Husband Supports Wife For 22 Years, Gets Nothing In Return After She Receives Big Inheritance

Receiving an inheritance can be a real blessing, especially for families that aren’t financially stable. The additional money can be used for children, mortgages, house maintenance—anything that can help reduce worries or anxieties related to their finances. However, when one spouse inherits money, the plan for it might not always align with the other partner’s.

Just like what happened to this couple, the husband, who had been supporting his unemployed wife for 22 years, expected her to finally contribute to the household and share the inheritance she received. However, his hopes were squashed when she announced that she was keeping all the money to herself. Such news left him completely baffled, pushing him to turn online for advice.

Scroll down to find the full story and a conversation with financial services specialist and founder of Gillet Agency, John Gillet, and certified financial planner and founder of Masuda Lehrman Wealth, Daniel Masuda Lehrman, CSLP., who kindly agreed to tell us more about sharing inheritance with a spouse.

Spouse receiving an inheritance can be a huge financial relief for a family

Image credits: Getty Images (not the actual photo)

That is if they decide to share it and not keep it all to themselves

Image credits: Getty Images (not the actual photo)

Image source: IrishRoller

Inheritance is considered a separate property

Image credits: Getty Images (not the actual photo)

In all 50 states in the US, inheritance is considered a separate property. This suggests that if a person is married, they aren’t entitled to share their inherited assets with their spouse. The beneficiary has free will to decide whether they are keeping the inheritance to themselves or sharing it with their partner.

But does this mean that the inherited wealth should remain separate? Since it’s usually expected that everything should be joint in marriage, a refusal to do so can cause some friction in the relationship, especially if prior to this they pooled their finances together.

It can be hard to make the right decision without risking an emotional reaction. So we reached out to financial services specialist and founder of Gillet Agency, John Gillet, and certified financial planner and founder of Masuda Lehrman Wealth, Daniel Masuda Lehrman, CSLP., for their expert opinions on the matter.

“Whether an inheritance should be shared in a marriage is ultimately a personal decision between two spouses,” says Masuda Lehrman.

“However, it’s essential to know that an inheritance is considered to be owned solely by the named beneficiary unless it is commingled with other marital assets. In the event of divorce, the inheritance stays with the named beneficiary unless the inheritance was commingled with other marital assets. Therefore, from the perspective of the named beneficiary, the inherited assets should be kept separate.”

Meanwhile, Gillet believes that inherited assets should be respectfully shared in a marriage, but not in the case of divorce. “I have many clients who benefit from their spouses inherited assets. Additionally, children of these marriages can benefit tremendously,” he explained.

“Many times Trust Funds are set up for children, utilizing these inherited assets to fund the trust. Some of my clients have gone a step further to put directives in the Trust to make sure these assets purchase life insurance on the lives of these Trust fund beneficiary children to replenish the Trust fund for the next generations in perpetuity. Therefore, inherited assets should be shared in a marriage and benefit the children of that marriage.”

To avoid any marital conflicts over inherited assets, experts recommend having honest communication

Image credits: Priscilla Du Preez ???????? (not the actual photo)

In some cases, couples may decide to keep the inherited assets separate. The beneficiary might’ve been advised to keep the money to themselves in the chance that the marriage doesn’t last.

“A partner might choose to keep their inheritance separate from their spouse to separate it from marital assets to protect it from being vulnerable to loss in a divorce settlement. A strong case for this measure would be an inheritance of strong sentimental value, like the family house or mansion,” Gillet said. “I’m sure that many memories and generations of memories sometimes are a part of such an inheritance. It would be emotionally painful to lose such an inheritance in a divorce settlement.”

He also notes that when there’s a substantial inheritance involved, a beneficiary might want to protect it due to a significant net worth or age gap.

“Additionally, concerns could arise if this is a second or third marriage and the inheriting spouse has children from a prior marriage they wish to pass these assets to. For example, I had a client who recently passed away who had a prenuptial agreement and several trusts to help protect their assets. In addition, he took out numerous life insurance policies on his much younger wife to fund an Irrevocable Life Insurance Trust to provide for his family and children from a prior marriage.”

Everything considered, the decision what to do with the acquired wealth entirely depends on the couple and their unique circumstances. However, to avoid any conflict or unfairne

ss in the decision-making process, Masuda Lehrman recommends honest communication. “Consider speaking to a financial planner who can act as a neutral third party to avoid any awkward conversations!” he adds.

“The right decision would be to take the inheritance and discuss with a Financial Advisor and/or Attorney options to create a Revocable Trust that can own the inherited asset for the benefit of the couple’s retirement and/or for their children,” agrees Gillet.

“Make sure to create this mutually beneficial plan together with the understanding that it is revocable and can be changed under certain conditions that are mutually agreed on. I feel that this sense of inclusion, clarity of purpose and sense of sharing creates a healthy and respectful attitude toward each other in the relationship.”

Lastly, Gillet recommended getting rid of the “my money” and “your money” separatist idea. “When you choose a life partner, there should be a sharing, loving attitude that reflects the respect you have for your partner. You chose to “hitch your wagon” to that person for better or worse and share in this journey we call life. That includes assets or inherited windfalls that come your way.”

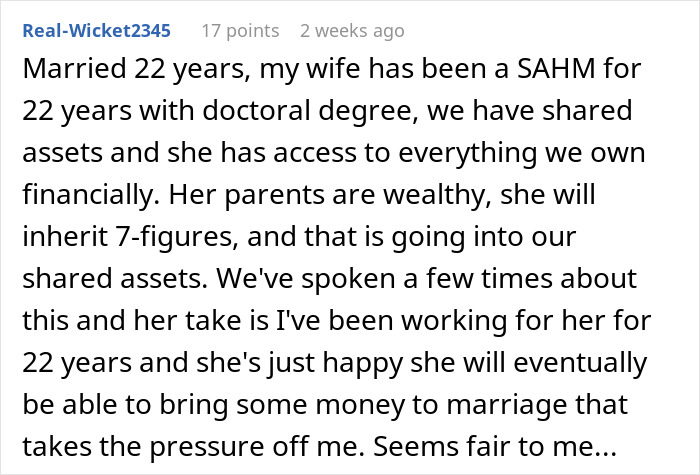

The husband shared more details on the situation in the comments

Most readers supported the husband

While some had opposing opinions

The post Husband Supports Wife For 22 Years, Gets Nothing In Return After She Receives Big Inheritance first appeared on Bored Panda.