Bristol Myers Squibb

Investing in pharmaceutical stocks is tricky. In addition to never-ending patent expirations, new and better drug development technologies are allowing the industry to become even more competitive. The winning drug companies are the ones that see and specifically respond to this dynamic by continually adding new drug prospects to their pipeline and portfolio.

Enter Bristol Myers Squibb (NYSE: BMY).

From a distance, it looks more or less like any other drugmakers, and in many ways it is. It's arguably better than most rivals in the way that matters most, though. That's its ability to identify and then acquire and/or create new prescription pharmaceuticals.

Take its blood-thinning medication Eliquis as an example. Last quarter's top seller was initially discovered by Bristol Myers Squibb nearly two decades ago. But, recognizing it would be best served by taking on a partner for clinical development, in 2007 the company announced a collaborative partnership with Pfizer to eventually bring the anticoagulant to the market beginning in 2012.

Its cancer-fighting Revlimid's story is considerably different. This drug starting winning FDA approvals all the way back in 2005. Bristol Myers Squibb didn't own it at all, however, until it acquired Celgene back in 2019.

Although proverbially late to the party, the decision has proven brilliant. The pharmaceutical giant has continued to extract value from this drug by consistently adding new uses in the meantime. Last quarter's revenue of $1.2 billion translates into yearly revenue of nearly $5 billion, reviving the oncology treatment that many thought might be well past its patent-protected prime by now.

The point is, this is the sort of cost-effective developmental navigation that Bristol Myers Squibb has proven it's capable of for a long, long time, even if it's suffered the occasional near-term stumble.

More to the point for interested income investors, being able to constantly refill its drug pipeline has allowed Bristol Myers Squibb to raise its dividend for 16 consecutive years now.

Today's buyers will be plugging in while the dividend yield is a respectable 4.4%.

3. JPMorgan Chase

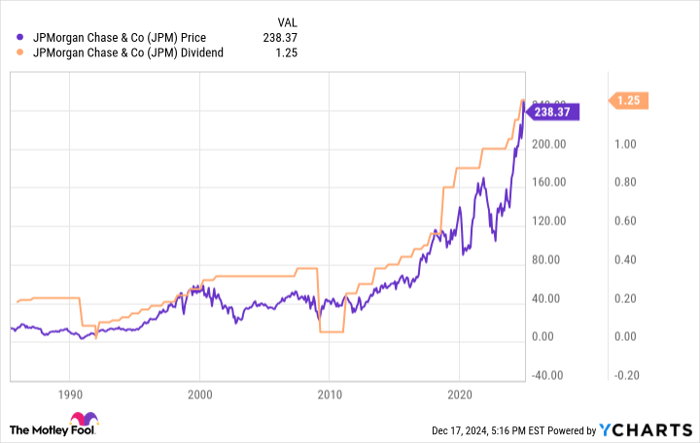

Last but certainly not least, anyone looking for decades of passive income might want to put JPMorgan Chase (NYSE: JPM) on their radar, if not in their portfolio.

The forward-looking dividend yield of 2.1% is admittedly less than thrilling. Keep it in perspective though. What this stock might lack in current yield, it makes up for in other ways, like value and consistency. Its dividend payment has grown every year since 2010, for instance, when it first started climbing out of the hole dug by 2008's subprime mortgage meltdown.

This dividend growth is slowing down, for the record, largely reflecting current economic headwinds. Interest rate volatility has wreaked a little havoc on the amount of net interest income available to fund these dividend payments of late.

Again, however, keep things in perspective. This well-diversified financial machine has many different revenue levers to pull, including basic banking, market-related services, wealth management, investment banking, and more. All of these businesses ebb and flow, but JPMorgan Chase is good at all of them, and remains ready to capitalize when opportunity arises on any of these fronts. There's a reason it's the nation's single-biggest bank, boasting nearly $3.6 trillion in assets!

But the disruption resulting from 2008's economic crisis that wrecked the dividend payment for several years? Don't worry. That was a once-in-a-lifetime kind of event that isn't likely to happen again anytime soon -- if ever -- simply because so many regulatory guardrails have been erected since then.

Bottom line: It may never be a high-growth name. But, as long as the world uses money to buy and sell goods and services, it will need financial middlemen like JPMorgan. It's a business that's ideally suited to drive recurring, rising dividend payments.

Should you invest $1,000 in JPMorgan Chase right now?

Before you buy stock in JPMorgan Chase, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Chase wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $800,876!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 16, 2024

JPMorgan Chase is an advertising partner of Motley Fool Money. James Brumley has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bristol Myers Squibb, JPMorgan Chase, Pfizer, TJX Companies, Tractor Supply, and Walmart. The Motley Fool has a disclosure policy.