Where Will Bitcoin Be In 1 Year?

It's been a milestone year for cryptocurrency, and in particular, the industry's poster child -- Bitcoin (CRYPTO: BTC).

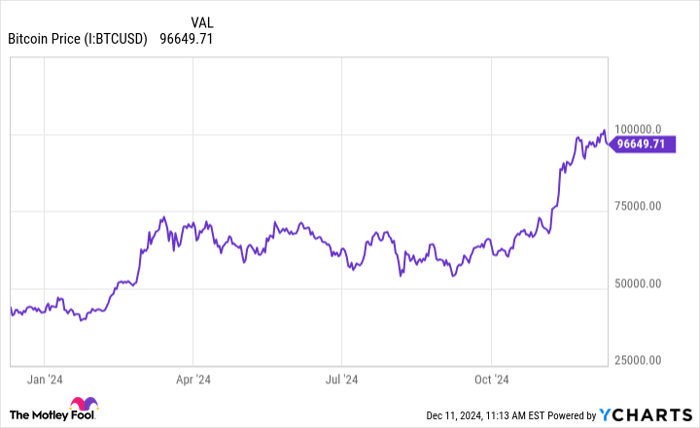

With just a few weeks left in 2024, Bitcoin's price has soared by 140% and has topped a price of $100,000 per coin. Although Bitcoin has since oscillated above and below the $100,000 mark, I think there are plenty of reasons to remain optimistic about the cryptocurrency's future.

Let's explore some tailwinds that could positively impact Bitcoin in 2025, and assess where it could be trading this time next year.

Shaking things up at the Securities and Exchange Commission

Gary Gensler is one of the most intriguing personalities in the financial world today. As a former investment banker at Goldman Sachs, Gensler initially concentrated on mergers and acquisitions (M&A) before transitioning into other roles across trading, fixed income, and treasury operations.

But in the late 1990s, Gensler left Wall Street to pursue a career in public service. Gensler has served in various roles under Presidents Clinton, Obama, and now Biden. Since 2021, he has been Chairman of the Securities and Exchange Commission (SEC).

On Nov. 20, the SEC issued a statement that Chairman Gensler will be stepping down from his role at the SEC come Jan. 20. While this may look like Chairman Gensler is retiring, take note of the timing of his resignation -- January 20, 2025 is president-elect Trump's inauguration day.

Image source: Getty Images.

A new regulatory landscape could be on the way

In my opinion, one of the chief reasons Gensler is moving on from the SEC has to do with his philosophy around the crypto landscape versus that of president-elect Trump. Trump appears to be taking a more open-minded approach to crypto legislation, listening to some of the ideas touted by prominent executives at crypto companies such as Coinbase. While the crypto industry did make some progress under Gensler -- the introduction of spot Bitcoin ETFs, for example -- I think the incoming administration is more pro-crypto than what is in place right now from a regulatory perspective.

The first step to push the ball forward in crypto regulation starts with the Financial Innovation and Technology for the 21st Century Act (FIT21). This bill was passed by the House of Representatives back in May. At its core, the FIT21 aims to form more thorough guidelines surrounding crypto regulations. One of the prominent components of the bill is determining how the SEC and Commodity Futures Trading Commission (CFTC) will oversee digital assets.

President-elect Trump has nominated pro-crypto businessman Paul Atkins to succeed Gensler as Chair of the SEC. Moreover, the Republican Party will have majority control in both the House of Representatives and the Senate. Such a dynamic should help with Atkins' cabinet approval process while also giving Trump a swift path to sign the FIT21 into law.

In addition to the points above, another sweeping change that could be in store under the new Trump administration is imposing tariffs. While it's too early to tell right now how tariffs would impact the economy, there is a very real possibility that the cost of goods and services could rise in the short term. As a result, consumer purchasing power could weaken, which could end up slowing down economic growth for a period of time.

This dynamic would directly impact businesses and the stock market. If companies begin to show signs of decelerating sales or weaker profit margins, the stock market could begin to sell off. During situations featuring widespread economic uncertainty, investors tend to flock toward alternative assets. Given the increasing adoption of crypto, I would not be surprised to see prominent cryptocurrencies such as Bitcoin begin to move upwards as investors add it as an extra layer of diversification to their portfolio.

Will Bitcoin be higher or lower one year from now?

The chart below shows the price of Bitcoin throughout 2024. Following a short-lived jolt earlier in the year, Bitcoin's price movements were actually quite mundane throughout the spring and summer. It wasn't until around the time of the election that Bitcoin started to materially surge.

Bitcoin Price data by YCharts

I think that the recent momentum fueling Bitcoin could suggest optimism over how the incoming administration will positively impact and change the crypto landscape.

While I can't say for certain in which direction the price of Bitcoin will move, history suggests that it should continue surging under the new Trump administration. With new legislation looking likely and a more pro-crypto administration incoming, I am cautiously optimistic that Bitcoin's price will continue to rise over the next year.

Should you invest $1,000 in Bitcoin right now?

Before you buy stock in Bitcoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Bitcoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $822,755!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 9, 2024

Adam Spatacco has positions in Coinbase Global. The Motley Fool has positions in and recommends Bitcoin, Coinbase Global, and Goldman Sachs Group. The Motley Fool has a disclosure policy.